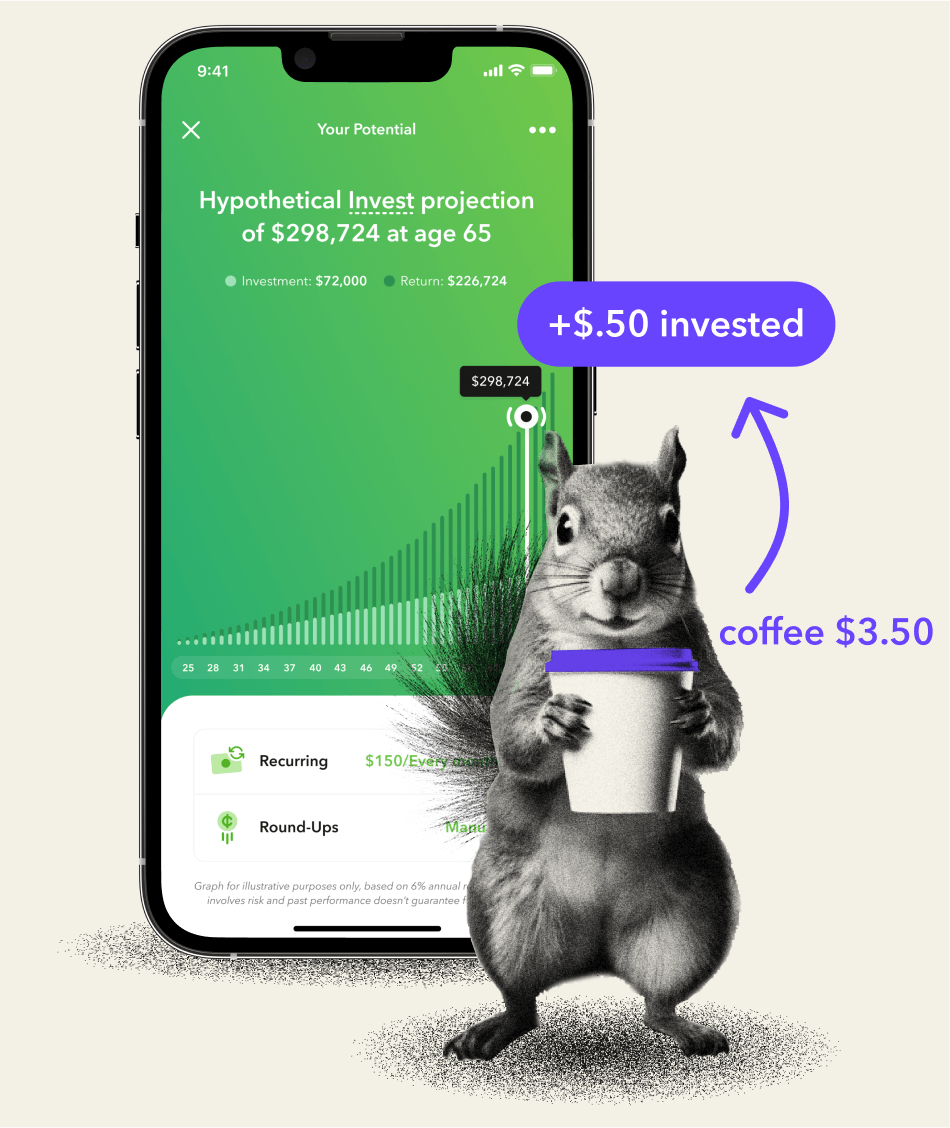

Illustration of the power of compounding based on initial deposit, contribution schedule, time horizon, and rate of return specified. Changes in those variables can affect the outcome. Reset the calculator using different figures to show different scenarios. Does not include Acorns’ monthly subscription fees (min $3/mo), which would reduce account returns over time, or other deposits or withdrawals. Results do not predict or represent the performance of any Acorns portfolio and do not take into consideration economic or market factors which can impact performance. Investment results will vary. No guarantee investment return will achieve 8% or any annual returns.

Saving & investing made simple

Cricket customers get a $20 bonus investment. Download Acorns on your Cricket device to get started.

2Requires min. $5/mo. Cricket purchase using the card linked to Acorns account.

Cricket is a non-client partner of Acorns and compensates Acorns in exchange for administering this promotion. Cricket has an interest in positively promoting Acorns, as its customers can receive benefits from Acorns so long as they remain customers of Cricket. Therefore, all opinions within the material may be biased. For a larger representative sample, refer to reviews of Acorns available online and on public review forums such as the Apple App Store and Google Play Store.

Over 14 million all-time customers and over $27 billion invested since inception as of 8/18/2025. App store star rating as of 8/19/2025.

Small investments add up

Important Disclosures

Welcome to the Acorns site, operated by Acorns Advisers, LLC ('Acorns'). Sign up bonus is exclusively for new customers who have not previously opened an Investment Account. Account approval is contingent on verification and approval pursuant to regulatory requirements. Acorns is only offered to US-residents who are 18 years of age or older. Acorns reserves the right to restrict or revoke this promotional offer at any time and without notice. More information about Acorns Advisers is available in the wrap fee brochure and our customer relationship summary.

Investing involves risk, including loss of principal. Please consider, among other important factors, your investment objectives, risk tolerance and Acorns’ pricing before investing. Acorns Subscription Fees are assessed based on the tier of services in which you are enrolled, view details in our program agreement. Investment advisory services offered by Acorns Advisers, LLC (Acorns), an SEC-registered investment advisor. Brokerage services are provided to clients of Acorns by Acorns Securities, LLC, an SEC-registered broker-dealer and member FINRA/SIPC.

11-Year Free Trial: Available only to new Acorns customers who open an Acorns account by May 31, 2024 with a current Cricket Wireless account. New Acorns customers will receive a fee waiver for the full amount of the customer’s chosen Acorns subscription fee tier for the customer’s first 12 months as an Acorns customer. Upon the expiration of the waiver period, Acorns will bill customers the full monthly price of the customer’s chosen Acorns subscription fee tier and each month after, unless the account is closed, at the then current subscription rate. The first subscription fee will be billed to new customers on the 13th month following the opening of the new customer’s Acorns account.

2$20 sign-up bonus is exclusively for Cricket Wireless customers who join Acorns on or after July 23, 2021 and who have not previously opened an Acorns Account. Offer must be redeemed by setting up a new Acorns Account and making your first investment into your Acorns Invest Account ($5 minimum) by December 31, 2025. You must also make a purchase of $5 or more, within the calendar month, at Cricket Wireless using a valid credit or debit card that is properly linked to your Acorns Invest Account. $20 bonus will be applied within 60 days of your qualifying first investment and Cricket purchase. Monthly bill-pay promotion is $0.75 invested into your Acorns Invest Account when you spend $5 each calendar month at Cricket using a card properly linked to your Acorns Invest Account. Cricket Wireless service is subject to its own Terms and Conditions, see https://www.cricketwireless.com/terms. Acorns is only offered to US-residents.

Spare change invested with Round-Ups® is transferred from your linked funding source to your Acorns Invest account, where the funds are invested into a portfolio of selected ETFs. If you do not maintain an adequate amount of funds in your funding source sufficient to cover your Round-Ups® investment, you could incur overdraft fees with your financial institution. Round-Up investments from an external account, will be processed when your Pending Round-Ups reach or exceed $5.

Acorns Invest is an individual investment account. Acorns Later is an Individual Retirement Account (either Traditional, ROTH or SEP IRA) selected for clients based on their answers to a suitability questionnaire. Invest and Later recommend a portfolio of ETFs (exchange traded funds) to clients, please note that a properly suggested portfolio recommendation is dependent upon current and accurate financial and risk profiles.

Acorns is not a bank. Acorns Visa™ debit cards and banking services are issued by Lincoln Savings Bank or nbkc bank, members FDIC. Acorns Checking clients are not charged overdraft fees, maintenance fees, or ATM fees for cash withdrawals from in-network ATMs.

Acorns, Round-Ups® investments, Real-Time Round-Ups® investments, Invest the Change and the Acorns logo are registered trademarks of Acorns Grow Incorporated. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

For additional important risks, disclosures, and information, please visit https://www.acorns.com/terms/.

© 2025 Acorns Grow Incorporated | Disclosures | Accessibility