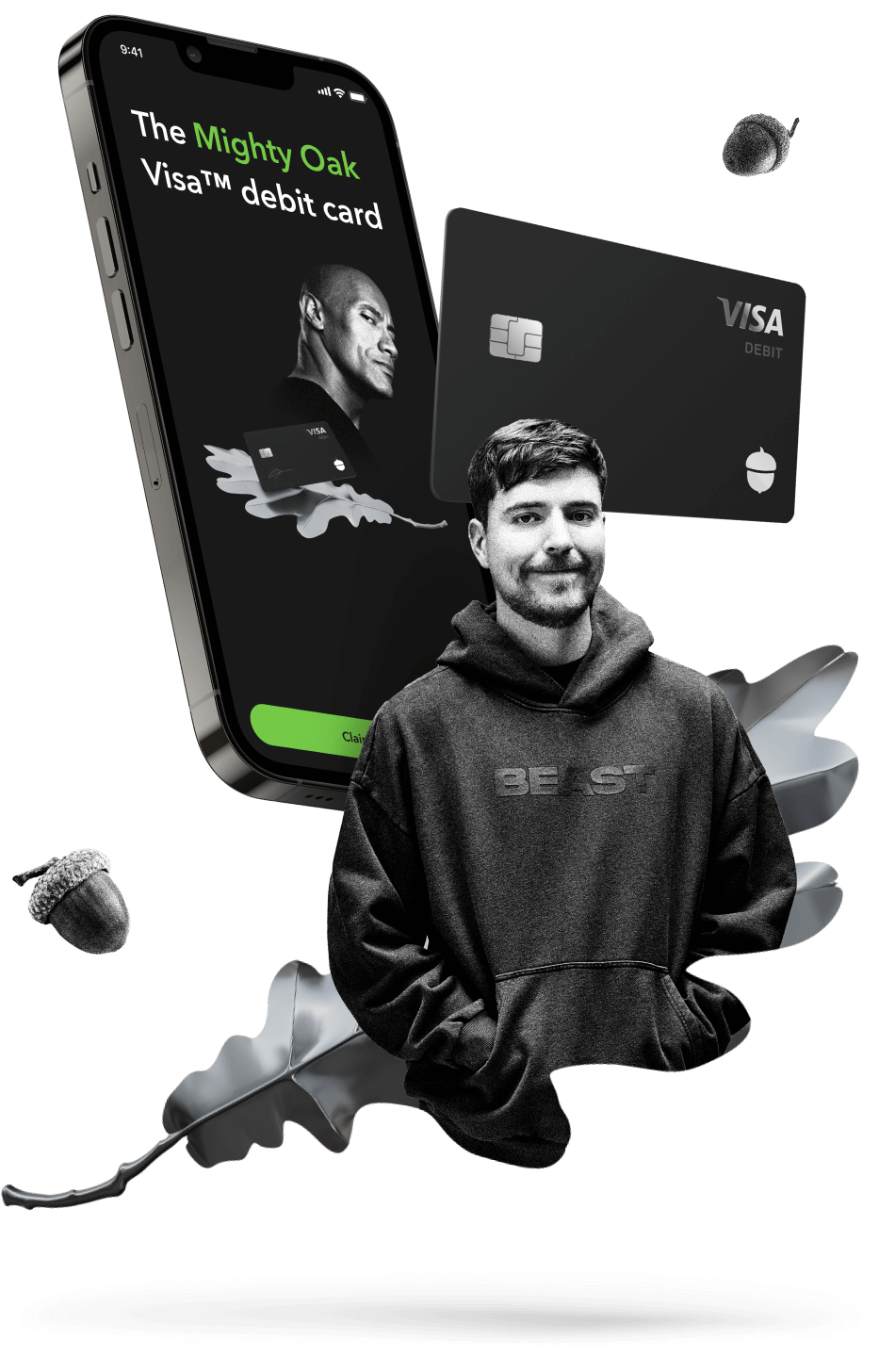

1. Comparisons are based on the national average Annual Percentage Yields (APY) published in the FDIC National Rates and Rate Caps as of October 16, 2023. As of January 13, 2024, Mighty Oak Checking Annual Percentage Yield (APY) is 3.00% and Emergency Fund APY is 5.00%. APY is variable and subject to change at our discretion, without prior notice. No minimum opening deposit or minimum balance required. Acorns is not a bank. Acorns Visa™ debit cards and banking services are issued and provided by Lincoln Savings Bank or nbkc bank, Members FDIC, to Acorns Checking account holders that are U.S. residents over the age of eighteen (18).

2. To be eligible for this offer, you must meet the following criteria: You must be a first-time Acorns customer and have an account in good standing at all times between signup and the date the bonus is invested is made to your Acorns Invest Account. You must make a successful deposit (minimum of $5) within the first 5 days of the month following the month in which your Acorns account was verified. Qualifying deposits can be made into either your Invest or Checking accounts. Bonuses will be invested into your account within 5 weeks of meeting offer qualifications.

3. Over 13 million all-time customers and almost $20 billion invested since inception as of 2014. App Store rating as of January 2024.

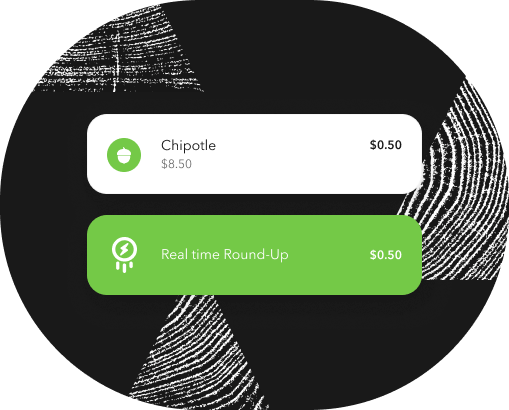

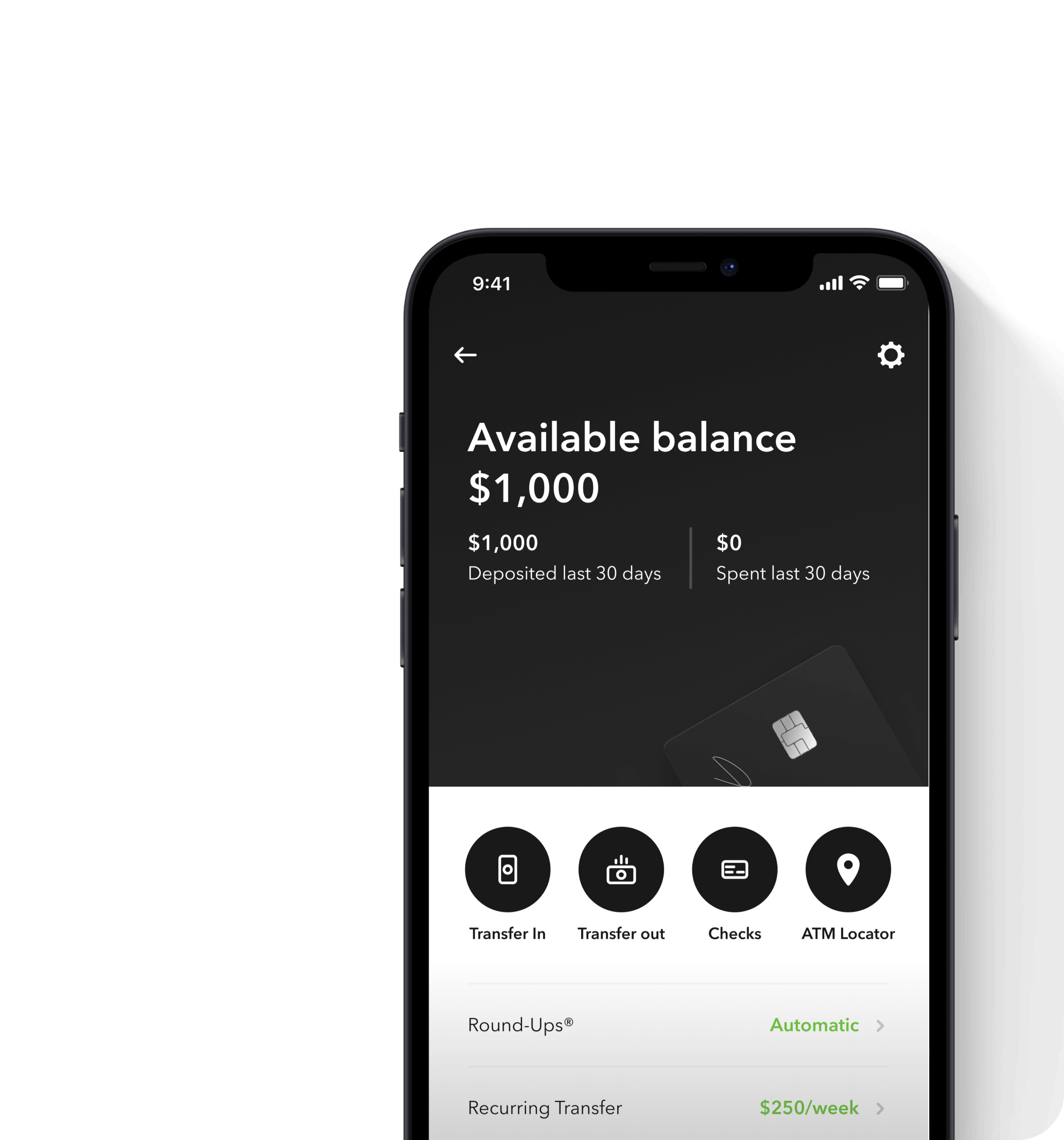

4. Acorns Checking Real-Time Round-Ups® invests small amounts of money from purchases made using an Acorns Checking account into the client’s Acorns Investment account. Requires both an active Acorns Checking account and an Acorns Investment account. Real-Time Round-Ups® investments accrue instantly for investment during the next trading window. Real-Time Round-Ups® investments from Acorns Checking accounts will be processed on an ongoing basis if the Round-Ups setting is set to automatic.

5. For more information on Acorns Mighty Paycheck Sweepstakes Official Rules including Terms and Conditions please visit acorns.com/mightypaychecksweepstakes.

6. Acorns is not a bank. Acorns Visa™ debit cards and banking services are issued and provided by Lincoln Savings Bank or nbkc bank. GoHenry Inc. The GoHenry card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International. T&Cs apply. For more information visit Acorns.com.

7. Paycheck Split is a feature of Acorns Checking that automatically allocates a portion of your direct deposit into Invest, Later, Early accounts.

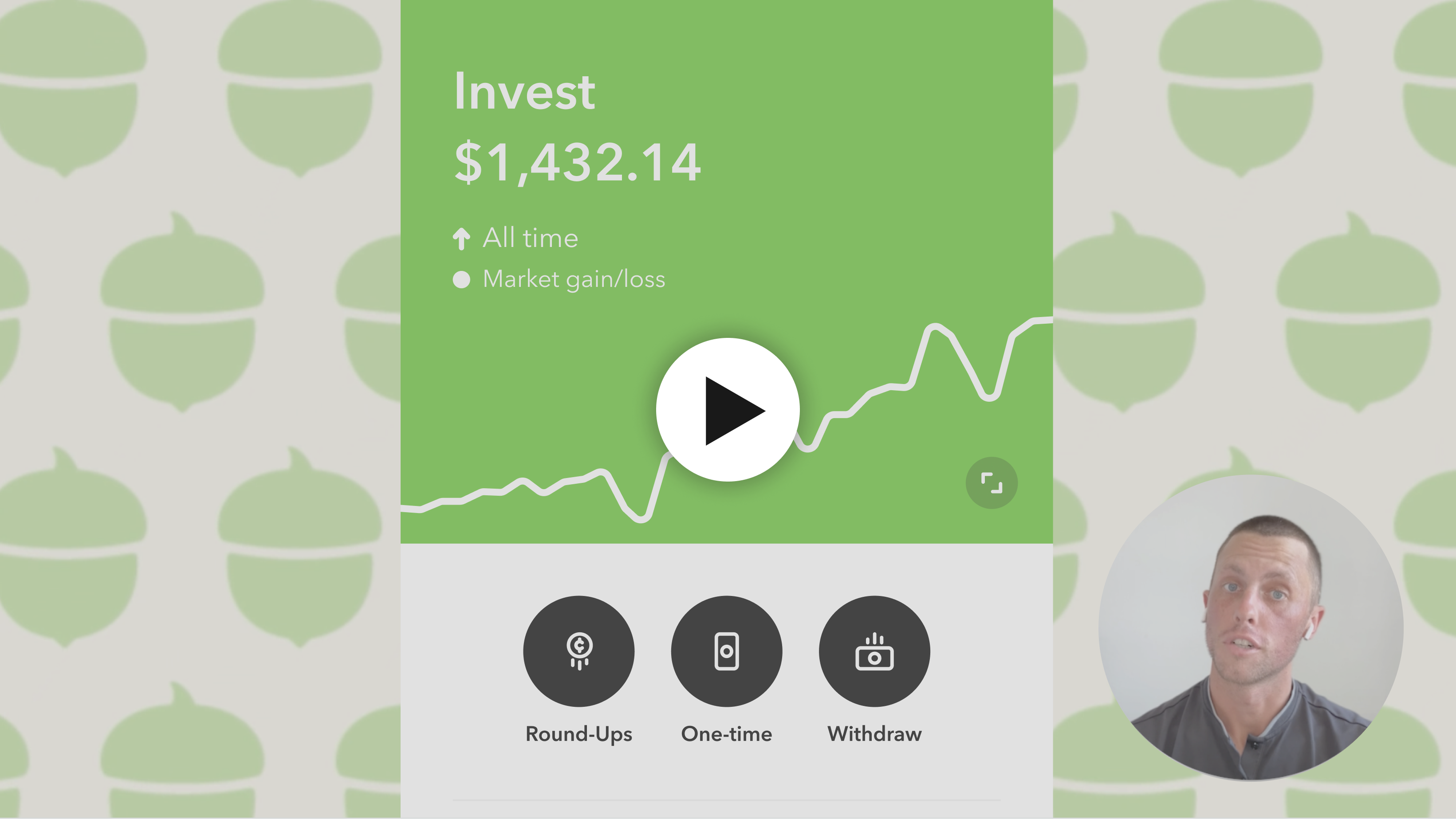

8. Acorns Invest is an individual investment account which invests in a portfolio of ETFs (exchange-traded funds) recommended to clients based on their investor profile.

9. Acorns Earn provides subscribers access to shop with partners to earn promotional bonus investments into your Acorns Invest account. These bonus investments are made by Acorns Grow, Inc. into your Acorns Invest account through a partnership Acorns Grow maintains with each Acorns Earn partner.

10. Investing involves risk, including the loss of principal. Please consider your objectives, risk tolerance, and Acorns' fees before investing. Acorns Advisers, LLC is an SEC-registered investment adviser. Brokerage services are provided to clients of Acorns by Acorns Securities, LLC. Member FINRA/SIPC.

11. Any balances you hold with Lincoln Savings Bank or nbkc bank, including but not limited to those balances held in Acorns Checking accounts are added together and are insured up to $250,000 per depositor through Lincoln Savings Bank or nbkc bank, Members FDIC. If you have funds jointly owned, these funds would be separately insured for up to $250,000 for each joint account owner. Lincoln Savings Bank or nbkc bank utilizes a deposit network service, which means that at any given time, all, none, or a portion of the funds in your Acorns Checking accounts may be placed into and held beneficially in your name at other depository institutions which are insured by the Federal Deposit Insurance Corporation (FDIC). For a complete list of other depository institutions where funds may be placed, please visit https://www.cambr.com/bank-list. Balances moved to network banks are eligible for FDIC insurance once the funds arrive at a network bank. To learn more about pass-through deposit insurance applicable to your account, please see the Account Documentation. Additional information on FDIC insurance can be found at https://www.fdic.gov/resources/deposit-insurance/.

12. Acorns is not a bank. Acorns Visa™ debit cards are issued by Lincoln Savings Bank or nbkc bank, Members FDIC for Acorns Checking account holders.