2024 Acorns Money Matters Report™

For our 2024 Money Matters Report™, we asked everyday Americans about their finances: how financially secure they feel, the impact their finances have on their wellbeing, and how macro events affect their sense of financial security.

This year, the report reveals a growing unease — so much so that nearly 1 in 4 Americans fear experiencing homelessness. Cost of living topped the list of concerns, with financial worries compounded by headlines about global turmoil and economic pressures. We also see the clear effects that these concerns can have on Americans' sense of financial wellbeing.

But many Americans are tackling these fears head-on by intensifying their saving efforts, focusing on their financial literacy, and making steady progress towards their goals. Here's what we found.

Facing financial insecurity

Americans' outlook for their financial security was dim. According to our survey, only 35% of Americans think they will be more financially secure next year than they are currently, while 44% expect their financial security to be about the same this time next year.

When asked to compare their level of financial security to last year, 46% felt they were in the same position as they were a year ago, while 25% felt more secure, and another 25% felt less secure.

Taking a closer look:

- Men are significantly more likely than women to say they feel more financially secure this year (29% compared to 20%).

- People who are married or in a domestic partnership are significantly more likely to feel more financially secure now compared to last year (29%) than those surveyed who are separated (18%), divorced (17%) or widowed (16%).

- People who live in major cities are almost twice as likely as people in smaller cities, suburbs, or rural areas to feel more financially secure this year (37% compared to about 20%).

- 33% of those with a household income of over $75k feel more financially secure now than last year. Only 14% of those with a household income of less than $40k feel more financially secure now than last year.

- Almost 10% of those with a household income of less than $40k say they’re “unsure” of their feelings about their financial security from last year to this year, compared to 2% with a household income of $75k or more.

The impact on financial wellbeing

Feelings of financial insecurity can take a toll. We found some signs of money management stress, with 33% of Americans saying that whenever they feel in control of their finances, something happens that sets them back.

- Millennials are more likely to agree that they can't enjoy life because they obsess too much about money (33% vs. 24% of the overall population).

- Americans living in a major city are also more likely to say they can’t enjoy life due to obsessing over money (29% vs. 24% of the overall population).

- In fact, those living in a major city are much more likely to say they're feeling major money management stresses overall, from feeling like their finances control their life (37% vs. 29% of the overall population) to feeling like they will never have the things they want in life because of their money situation (35% vs. 30% of the overall population).

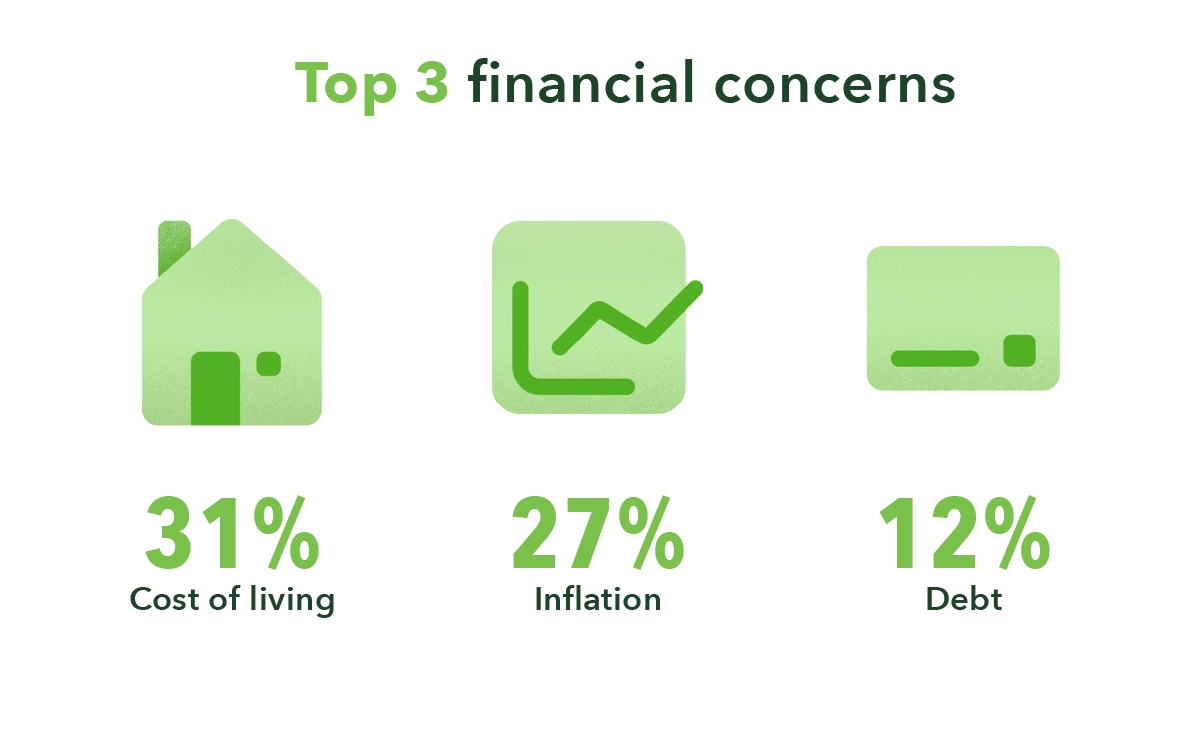

Americans’ biggest financial concerns

So what's behind these feelings of financial insecurity? Unsurprisingly, living expenses topped the list as Americans' biggest financial concern, with cost of living and inflation causing more worry than debt, retirement, interest and mortgage rates, and even lack of savings.

- We found the silent generation (over 78 years old) to be more than twice as likely as the general population to say they don’t have any financial concerns (22% vs. 9%).

- By household income, those surveyed with less than $40k were slightly more concerned about cost of living (37%) and those with over $75k were slightly less concerned about cost of living (26%) than the total (31%).

- Across household incomes, Americans' top three biggest financial concerns are cost of living, inflation, and debt.

- For those with a household income of less than $40k, lack of savings and retirement were the next most concerning (9% and 5% respectively), followed by interest and mortgage rates (4%).

- Those with a household income of more than $75k cited retirement as next most concerning (10%), followed by lack of savings (6%), and interest mortgage rates (5%).

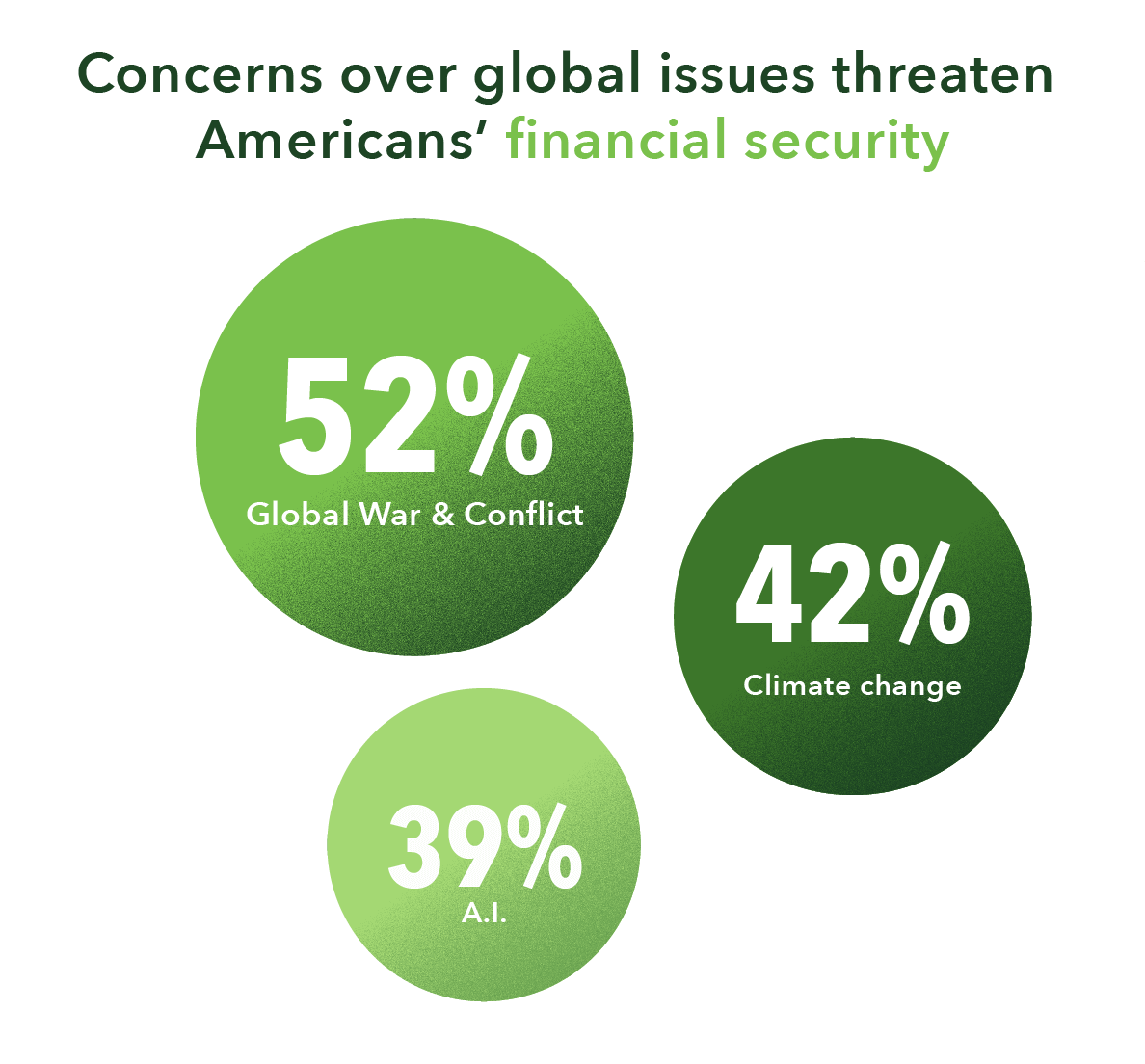

How current events impact Americans’ financial confidence

More than half of the people we surveyed expressed concerns about the effect macro events like global war and conflict have on their financial security, with 25% saying they are “extremely concerned.” Less than 10% said they were “not concerned at all.”

The rise of artificial intelligence (AI) and climate change also impact financial security, with more respondents expressing concern than not or neutral.

- Concern over current events on financial wellbeing hits millennials the hardest, with concerns of the effects of global war and conflict topping the list (55% of millennials), followed by climate change (48% of millennials), and AI (44% of millennials).

- Of the people we spoke to, parents are significantly more likely to be concerned that global conflict (53%) and AI (42%) will impact them financially vs. non-parents (49% and 35%, respectively).

Overall, we found financial security concerns increase as education and household income increase. This is particularly stark in response to fears of global war and conflict.

- Less than half (47%) of those with a high school degree are concerned global war will impact their financial security, rising to 51% among those with some college or an associate’s degree, and up to 57% for those with a bachelor’s degree or more education.

- A nearly identical trend exists for household income, increasing from 47% in the less than $40k group to 52% for those making $40k to $74k to 55% for those earning more than $75k.

Nearly a quarter of people we surveyed agree they’re concerned their financial situation could lead to experiencing homelessness.

The numbers are stark: the Department of Housing and Urban Development (HUD) reports that on a single night in 2023, roughly 653,100 people in the U.S. experienced homelessness, up a significant 12% from 2022.

- Our findings indicate that Gen Z and millennials are nearly three times more likely to fear their financial situation could lead to experiencing homelessness as compared to Boomers and older respondents.

- Single adults are more likely to be concerned about the threat of experiencing homelessness than married adults (28% vs. 19% respectively).

- We found that people living in a major city are more likely to be concerned about the threat of experiencing homelessness than those in the suburbs (32% vs. 18% respectively).

- Males (26%) are more likely than females (20%) to have this concern, while Black (29%) and Hispanic (28%) respondents are significantly more likely to share this concern than the overall consumer population (23%).

How Americans are preparing for the unexpected

Many Americans are tackling their financial fears head-on by increasing their emergency savings, focusing on their financial literacy, and making steady progress towards their goals.

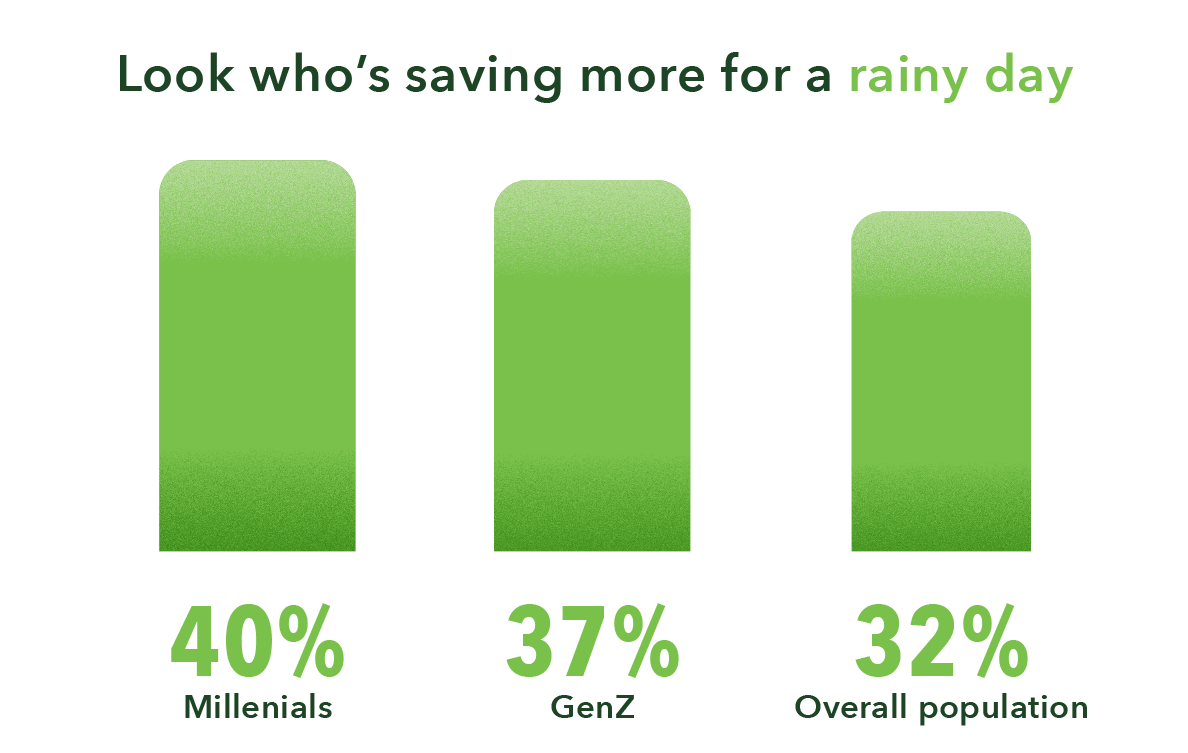

- 32% of Americans who have emergency funds have increased their emergency savings so far this year.

- About half (54%) of Americans polled have an emergency fund. Only about a quarter (27%) have never had one.

- Among those surveyed who have an emergency fund, and are saving more than they were last year — nearly half (47%) indicated they are contributing more to their emergency funds this year as compared to last because they’re worried about the effect of cost of living on their future financial security.

- Breaking it down further, younger generations are turning up the dial. Among those who have emergency funds, Gen Z (37%) and millennials (40%) are significantly more likely than the overall population (32%) to be saving more this year.

We also found that many Americans draw a direct connection between financial literacy and a sense of financial security.

Younger generations in particular have a spotlight on financial literacy — Gen Z (72%) and millennials (75%) who didn't receive a lot of financial literacy education as kids feel their financial security would be better today if they had. This is especially interesting given that these younger generations also report higher rates of early financial literacy education.

- Two-thirds (66%) of people who didn’t receive a lot of financial literacy education think their financial security would be better off today if they’d received more financial literacy education as kids.

- Almost a quarter (23%) of American adults did not receive any financial literacy education as children.

Hope as Americans work towards financial goals

Promisingly, a majority of Americans (54%) say they will achieve the financial goals they have set for themselves. Having realistic goals to work towards is half the battle — in fact, a 2019 study from the University of Basel found that setting attainable goals has a significant impact on our wellbeing.

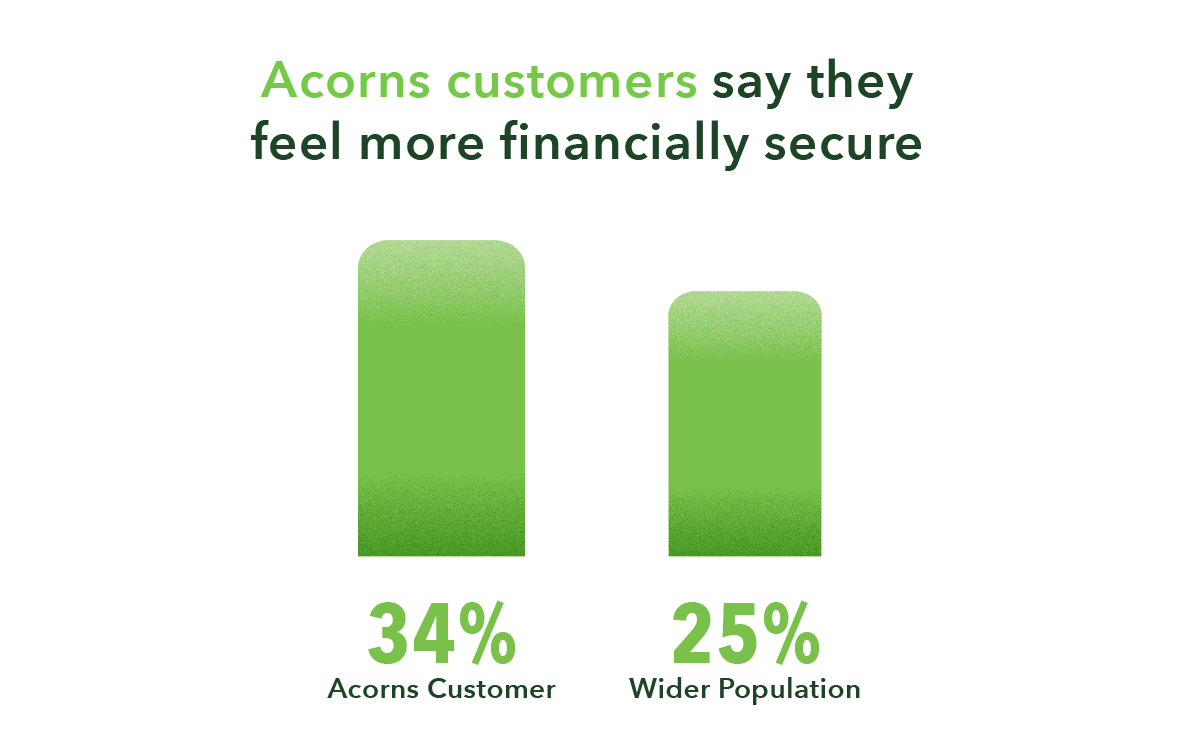

We see that progress amongst Acorns customers in particular. In a March 2024 survey, Acorns customers said they feel more financially secure year-over-year when compared to the wider population (34% of customers vs. 25% of wider population).

This is despite Acorns customers reporting a higher lack of early financial education compared to the wider pool (30% of customers vs. 23% of wider pool).

How Acorns grows hope

Acorns is working to put the tools of wealth-making into everyone’s hands, so Americans can save and invest for their goals every day!

Round-Ups® make it possible to invest spare change.

Acorns Later is an easy way to save for retirement, no matter what you do for a living.

Acorns Early helps you invest for the kids in your life now, because time goes fast.

Earn helps you earn bonus investments when you shop from thousands of top brands.

Grow your knowledge with our Learn hub because knowledge is power.

Banking with Acorns offers a checking account with a debit card that saves and invest for you so you can spend smarter. Acorns Visa™ debit cards and banking services are issued and provided by Lincoln Savings Bank or nbkc bank, Members FDIC.

From acorns mighty oaks do grow. With more than 6 million subscribers, we’ll keep finding ways to make it even easier to grow your oak!

______

Survey methodology

The research was conducted anonymously by Opinium Research and commissioned by Acorns. This survey was not directed at Acorns customers. Any response collected from a customer was coincidental. The survey was conducted from February 14, 2024 through February 23, 2024, using Opinium Research’s nationally representative online research panel. The sample population consisted of 5,000 U.S. consumers ages 18+, comprised of 2,466 males, 2,516 females, 13 nonbinary and 5 preferred not to say. The survey questionnaire was written by Acorns with questions related to the financial wellbeing index adapted from Netemeyer et. al (2018) with additional guidance from Professor Shlomo Benartzi. "Acorns" and "Money Matters Report" are trademarks of Acorns Grow, Inc.

Comparative survey was conducted by Acorns, compiling data from 1,965 Acorns customers surveyed from March 20, 2024 through March 26, 2024.

Who we heard from

- 2466 male, 2516 female, 13 nonbinary, 5 prefer not to say

- 764 Gen Z, 1417 Millennial, 1276 Gen X, 1411 Boomer, 132 Silent Generation or older (78+)

Money Matters from previous years

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Article contributors are not affiliated with Acorns Advisers, LLC. and do not provide investment advice to Acorns’ clients. Acorns is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.