Illustration of the power of compounding based on initial deposit, contribution schedule, time horizon, and rate of return specified. Changes in those variables can affect the outcome. Reset the calculator using different figures to show different scenarios. Does not include Acorns’ monthly subscription fees (min $3/mo), which would reduce account returns over time, or other deposits or withdrawals. Results do not predict or represent the performance of any Acorns portfolio and do not take into consideration economic or market factors which can impact performance. Investment results will vary. No guarantee investment return will achieve 8% or any annual returns.

Redeem your $5 bonus investment!

Why Acorns - Why Acorns - Why Acorns - Why Acorns - Why Acorns - Why Acorns - Why Acorns - Why Acorns - Why Acorns - Why Acorns -

Money tools for every stage of life

Easy and automatic saving and investing

All-in-one money app

Invest wisely, not wildly

Security as strong as oak

No hidden fees.

No commissions.

Show Your Potential

Your money, your future

Important Disclosures

Welcome to the Acorns site, operated by Acorns Advisers, LLC ('Acorns'). If you register for an Acorns Account and start investing, we will credit a reward in the form of investments to your Acorns Account. You will not be charged for the cost of what we pay to obtain your account or any differential from the fees we charge clients who come to us on their own without being referred by a friend. The referral reward is subject to change at the firm's discretion. Limited time offer. Shares are purchased once your account is approved. To be eligible for the reward, you must use your friend’s personal invitation code to complete sign up. Acorns is only offered to US-residents who are 18 years of age or older. Acorns reserves the right to restrict or revoke this offer at any time. More information about Acorns Advisers is available in the wrap fee program brochure, and our customer relationship summary.

Over 14 million all-time customers and over $27 billion invested since inception as of 8/18/2025. App store star rating as of 8/19/2025. For more information visit Acorns.com.

© 2026 Acorns

Important Risk Disclosures

Investing involves risk, including loss of principal. Please consider, among other important factors, your investment objectives, risk tolerance and Acorns’ pricing before investing. Acorns Subscription Fees are assessed based on the tier of services in which you are enrolled, view details in our program agreement. Investment advisory services offered by Acorns Advisers, LLC (Acorns), an SEC-registered investment advisor. Brokerage services are provided to clients of Acorns by Acorns Securities, LLC, an SEC-registered broker-dealer and member FINRA/SIPC. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principle. Compounding is the process in which an asset's earnings are reinvested to generate additional earnings over time. It does not ensure positive performance nor does it protect against loss. Acorns clients may not experience compound returns and investment results will vary based on market volatility and fluctuating prices.

Spare change invested with Round-Ups® is transferred from your linked funding source to your Acorns Invest account, where the funds are invested into a portfolio of selected ETFs. If you do not maintain an adequate amount of funds in your funding source sufficient to cover your Round-Ups® investment, you could incur overdraft fees with your financial institution. Round-Up investments from an external account, will be processed when your Pending Round-Ups reach or exceed $5. Acorns Invest is an individual investment account. Acorns Later is an Individual Retirement Account (either Traditional, ROTH or SEP IRA) selected for clients based on their answers to a suitability questionnaire. Invest and Later recommend a portfolio of ETFs (exchange traded funds) to clients, please note that a properly suggested portfolio recommendation is dependent upon current and accurate financial and risk profiles.

The ETFs comprising the Acorns portfolios charge fees and expenses that will reduce a customer’s return. Investors should read each fund's prospectus and consider the investment objectives, risks, charges and expenses of the funds carefully before investing. Investment policies, management fees and other information can be found in the individual ETF’s prospectus.

Acorns is not a bank. Acorns Visa™ debit cards and banking services are issued by Lincoln Savings Bank or nbkc bank, members FDIC. Acorns Checking clients are not charged overdraft fees, maintenance fees, or ATM fees for cash withdrawals from in-network ATMs.

Acorns Earn provides subscribers access to shop with our partners and earn bonus investments into your Acorns Invest portfolios when purchasing items from the partner brands. Acorns Earn rewards investments are made by Acorns Grow, Inc. into your Acorns Invest account through a partnership Acorns Grow maintains with each Acorns Earn partner.

Acorns, Round-Ups® investments, Real-Time Round-Ups® investments, Invest the Change and the Acorns logo are registered trademarks of Acorns Grow Incorporated. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

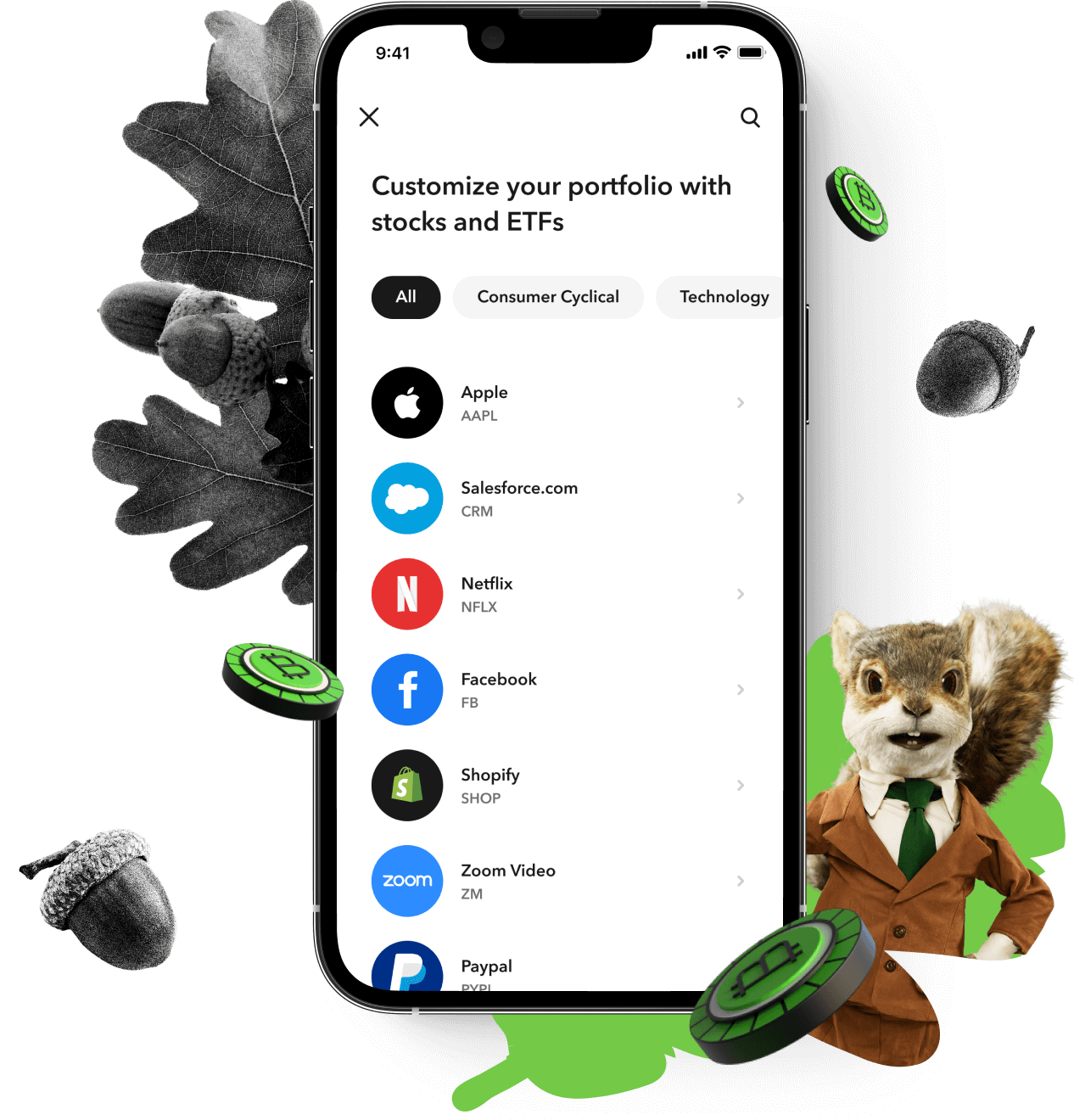

Custom Portfolios are non-discretionary investment advisory accounts, managed by the customer. Custom Portfolios are available only to Acorns Gold customers with an open Acorns Invest Account and are not available as a stand alone account. Custom portfolios are not instant trading. Customers wanting more control over order placement and execution may need to consider alternative investment platforms before adding a Custom Portfolio account. This content is for informational purposes only and should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Acorns Advisers does not provide investment advice with regard to orders directed in a Custom Portfolio.

For additional important risks, disclosures, and information, please visit https://www.acorns.com/terms/

© 2026 Acorns Grow Incorporated | Disclosures | Accessibility | Privacy | Your Privacy Choices