Acorns is not a bank. Acorns Visa™ debit cards are issued by Lincoln Savings Bank or nbkc bank, Members FDIC for Acorns Checking account holders.

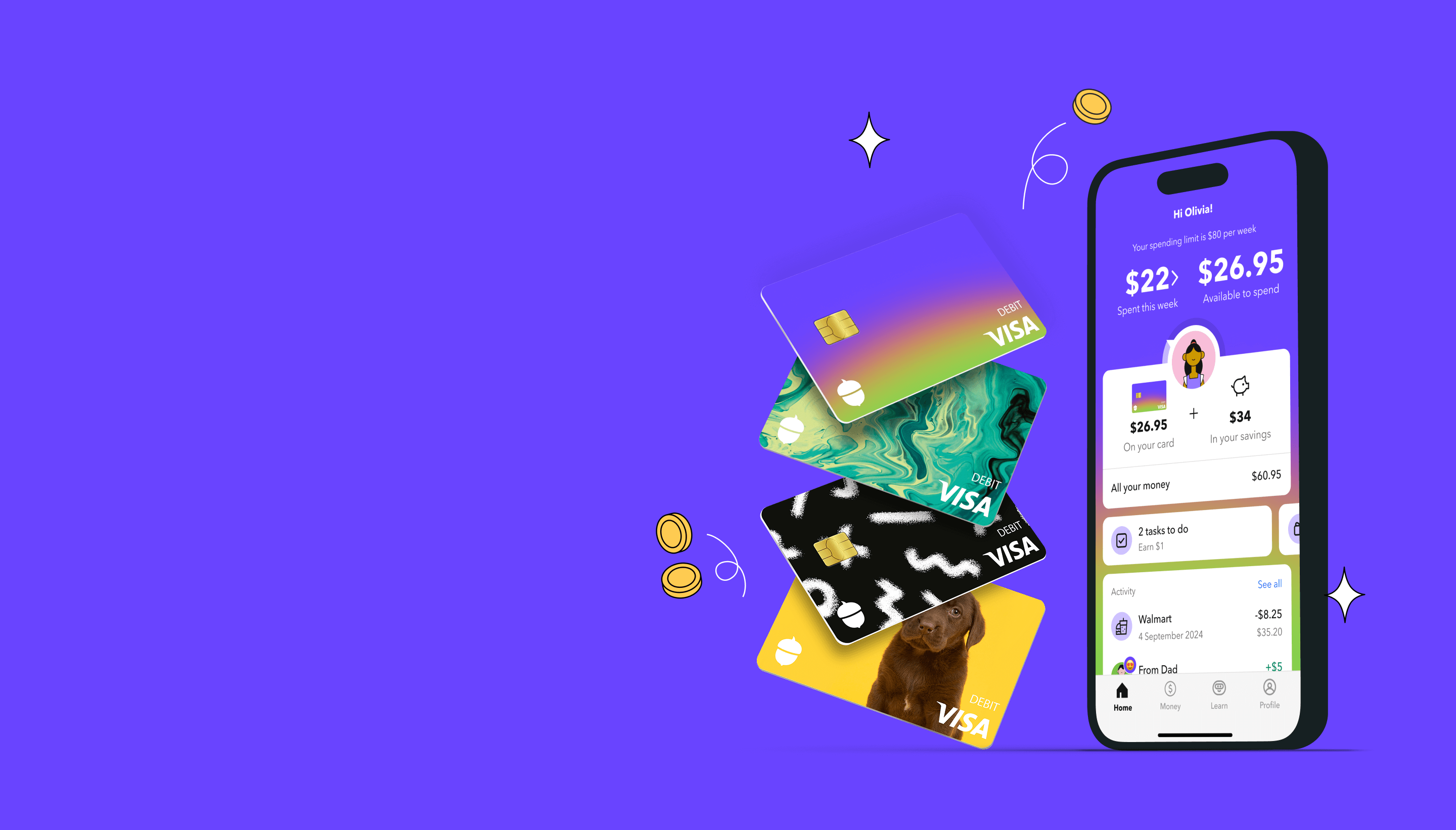

Say Hello to Acorns

An automated saving and investing app for you and your family

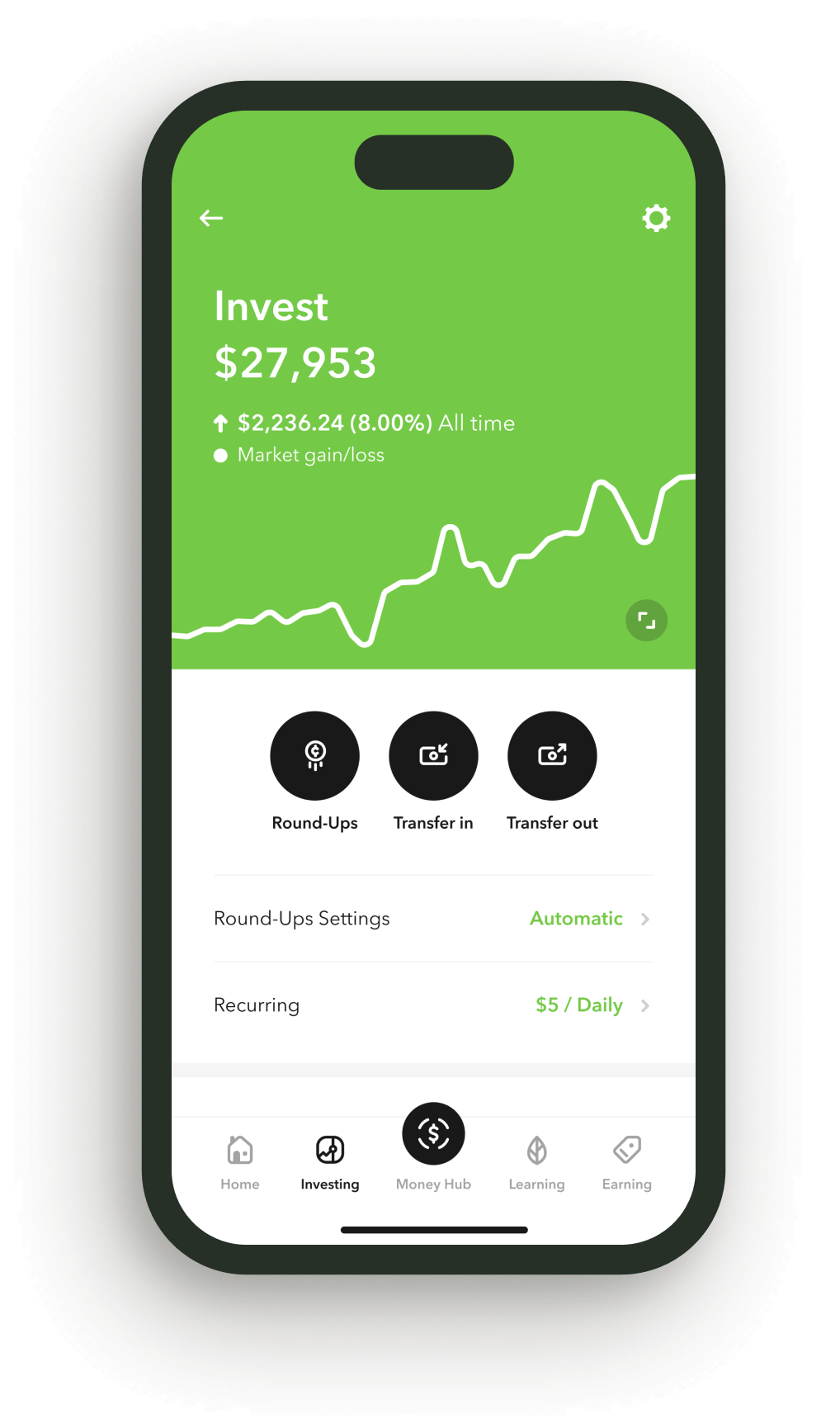

A BETTER WAY TO INVEST

Why Acorns - Why Acorns - Why Acorns - Why Acorns - Why Acorns - Why Acorns - Why Acorns - Why Acorns - Why Acorns - Why Acorns -

Money tools for every stage of life

Investing as a beginner? Planning for retirement? Saving for your kids? Wherever you are on your money journey, Acorns’ financial wellness tools can help you reach your goals.

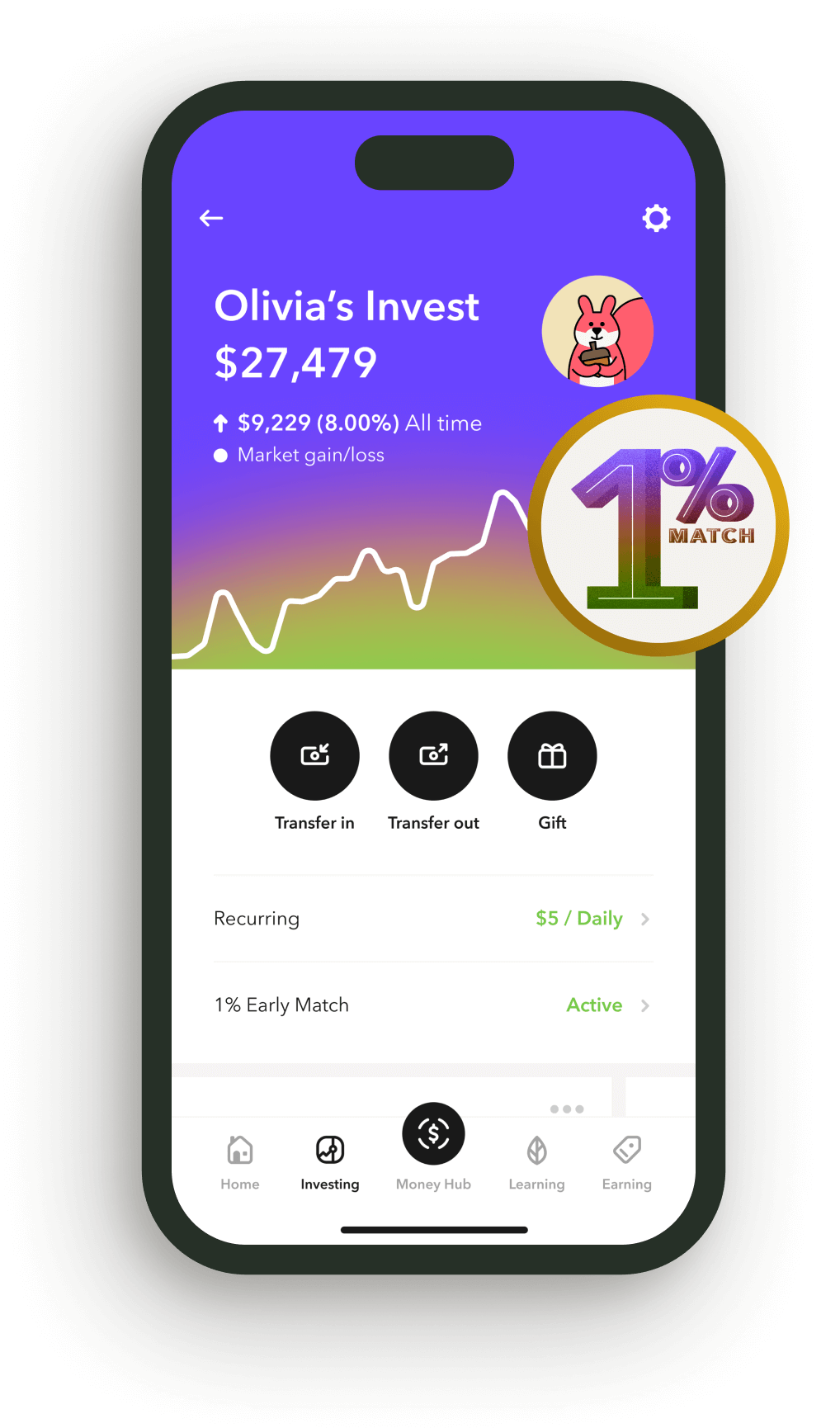

Easy and automatic saving and investing

No confusing charts or investing tools. Just choose an amount, set a schedule, and we’ll automatically save and invest your money for you. You can even get started with just your spare change!

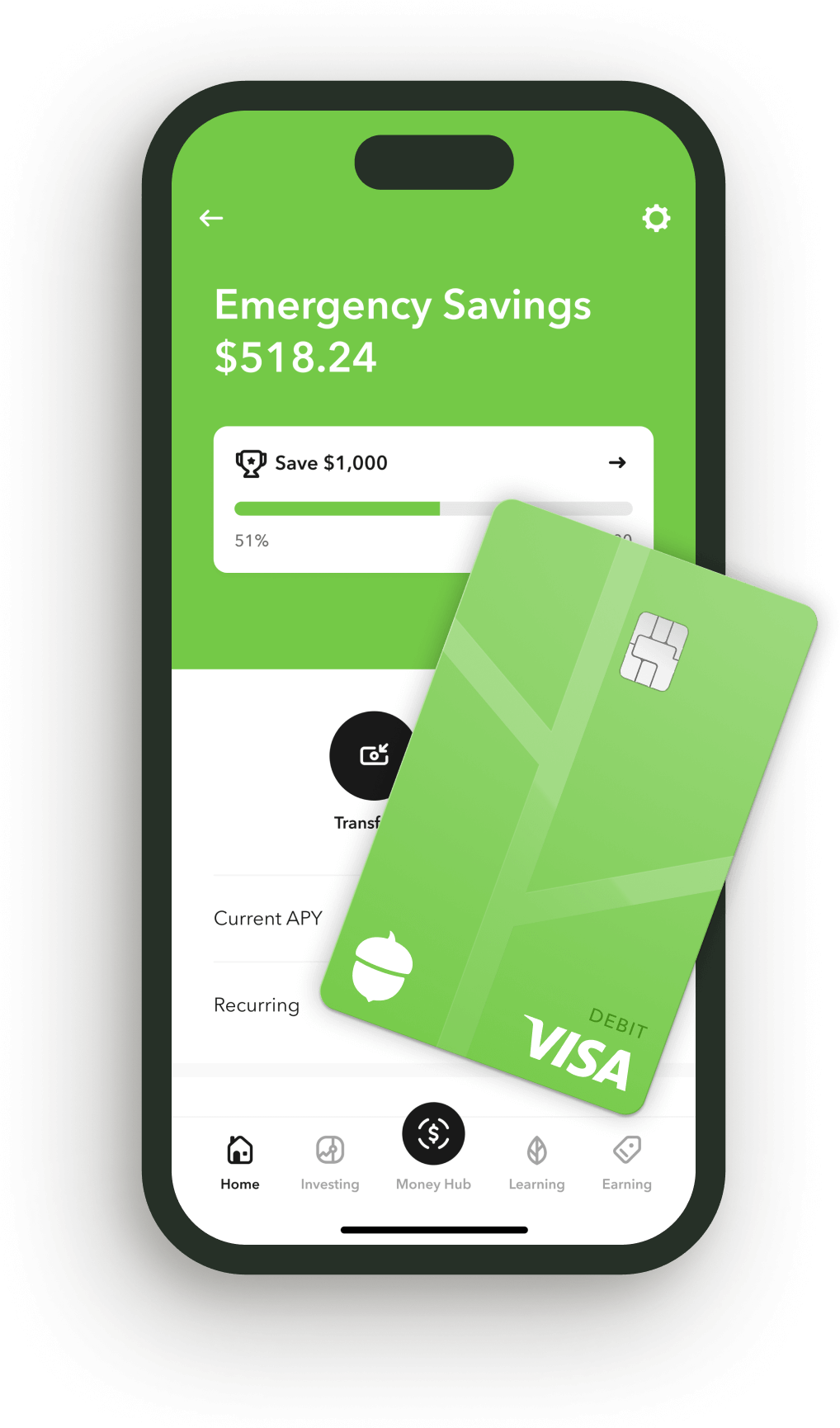

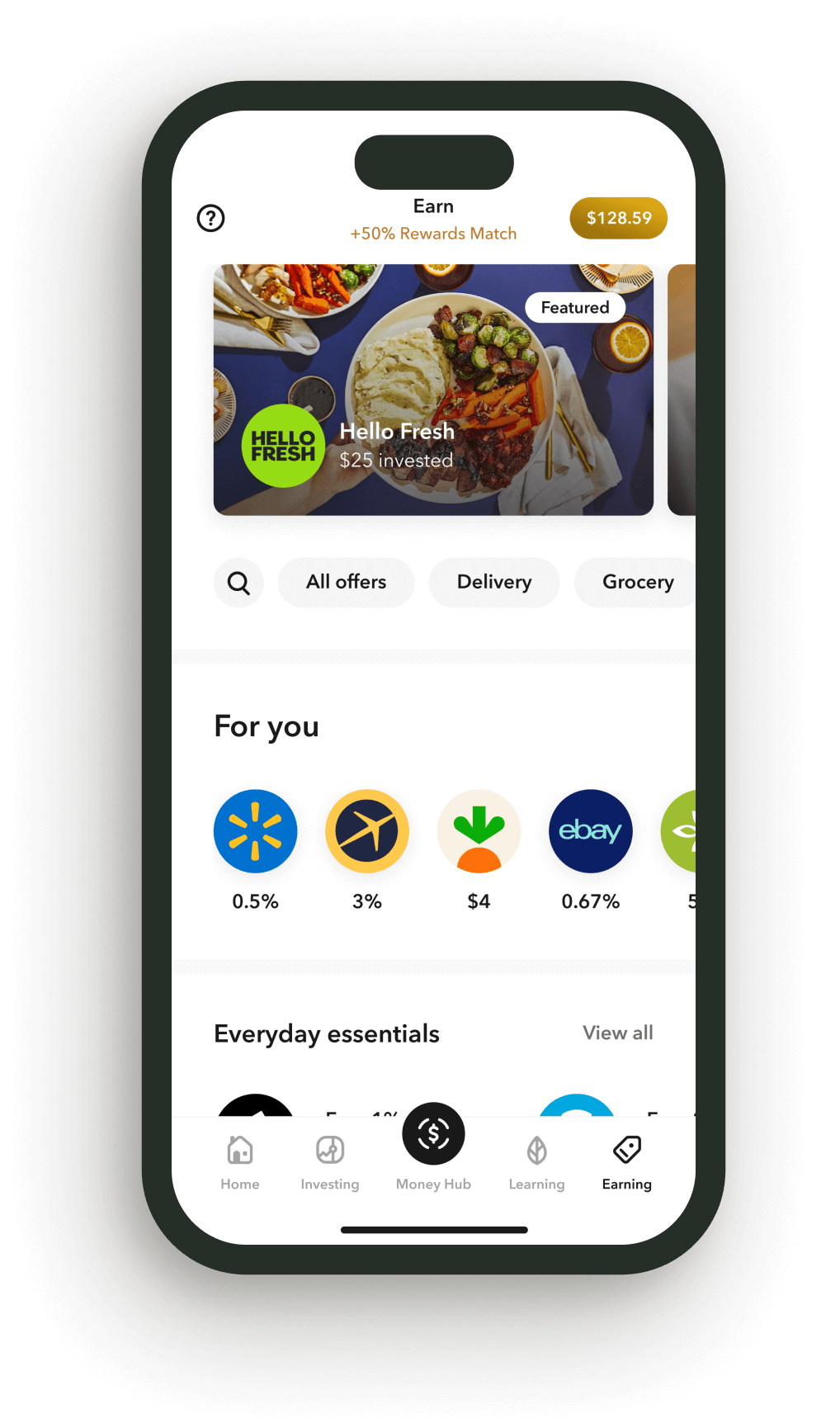

All-in-one money app

Acorns brings checking, savings, investing, and retirement together into one simple app. So everything you need for your money is in one place — easy, seamless, and always in your control.

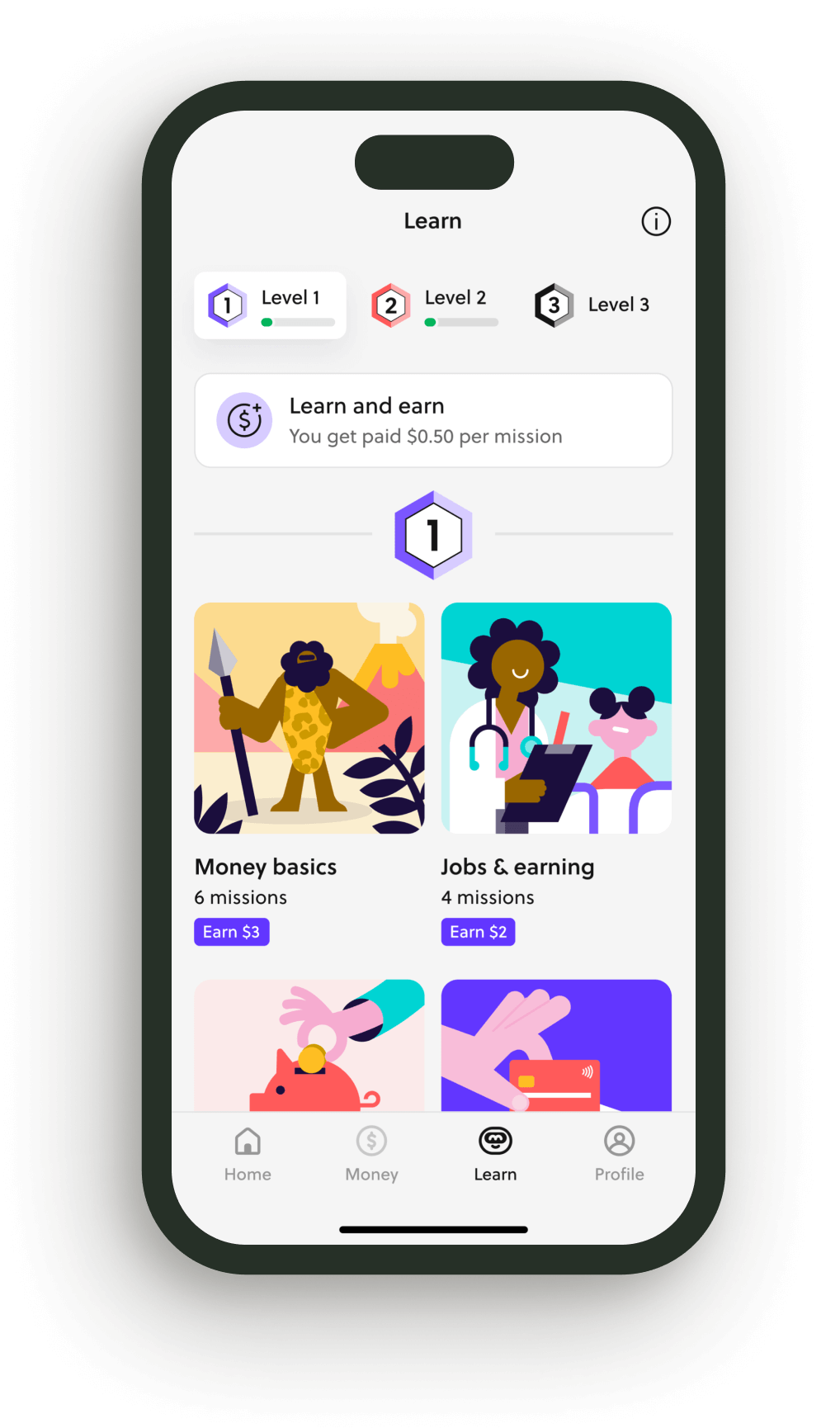

Invest wisely, not wildly

It takes more than money to grow — money skills matter, too. That’s why Acorns combines expert-built, diversified ETF investment portfolios with educational tools to help you with your long-term goals.

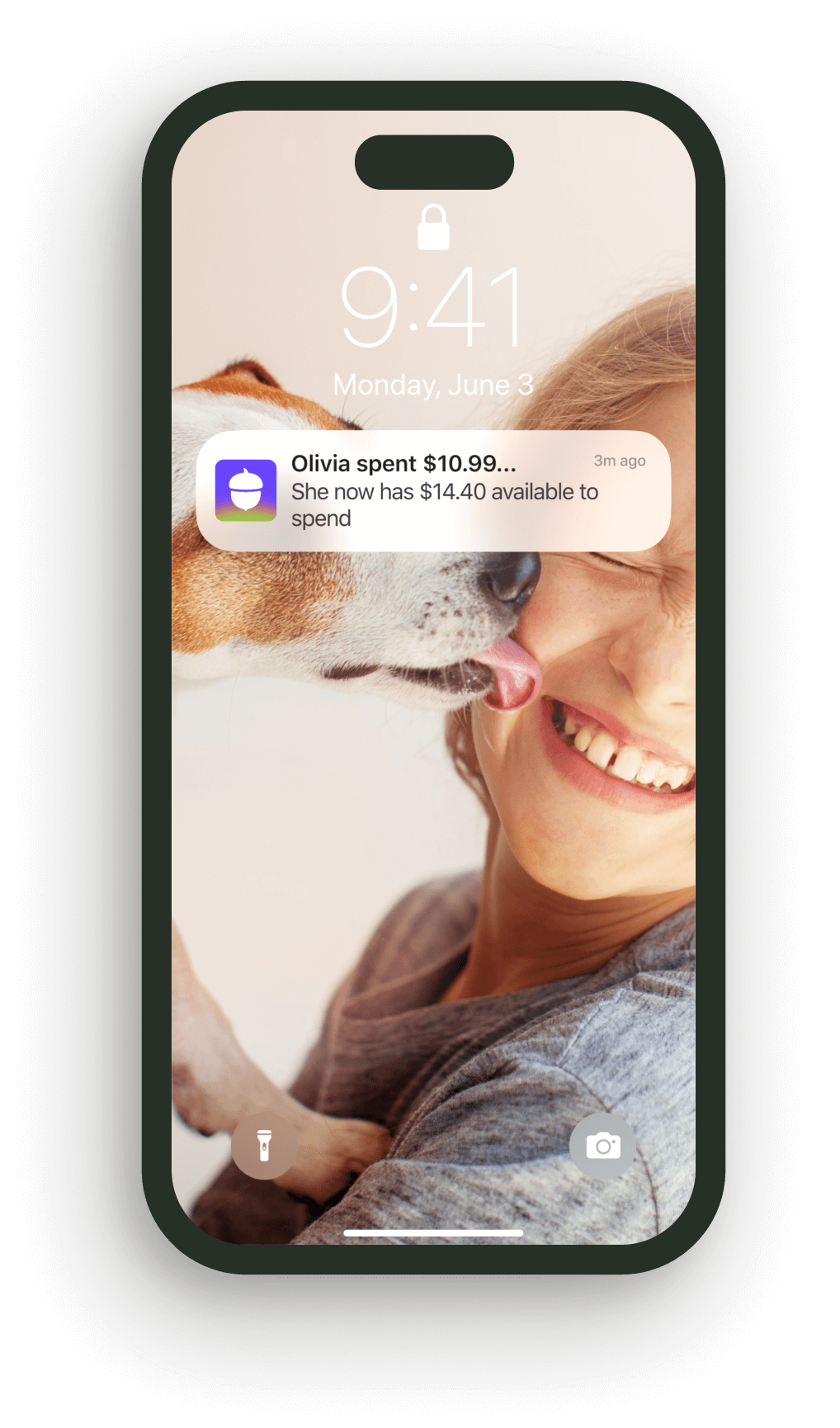

Security as strong as oak

From day one, your money and investments are secured with bank-level encryption, SIPC protection up to $500,000, and industry-standard security. No hidden fees, real-time alerts, and 24/7 support.

No hidden fees.

No commissions.

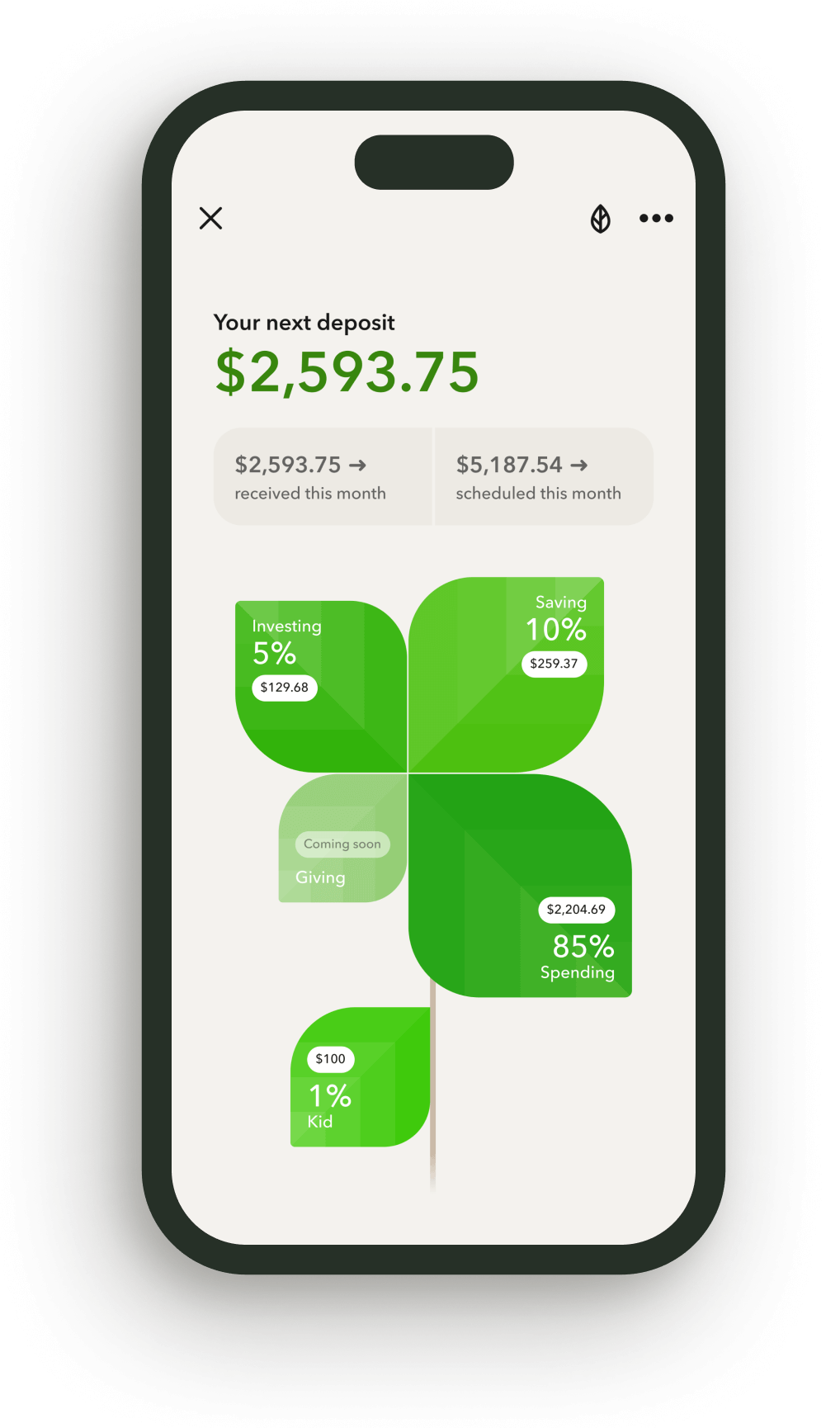

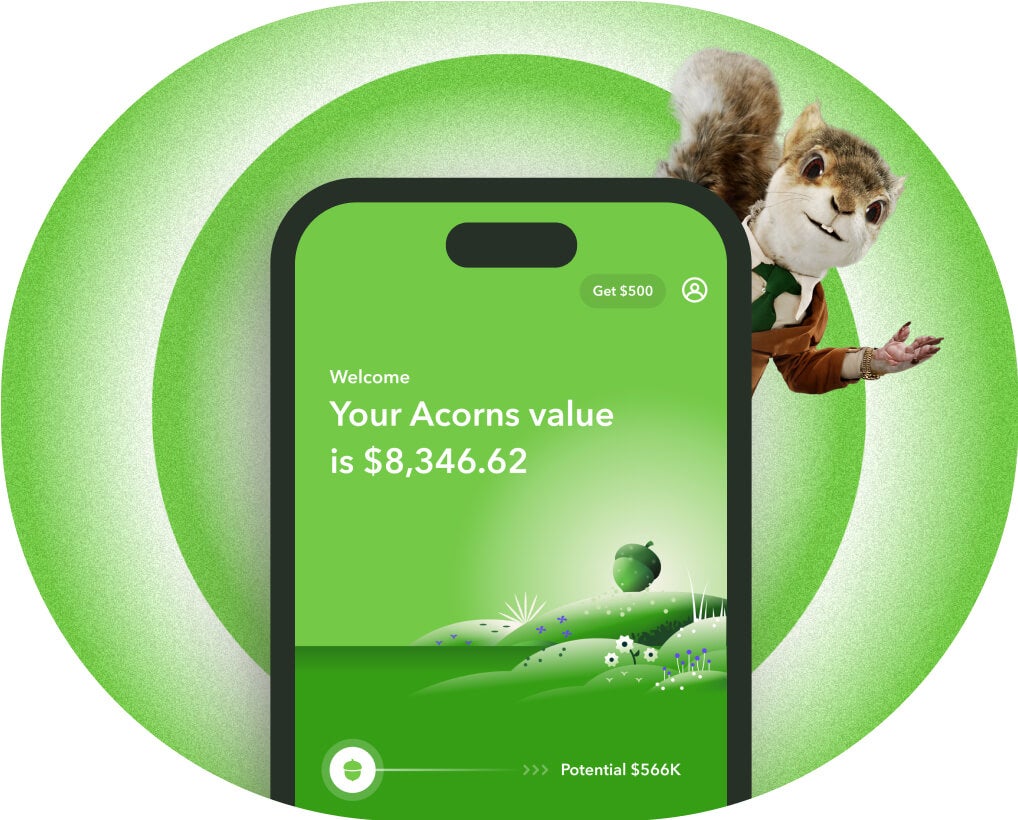

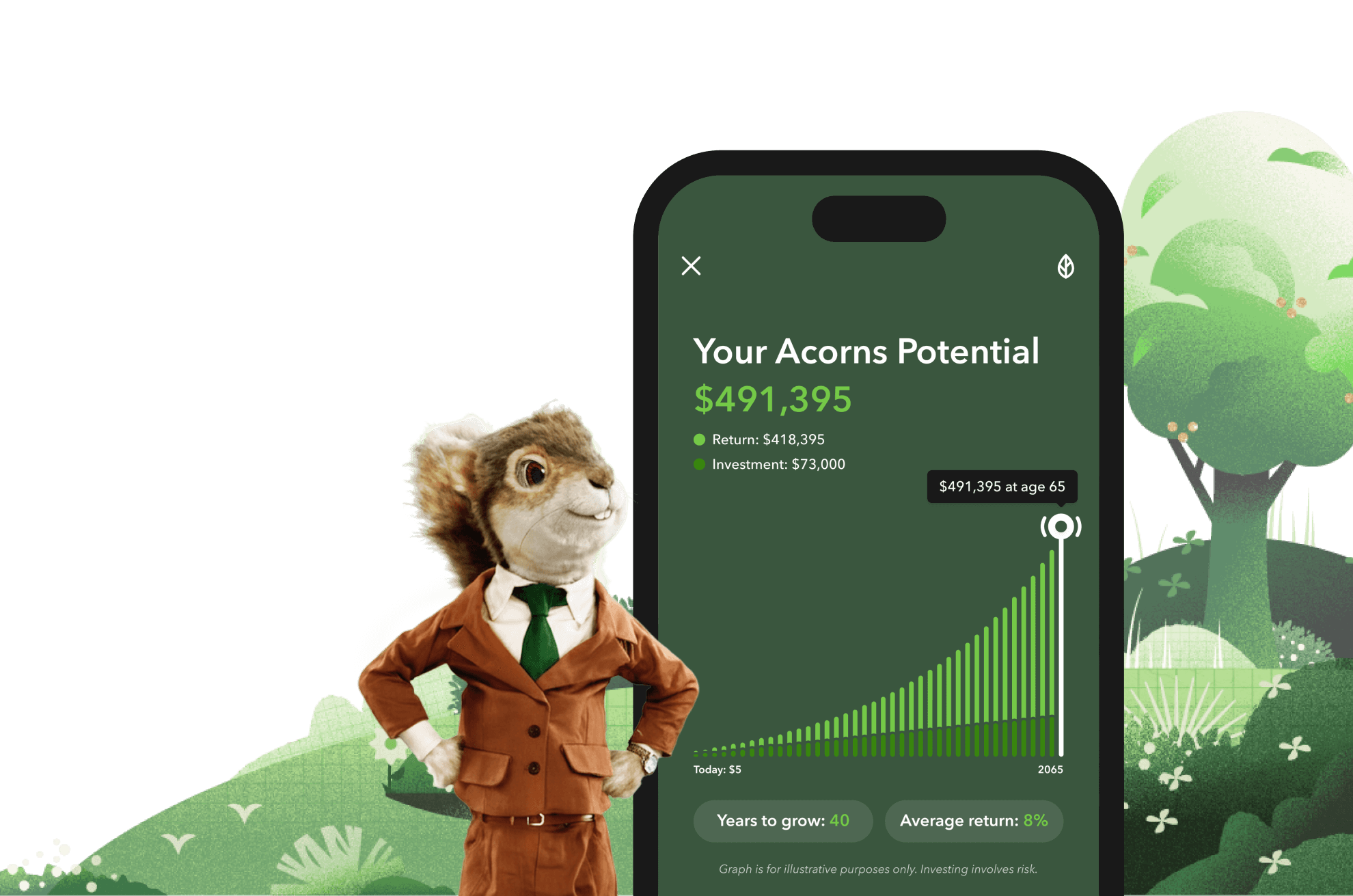

Show Your Potential

Your money, your future

Your money’s got potential, and we’ll help you see it. Our Potential screen updates with every dollar you invest, showing how your money can grow with long-term investing and compounding.

$XX,XX5

Illustration of the power of compounding based on initial deposit, contribution schedule, time horizon, and rate of return specified. Changes in those variables can affect the outcome. Reset the calculator using different figures to show different scenarios. Does not include Acorns’ monthly subscription fees (min $3/mo), which would reduce account returns over time, or other deposits or withdrawals. Results do not predict or represent the performance of any Acorns portfolio and do not take into consideration economic or market factors which can impact performance. Investment results will vary. No guarantee investment return will achieve 8% or any annual returns.

“My Acorns Invest account was a huge lifesaver. Now, I’m working on building another nest egg.”

Lou Caltabiano, acorns customer

Customer received $5,000, which provides incentive to recommend Acorns and therefore all opinions within material may be biased. Testimonials not representative of all customers and are not guarantees of future performance or success.

“I never thought I could afford to invest until I found Acorns.”

Taryn Thompson, acorns customer

Customer received $5,000, which provides incentive to recommend Acorns and therefore all opinions within material may be biased. Testimonials not representative of all customers and are not guarantees of future performance or success.

"I felt way behind and I wasn't sure where to start. But Acorns gave me an easy way in."

Marissa LeBarron, acorns customer

Customer received $5,000, which provides incentive to recommend Acorns and therefore all opinions within material may be biased. Testimonials not representative of all customers and are not guarantees of future performance or success.

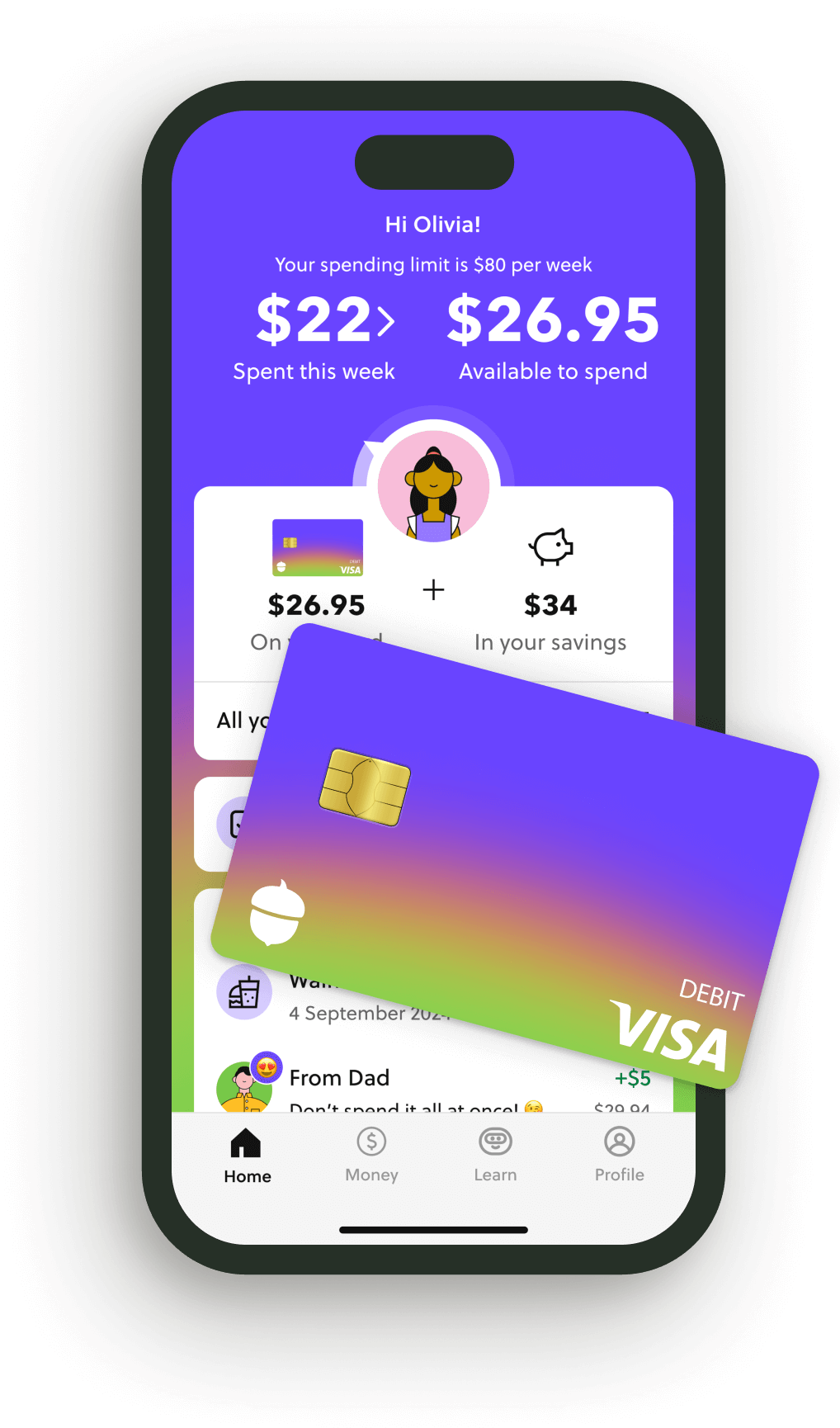

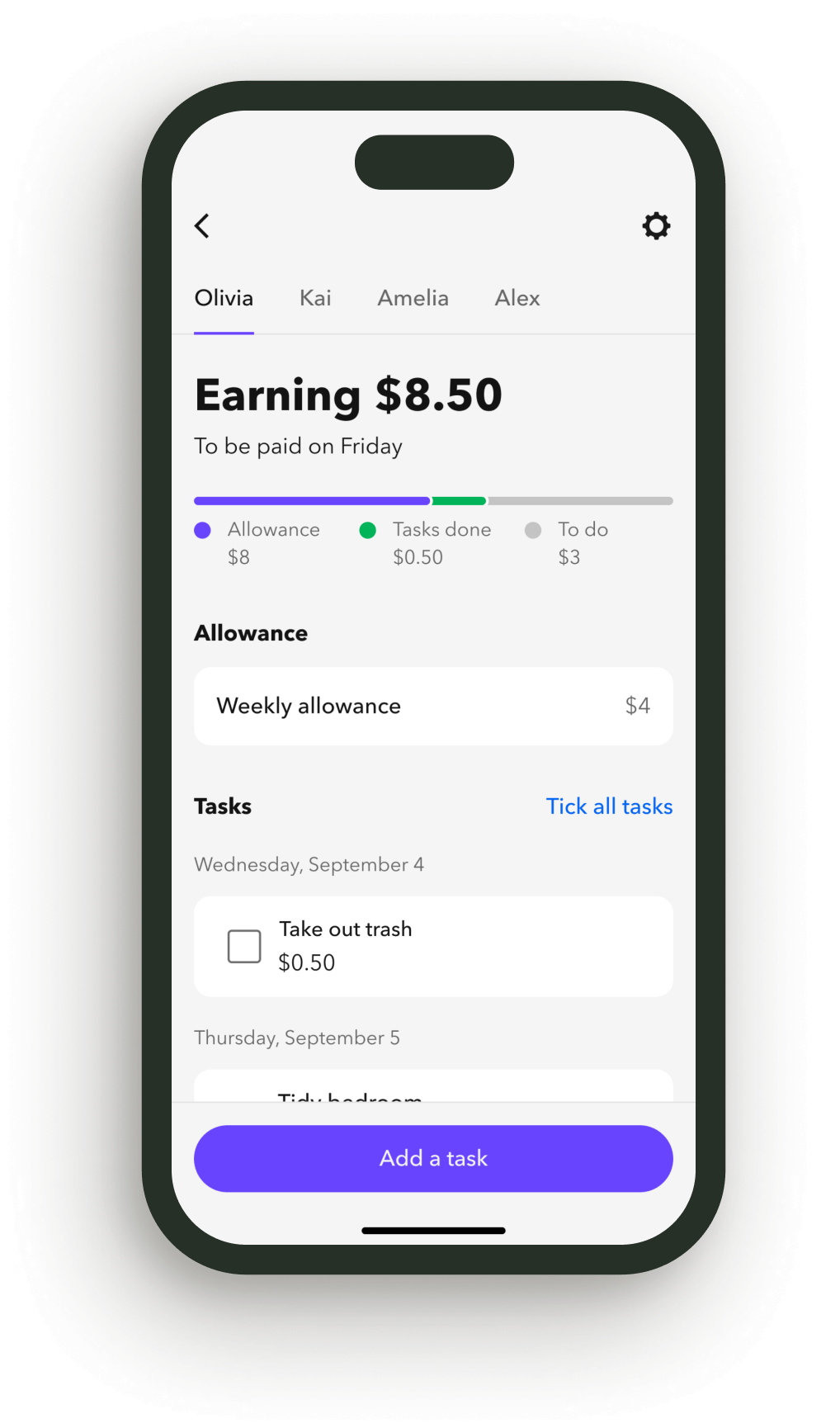

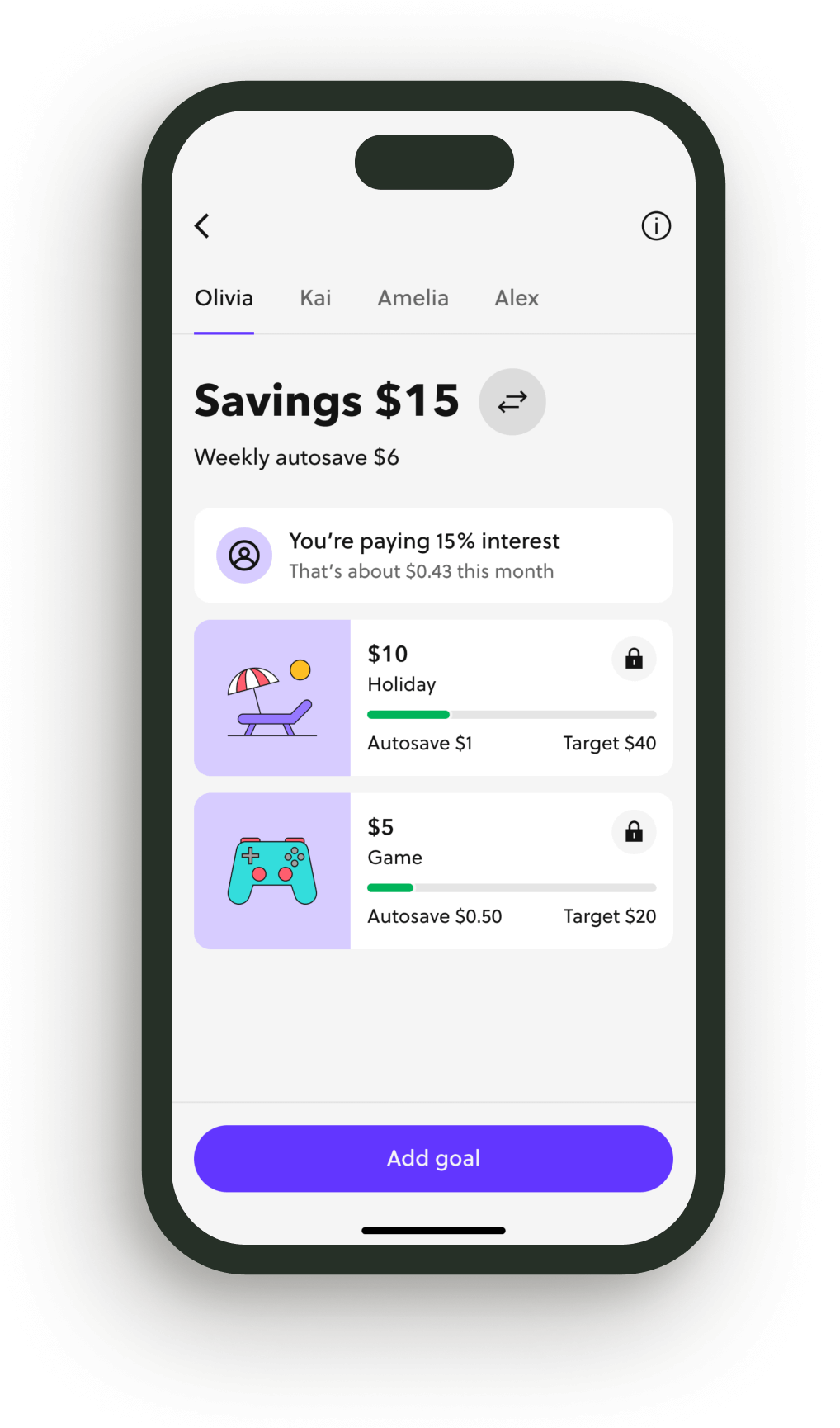

"I'm using my kids' Acorns Early cards to show them that money isn't just for spending. It's a tool. I want them to understand ownership, investing, and how to make their money work for them."

Naseema McElroy, acorns Early customer

Customer received $15,000, which provides incentive to recommend Acorns and therefore all opinions within material may be biased. Testimonials not representative of all customers and are not guarantees of future performance or success.

“I’m investing with Acorns to build back my retirement [account]. I love what I do, I just don’t want to do it forever.”

Kristie Harford, acorns customer

Customer received $5,000, which provides incentive to recommend Acorns and therefore all opinions within material may be biased. Testimonials not representative of all customers and are not guarantees of future performance or success.

“I like using my own money because I know I worked hard for it.”

Mila Young, acorns Early customer

Customer received $5,000, which provides incentive to recommend Acorns and therefore all opinions within material may be biased. Testimonials not representative of all customers and are not guarantees of future performance or success.

“My wife and I are using Acorns to invest in a new legacy — one that’s filled with brighter days.”

SHAWN PERDUE, acorns customer

Customer received $5,000, which provides incentive to recommend Acorns and therefore all opinions within material may be biased. Testimonials not representative of all customers and are not guarantees of future performance or success.

“I’m not just investing for myself, but for my children and grandchildren. Every contribution I make is a step toward generational stability.”

Chiane Hall, acorns customer

Customer received $5,000, which provides incentive to recommend Acorns and therefore all opinions within material may be biased. Testimonials not representative of all customers and are not guarantees of future performance or success.

“We started investing with Acorns Early Invest to give our kids a head start. They’ll still have to work hard. But maybe they can worry a little less.”

Rachel Young, acorns customer

Customer received $5,000, which provides incentive to recommend Acorns and therefore all opinions within material may be biased. Testimonials not representative of all customers and are not guarantees of future performance or success.

Your total Potential hypothetical calculation is for illustrative purposes only and assumes an initial $15,000 investment and an 8% fixed annual rate of return with $5 daily contributions over a 45-year period.