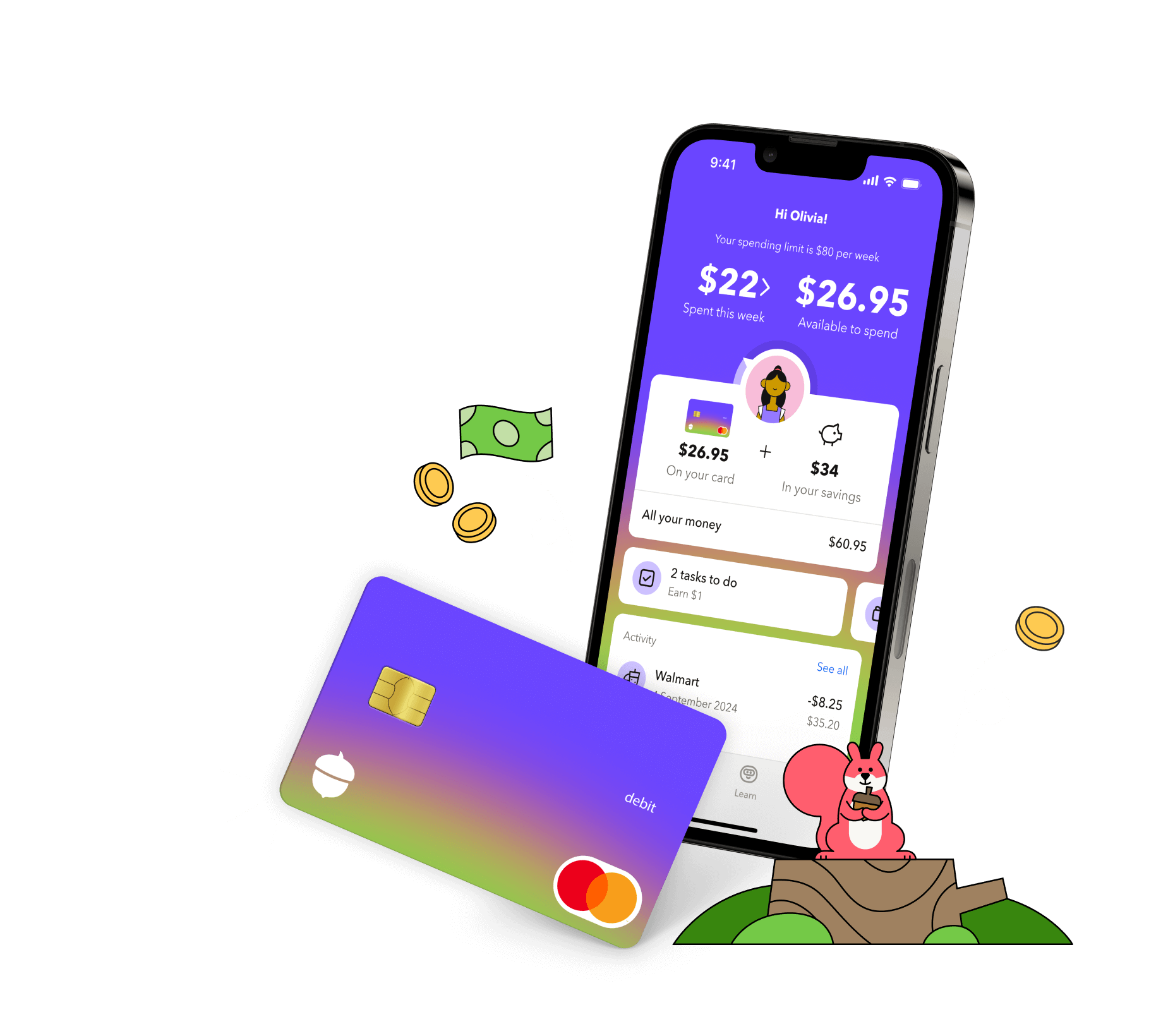

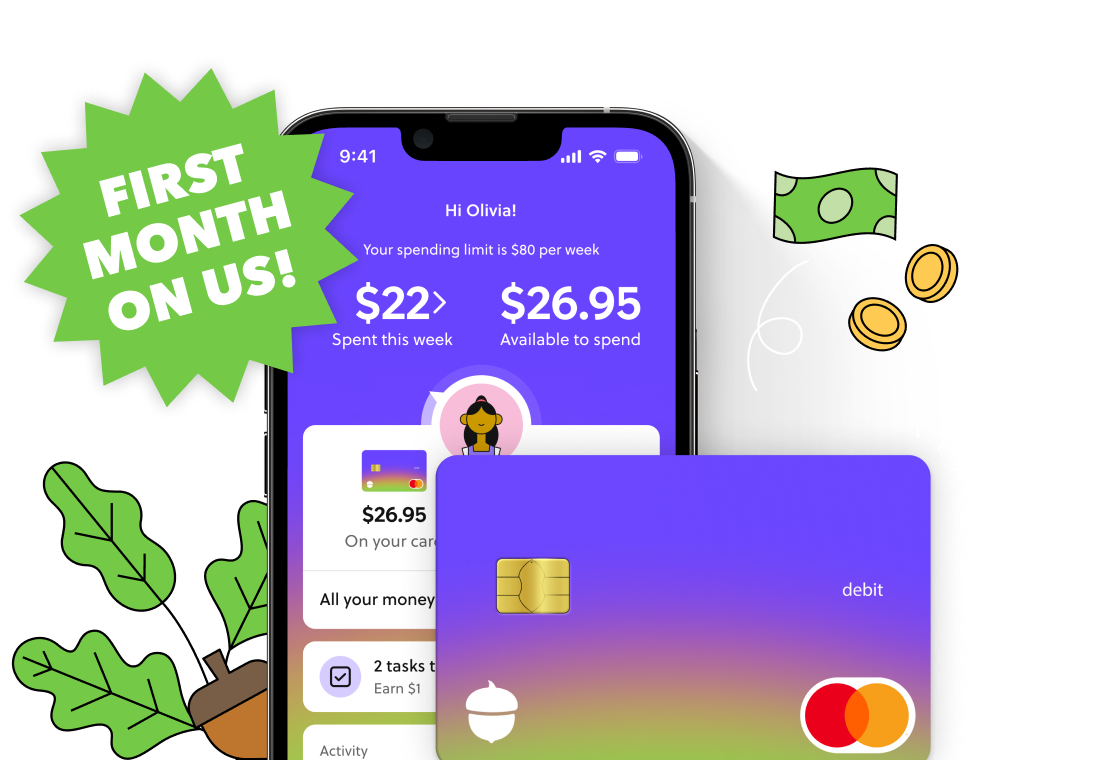

The smart money app and debit card for kids

Grow your kids’ money skills with Acorns Early — a smart money app and debit card that teaches them the value of money.

Get Acorns Early

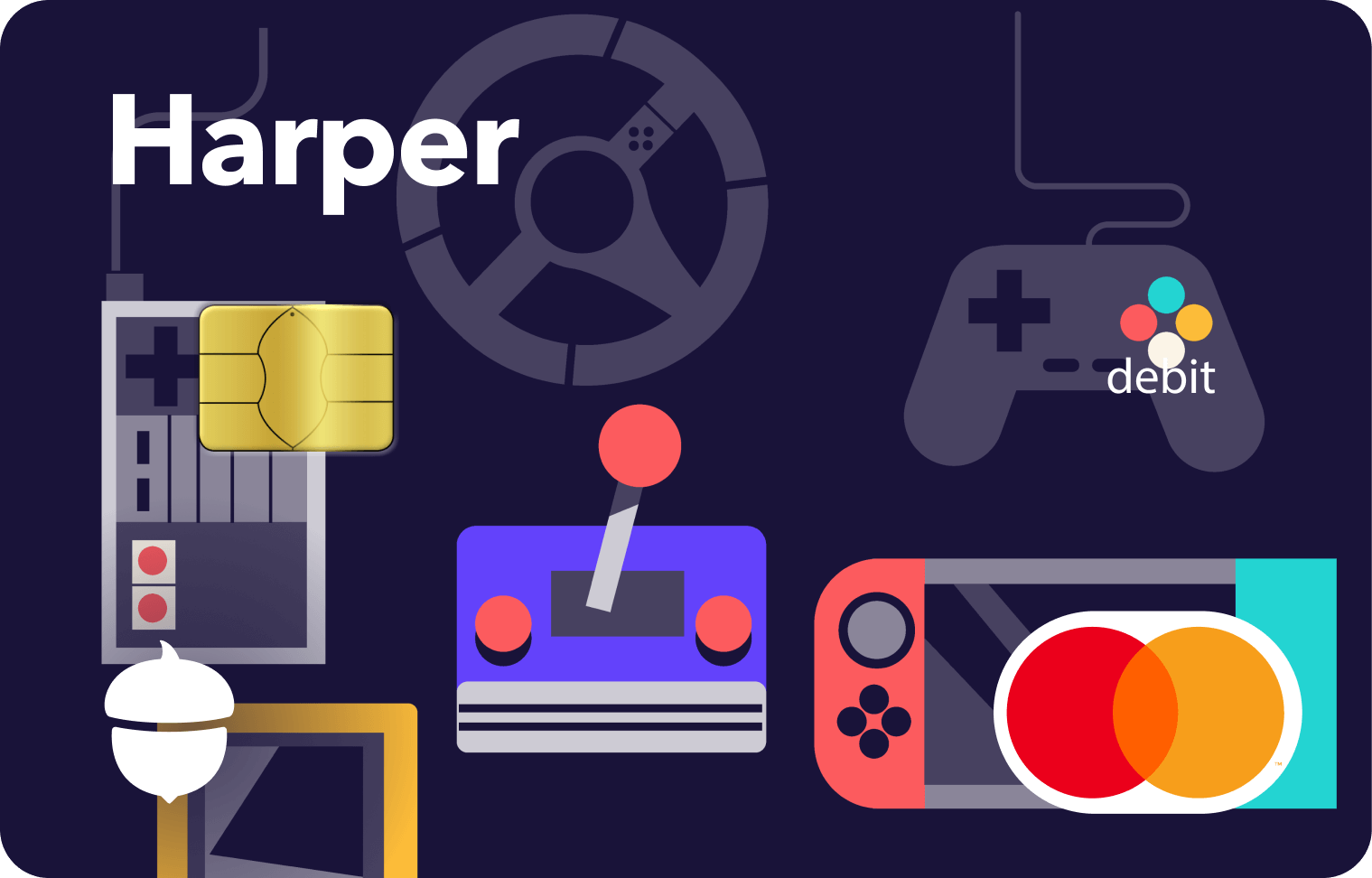

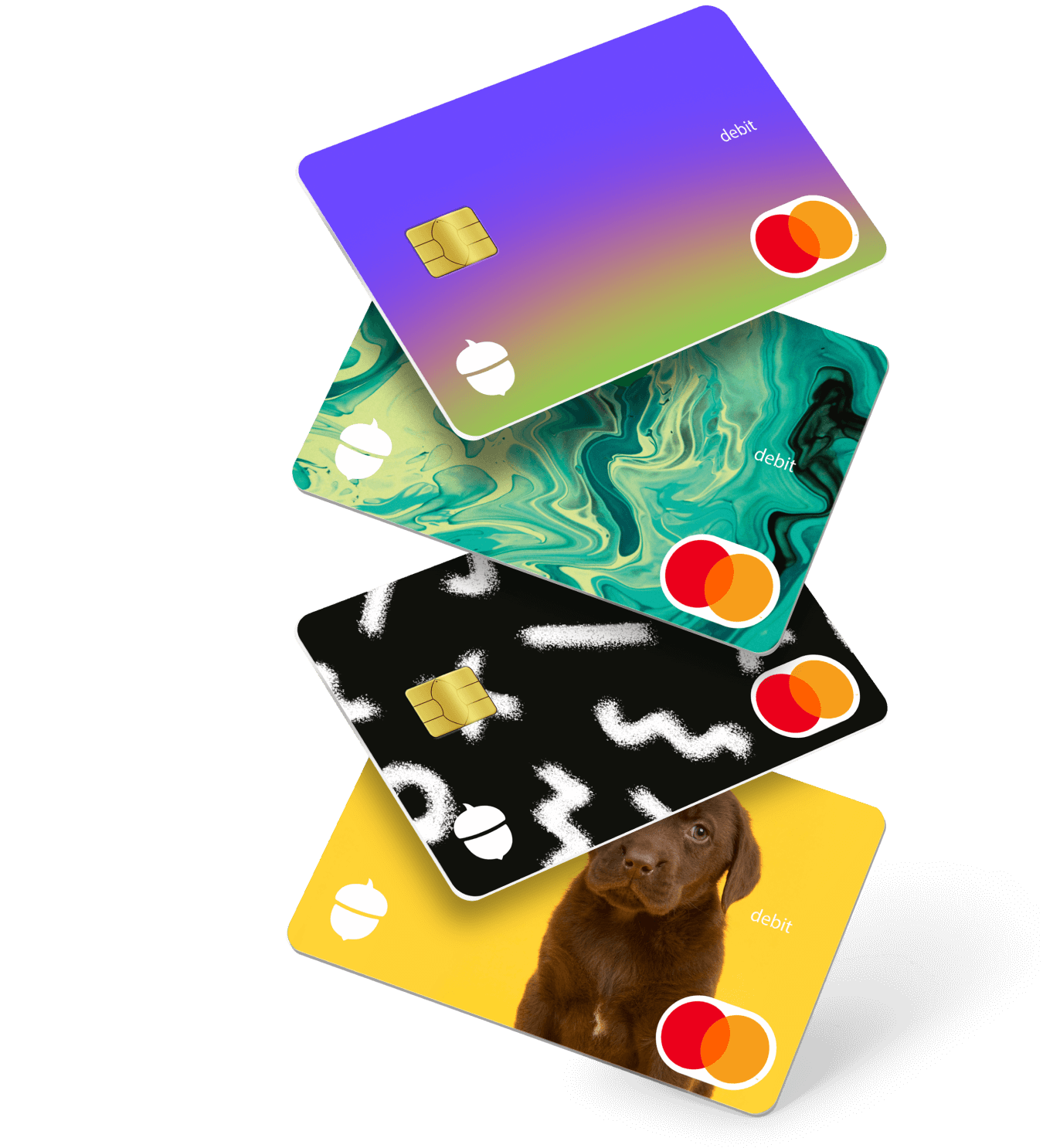

Choose from 35+ customizable debit card designs

Why choose Acorns Early for kids?

Bank-level encryption

Bank-level encryption

Chip and PIN-protected transactions

Chip and PIN-protected transactions

Acorns Early blocks unsafe spending categories

Acorns Early blocks unsafe spending categories

Secure PIN recovery in the app

Secure PIN recovery in the app

FDIC-insured up to $250,000 through a partner bank

FDIC-insured up to $250,000 through a partner bank

Zero Liability Protection by Mastercard®

Zero Liability Protection by Mastercard®

Real-time spending notifications

Real-time spending notifications

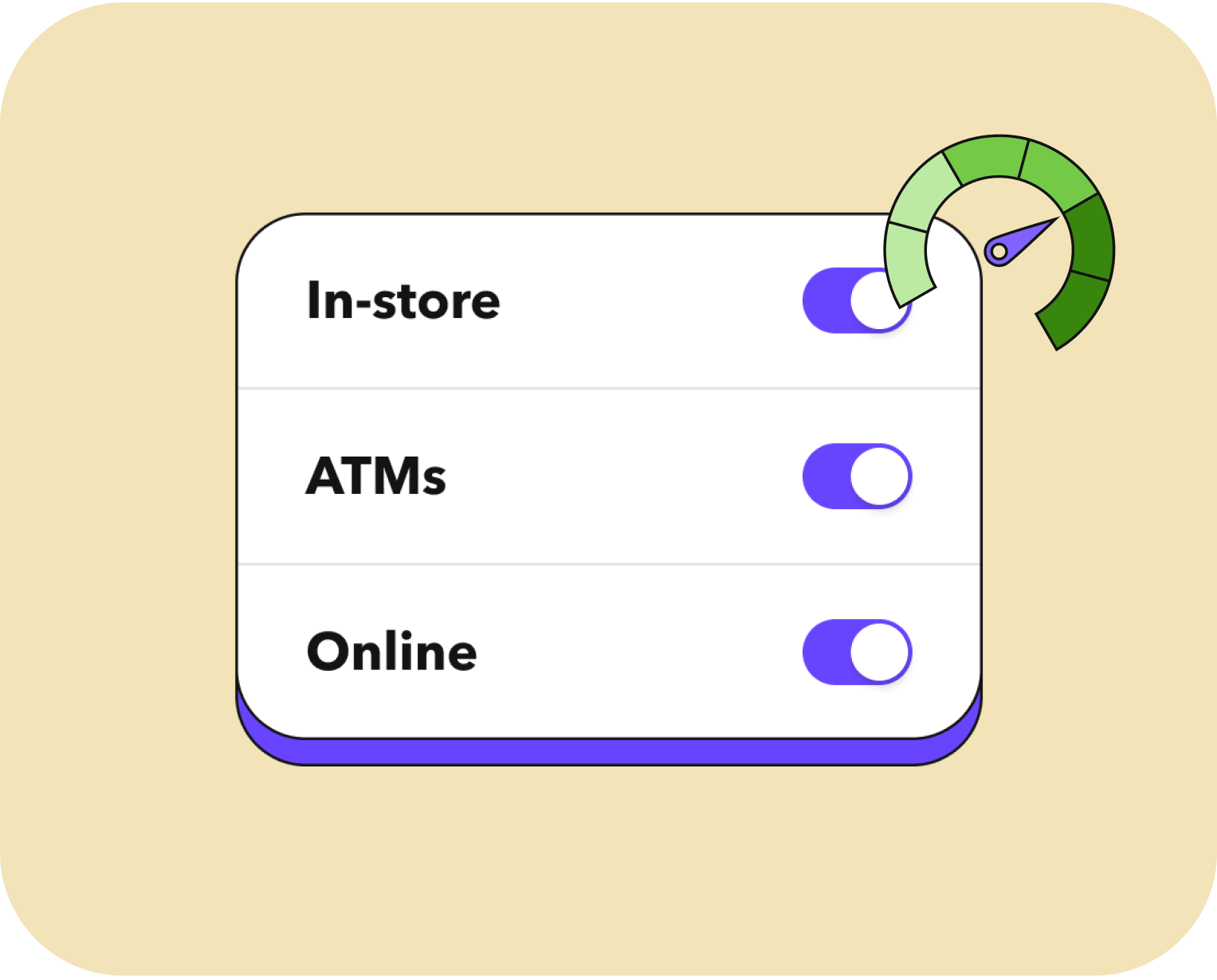

Easily block and unblock cards

Easily block and unblock cards

Spending, sending, giving, and more

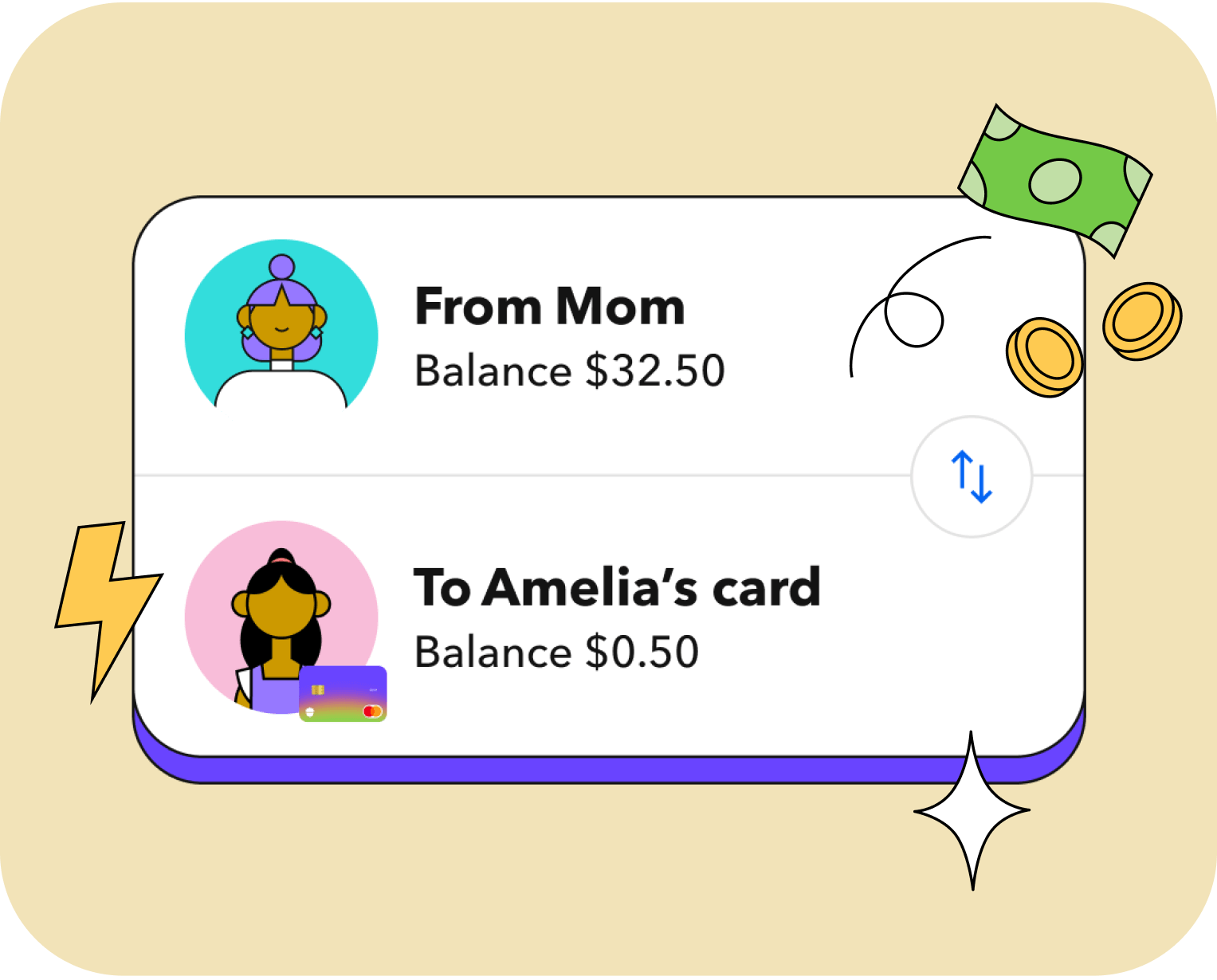

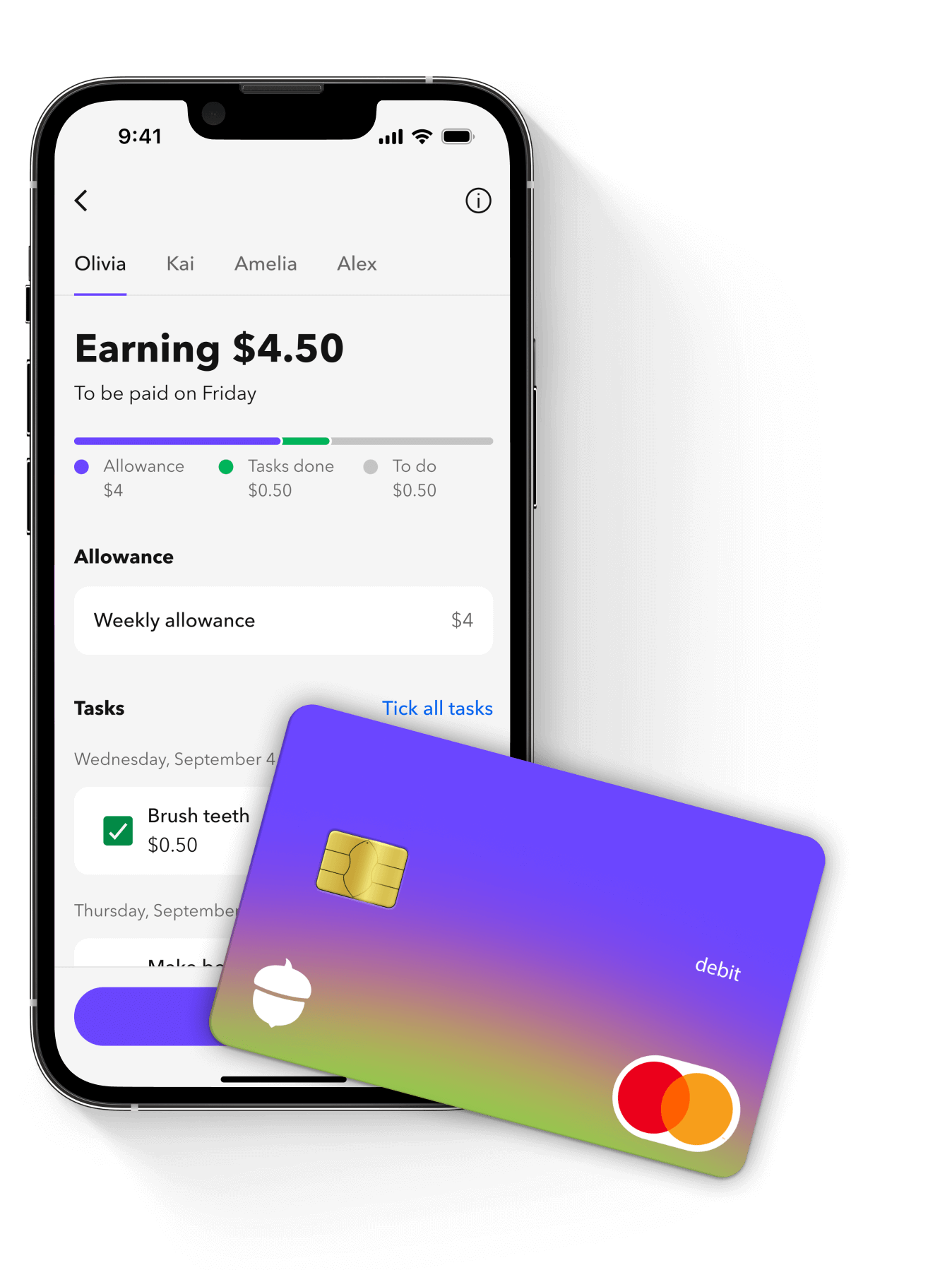

To help kids learn about the power of earning, parents can set paid tasks in the app. As soon as kids tick them off, they'll automatically receive cash on their card. You'll also have the option to check tasks have been completed in-app before your child receives their money.

2-4 kids

Frequently asked

What age is an Acorns Early debit card for?

Acorns Early (formerly GoHenry) is for kids ages 6-18. It’s a great way for them to learn the value of money. Acorns Early helps kids develop healthy earning, saving, budgeting, and spending habits that will last a lifetime. Ultimately, we know that every family has a different approach to money and learning — so it’s up to you when you feel your kid is ready to give Acorns Early a try.

How much is an Acorns Early kids debit card?

We charge one monthly subscription of just $5 per kid. For families with up to four kids, it's just $10 per month. You get access to all of the features of Acorns Early, including the kid's debit card, chore tracking, automatic allowance, parental controls, and more.

Where can you use Acorns Early debit cards?

Acorns Early debit cards can be used anywhere that Mastercard® is accepted. This includes online, in stores, and at ATMs.

Are kids' debit cards a good alternative to traditional bank cards and credit cards?

Acorns Early debit cards are for kids ages 6-18, which means kids under 18 can start learning about money before they are eligible for a traditional bank card and/or credit cards of their own. Plus, Acorns Early has features that traditional bank cards and credit cards might not have, such as instant transfers, chore tracking, and automatic allowances. And with real-time spend notifications, card locking, and spend category blocking, Acorns Early makes it easy for parents to stay in control.

Is Acorns Early included in an Acorns subscription?

Acorns Early is included in every Gold subscription. The Gold subscription also includes Acorns Early Invest, a flexible investment account for kids with a 1% match, Acorns Invest, an investment account with an expert-built, diversified portfolio, and Acorns Later, a retirement account with a 3% IRA match on new contributions, and much, much more!