Diversification, simply, is not putting all of your eggs in one basket. Say you invest all of your savings in the hot stock of the moment. If that stock bottoms out, there go your savings and your earning potential. Instead, if you diversify across different investments, and one drops, the others can help you stay on track toward your long-term money goals.

Bitcoin ETF

Bits of Bitcoin is how we do Bitcoin

Diversification, simply, is not putting all of your eggs in one basket. Say you invest all of your savings in the hot stock of the moment. If that stock bottoms out, there go your savings and your earning potential. Instead, if you diversify across different investments, and one drops, the others can help you stay on track toward your long-term money goals.

Our mission is to look after the financial best interests of the up-and-coming, beginning with the empowering, proud step of micro investing.

And if it could,

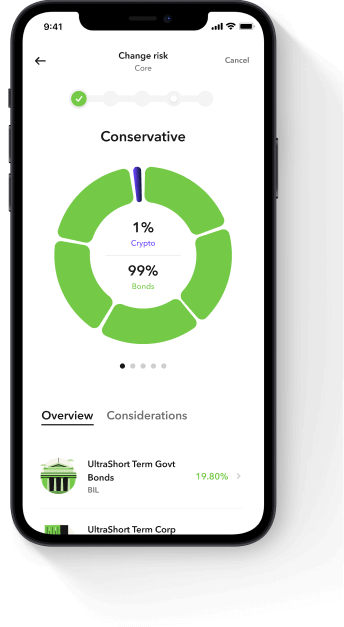

Customers can invest up to 5% of their Acorns Invest portfolio in a Bitcoin-linked ETF. That percentage is determined by their investment profile, which includes details like age, income, and money goals.

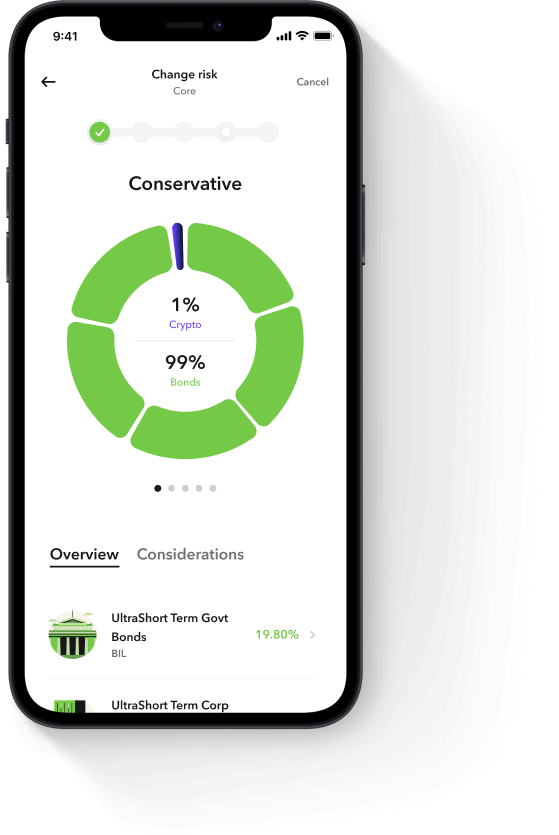

So, for example, if you invest $100 a month through a Recurring Investment and you’re in the Conservative portfolio, $1 per month will be allocated to a Bitcoin-linked ETF, and the rest will be diversified across the relevant stock and bond ETF portfolios.

Instead of betting the farm on Bitcoin all at once, now you can reduce your risk by investing in a Bitcoin-linked ETF over time.

Bit by bit.

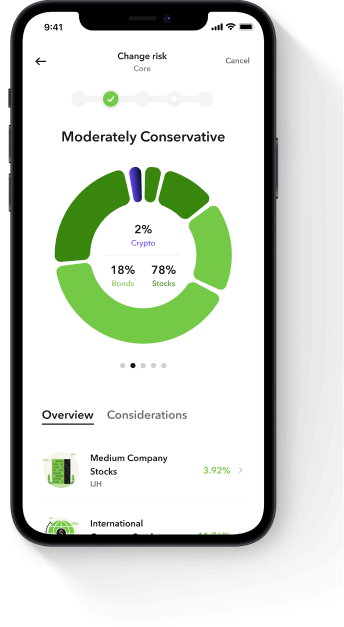

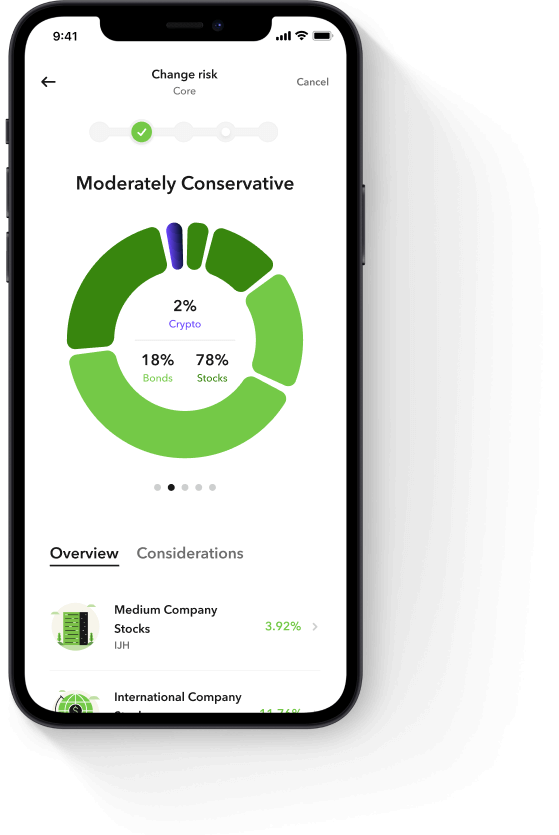

So, for example, if you invest $100 a month through a Recurring Investment and you’re in the Moderately Conservative portfolio, $2 per month will be allocated to a Bitcoin-linked ETF, and the rest will be diversified across the relevant stock and bond ETF portfolios.

Instead of betting the farm on Bitcoin all at once, now you can reduce your risk by investing in a Bitcoin-linked ETF over time.

Bit by bit.

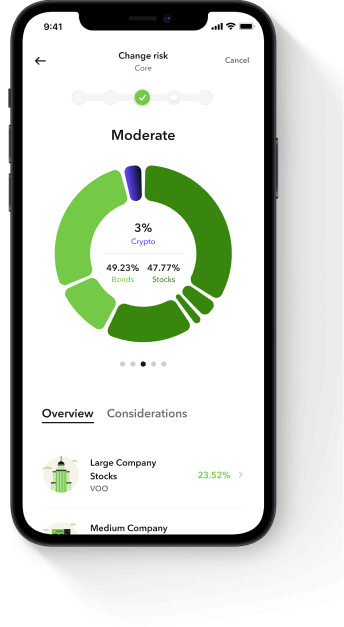

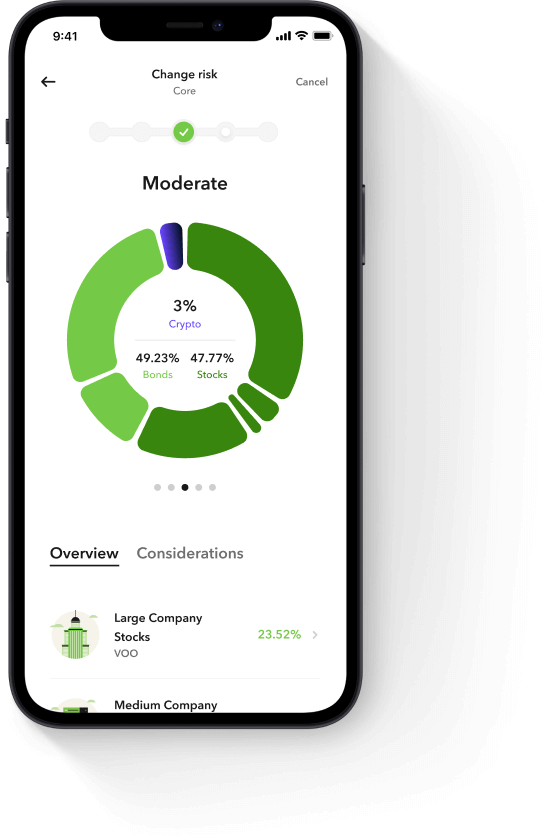

So, for example, if you invest $100 a month through a Recurring Investment and you’re in the Moderate portfolio, $3 per month will be allocated to a Bitcoin-linked ETF, and the rest will be diversified across the relevant stock and bond ETF portfolios.

Instead of betting the farm on Bitcoin all at once, now you can reduce your risk by investing in a Bitcoin-linked ETF over time.

Bit by bit.

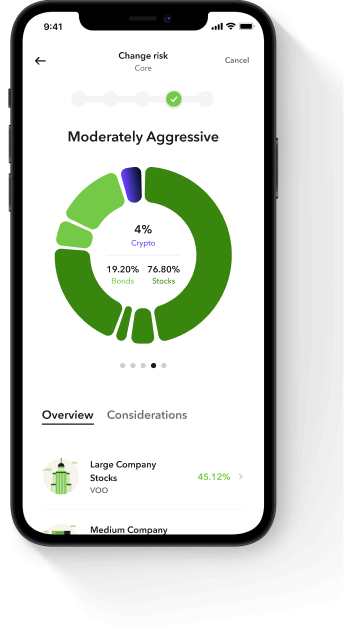

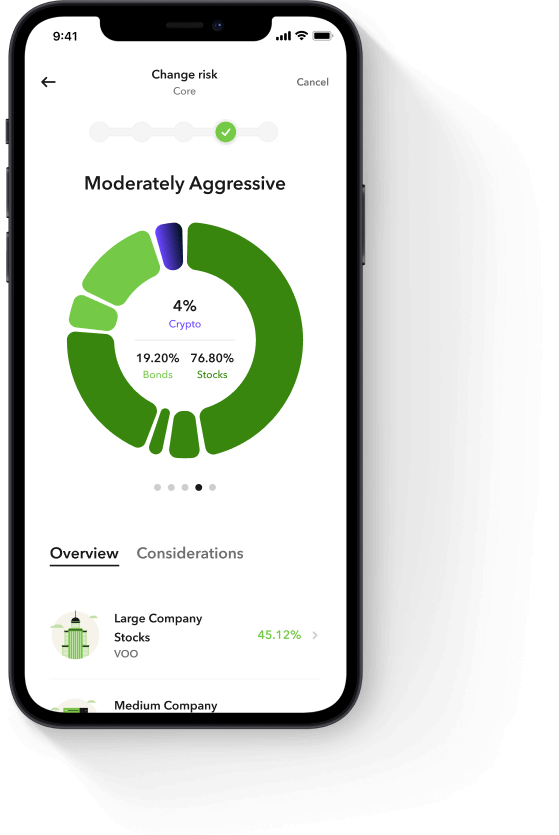

So, for example, if you invest $100 a month through a Recurring Investment and you’re in the Moderately Aggressive portfolio, $4 per month will be allocated to a Bitcoin-linked ETF, and the rest will be diversified across the relevant stock and bond ETF portfolios.

Instead of betting the farm on Bitcoin all at once, now you can reduce your risk by investing in a Bitcoin-linked ETF over time.

Bit by bit.

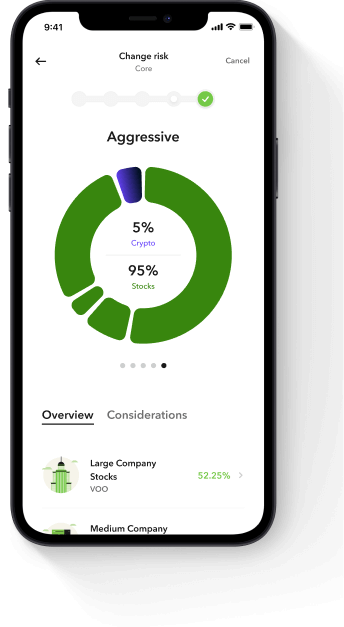

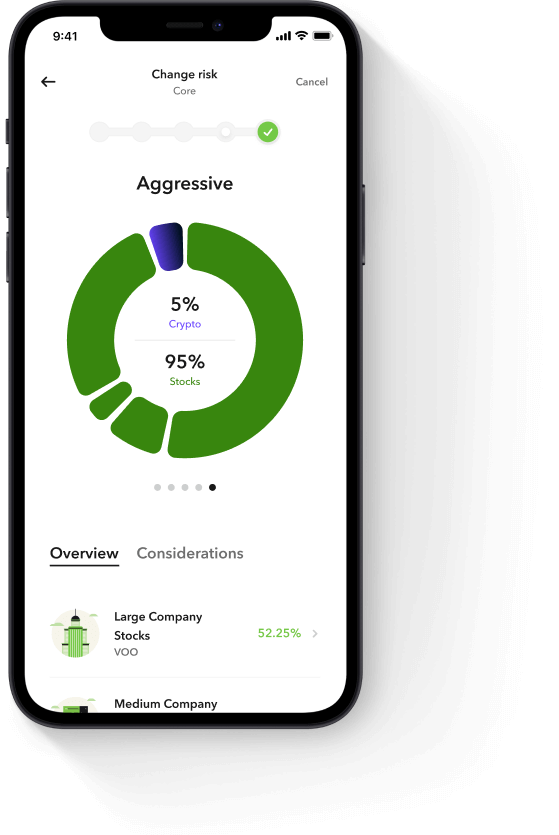

So, for example, if you invest $100 a month through a Recurring Investment and you’re in the Aggressive portfolio, $5 per month will be allocated to a Bitcoin-linked ETF, and the rest will be diversified across the relevant stock and bond ETF portfolios.

Instead of betting the farm on Bitcoin all at once, now you can reduce your risk by investing in a Bitcoin-linked ETF over time.

Bit by bit.

Acorns does not provide access to invest directly in Bitcoin. Bitcoin exposure is provided through the ETF BITO, which invests in Bitcoin futures. This is considered a high-risk investment given the speculative and volatile nature. Investing involves risk including the loss of principal. Please find further disclosures here.

To explore the Bitcoin-linked ETF experience in your Acorns app, look for the card on your Home and Invest screens. If you have any questions, don’t hesitate to view our dedicated customer support materials, or Tweet our Chief Investment Officer, Seth Wunder, @acorns.

From acorns, mighty oaks do grow. It’s our honor to help you grow your oak!

Your Acorns Team

Read the full manifesto here.

Acorns does not provide access to invest directly in Bitcoin. Bitcoin exposure is provided through the ETF BITO, which invests in Bitcoin futures. This is considered a high-risk investment given the speculative and volatile nature. Investing involves risk including the loss of principal. Please find further disclosures here.

Learn more about bitcoin and why we're adding this feature, this way.

What is bitcoin & how does it work?

Learn the bitcoin basics and more to help you make an informed decision for the long-term.

Read

What's the difference between bitcoin and a bitcoin ETF?

Find out some of the key differences between investing directly in bitcoin, and investing in a bitcoin exchange traded fund (ETF).

Read

How do I add the bitcoin ETF to my Acorns portfolio?

Learn how easy it is to add the bitcoin ETF to your Acorns portfolio and invest bit by bit.

ReadFrequently asked

What is crypto?

Cryptocurrency, sometimes called crypto, is a form of currency that exists digitally and uses cryptography to encrypt transactions. Unlike traditional currencies that are governed by Central Banks (in the U.S., the Federal Reserve) to determine when they increase or decrease supply, Bitcoin is limited to a certain number of units that can ever be created (21 million).

Cryptocurrencies are tracked on a platform called a blockchain, a record of all transactions updated and held by crypto holders. Units of cryptocurrency are released through a process called mining, which involves using computers to solve complicated mathematical problems that generate coins.

When you own cryptocurrency, you own a key that allows you to move money from one person to another without a trusted third party (bank). It’s a person-to-person system that can enables anyone anywhere to send and receive payments.

The first cryptocurrency was Bitcoin, which was founded in 2009 and remains the best known, and largest, today.

What is Bitcoin?

Bitcoin is the largest cryptocurrency: a form of currency that only exists digitally. It is decentralized, meaning it’s not owned or operated by any nation or government. It can be used to diversify your investment portfolio and in limited cases to buy goods or services.

Acorns’ offering of a Bitcoin ETF allows investors an opportunity to gain exposure to Bitcoin returns in a convenient and transparent way. The fund seeks to provide capital appreciation primarily through managed exposure to bitcoin futures contracts. By adding crypto exposure to your portfolio, you increase the portfolio’s overall diversity. This diversity in your portfolio can help you weather market bumps long-term.

What am I investing in when I add a Bitcoin ETF?

Investing in a Bitcoin ETF gives you exposure to Bitcoin by investing in its potential value, without requiring that you own the cryptocurrency itself. If you opt-in to Bitcoin ETF in your Acorns Invest portfolio, you’re adding ProShares Bitcoin Strategy ETF. Its ticker symbol is BITO, and it invests in Bitcoin futures.

How do I invest in a Bitcoin ETF with Acorns?

For existing customers, you should see a pop-up to add the Bitcoin ETF (BITO) to your portfolio for your Acorns Invest account on your feed after logging in. If not, please make sure you are on the most current version of the Acorns App, then complete the following steps to add BITO to your portfolio:

For Mobile:

- Tap on Invest

- Tap "Portfolio"

- Scroll towards the bottom.

- Tap “Diversify your portfolio with a Bitcoin ETF”

- Review the FAQs, details, and disclosures

- Carefully review the information on the screen

- Tap on ”Add to your portfolio”.

- Tap on “Add” to confirm allocation.

- Tap “Done”.

For Web:

- Click on Invest.

- Click “Portfolio”

- Scroll to the bottom.

- Click “Diversify your portfolio with a Bitcoin ETF”

- Review the FAQs, details, and disclosures

- Carefully review the information on the screen

- Click on ”Add to your portfolio”

- Click on “Add” to confirm allocation.

- Click “Done”.

Changes to your Invest portfolio will occur with your next investment. New money coming in will be applied towards your new allocation preferences till you reach your designated allocation goal.

Please note, Acorns' offering of Bitcoin ETF allows investors an opportunity to gain exposure to bitcoin returns in a convenient, and transparent way. The fund seeks to provide capital appreciation primarily through managed exposure to bitcoin futures contracts. This diversity in your portfolio can help you weather market bumps long-term. You are not buying Bitcoin tokens from Acorns directly.

How much am I investing in BITO?

Your available portfolio allocation towards BITO will be fixed (up to 5%) depending on your Acorns portfolio type. If your portfolio is “Conservative,” your target Bitcoin ETF investment will be 1% of your overall portfolio. “Moderately Conservative” is set at 2%, “Moderate:” 3%, “Moderately Aggressive:” 4%, and “Aggressive:” 5%.

Please note, this applies to both our Core and ESG portfolios and is opt-in only.

Why add a Bitcoin ETF instead of directly investing in the Bitcoin token?

Investing in a Bitcoin ETF like BITO simply makes adding exposure to Bitcoin easier. It allows investors an opportunity to gain exposure to Bitcoin returns in a convenient, liquid, and transparent way, thereby diversifying your portfolio. It also helps you save on transaction fees, there’s no need to download another app, and removes the need for a digital wallet: something required to buy and trade the Bitcoin token.

Lastly, by adding a Bitcoin ETF, you can keep all of your investments within Acorns.

What are the risks associated with investing in Bitcoin or a Bitcoin ETF?

Cryptocurrencies have historically been a volatile asset, meaning it has had more rapid and unpredictable changes in their price over the years than other assets like stocks or bonds. A portfolio invested in a highly volatile asset is more likely to experience more dramatic changes to its value than a portfolio of less volatile assets.

Bitcoin tends to have a low correlation to stocks and bonds. That means when the price of stocks goes up or down, it doesn't necessarily influence the value of Bitcoin. This diversity in your portfolio can help you weather market bumps long-term.

How does investing in a Bitcoin ETF through Acorns work?

Any new deposits you make to your Acorns Invest account (e.g., Round-Ups®, Recurring Investments) will contribute to your target Bitcoin ETF percentage. Depending on how much you contribute as well as market factors, your portfolio may not meet its exact targets. If it’s off by 5% or more, we’ll rebalance it for you, meaning we’ll buy and sell some investments to get you where you want to be.

How do I remove Bitcoin (BITO) from my Acorns portfolio?

Please note, opting out of the Bitcoin ETF is not the same thing as requesting a withdrawal from your portfolio. Meaning, instead of shares being sold to create cash to deliver to your funding source, if you elect to remove the Bitcoin ETF from your portfolio, all of your holdings in BITO will be sold and the proceeds will be redistributed across the rest of your portfolio. This may have tax implications. If you wish to continue, please complete the following steps to remove BITO from your portfolio:

For Mobile:

-

Tap on Invest

-

Tap “Portfolio”

-

Swipe left to tap “Bitcoin Strategy” and see the fund details.

-

Scroll towards the bottom.

-

Tap “Remove from portfolio”

-

Tap on “Remove” for confirmation.

-

Tap “Done”.

For Web:

-

Click on Invest.

-

Click “Portfolio”

-

Click “Bitcoin Strategy” to see the fund details.

-

Scroll towards the bottom.

-

Click on “Remove from portfolio”

-

Click on “Remove” for confirmation.

-

Click “Done”.