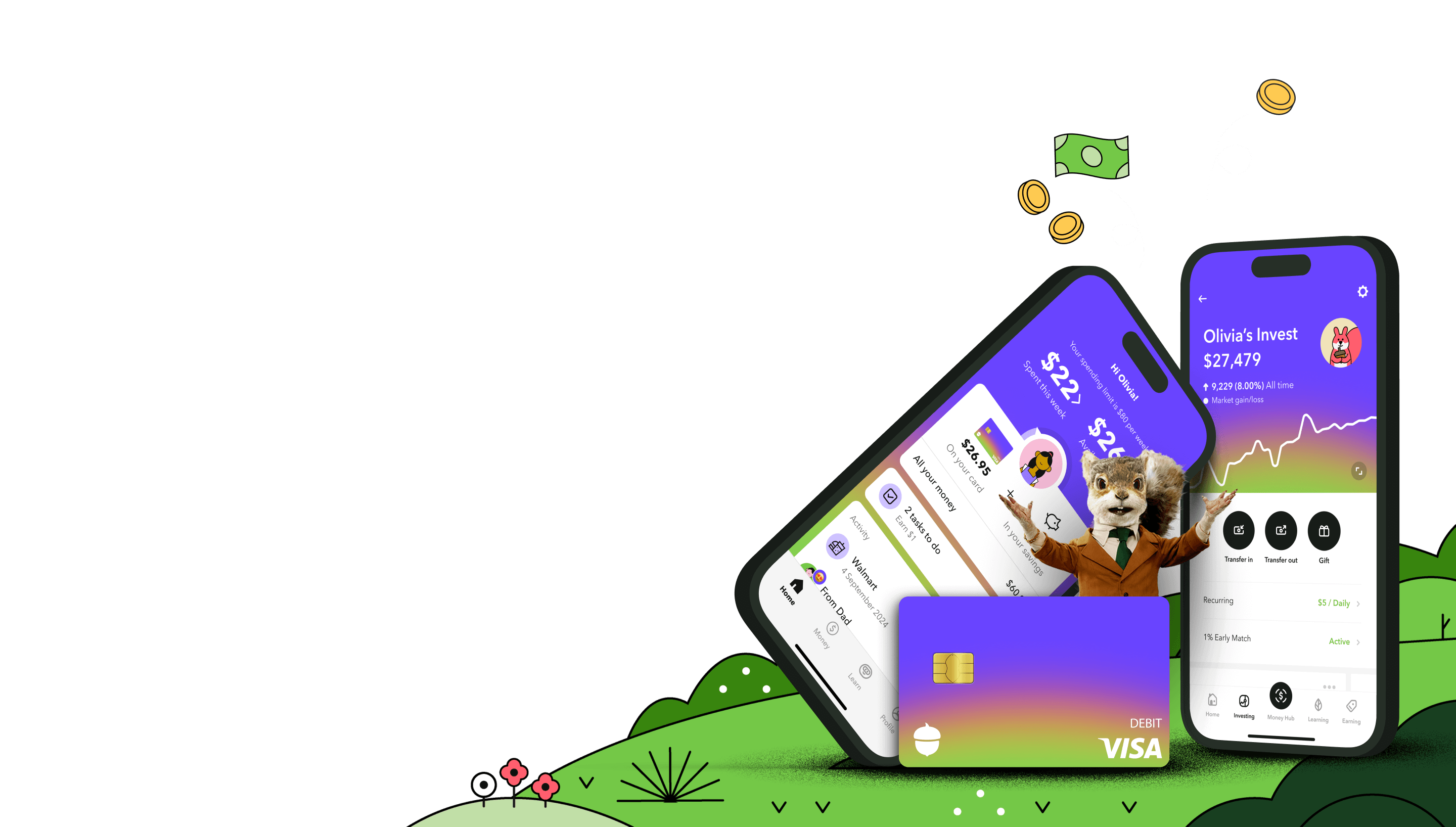

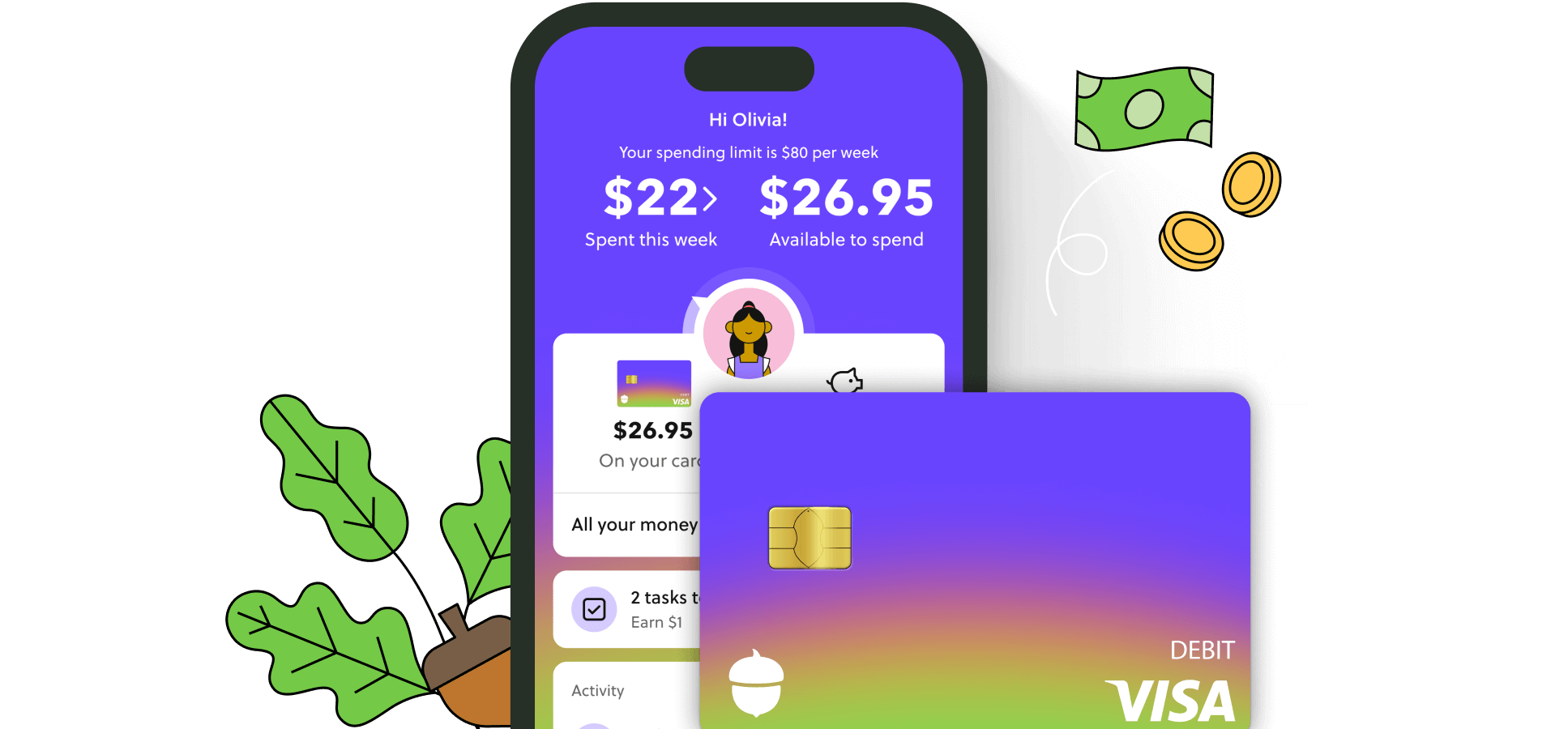

The smart money app and debit card for kids

Help your kids grow smart money habits by teaching them how to save, earn, spend, and invest — all in one place.

Get Acorns Early

Acorns Early

How it works

for kids

kids’ futures

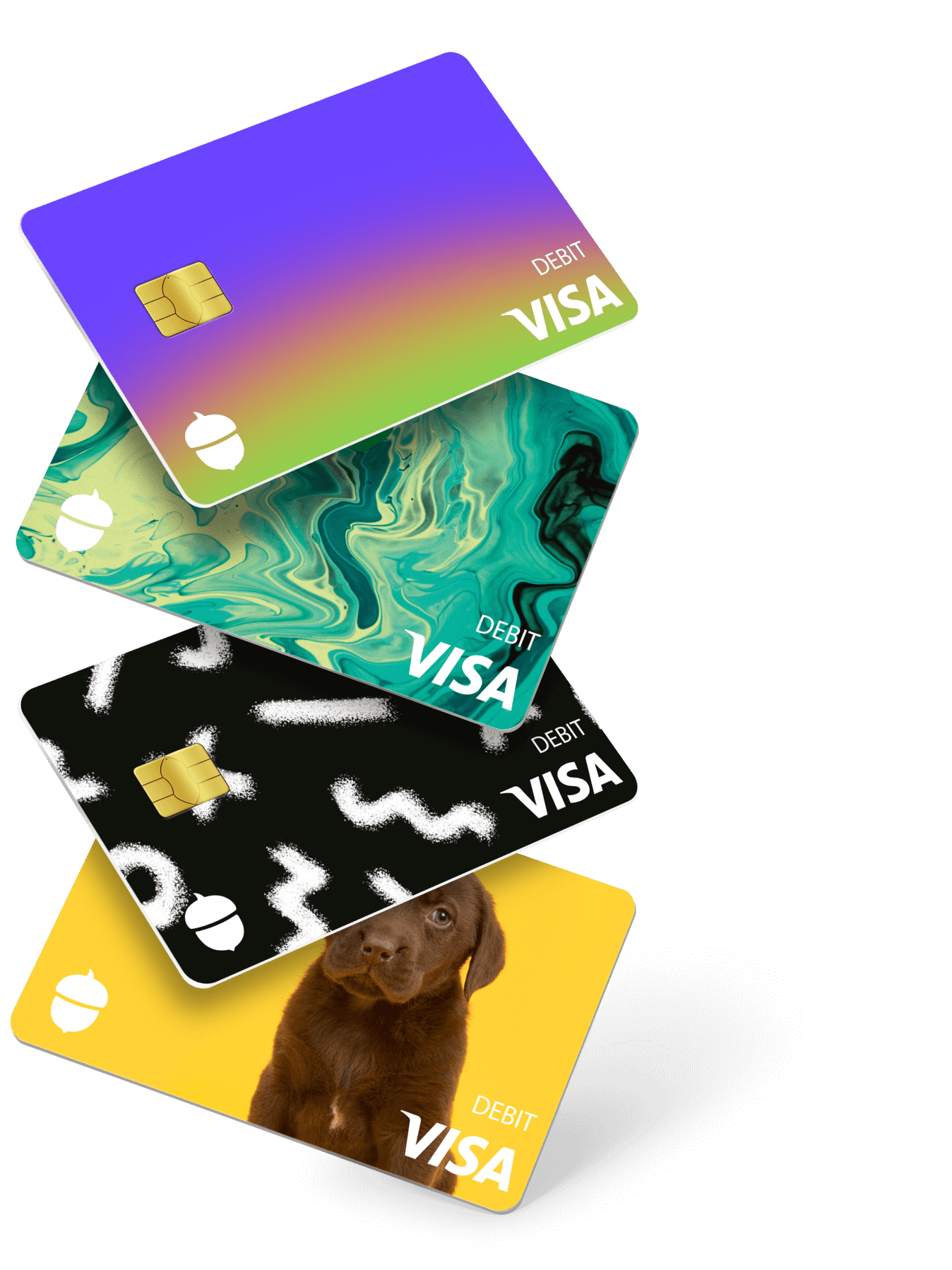

Choose from 35+ customizable debit card designs

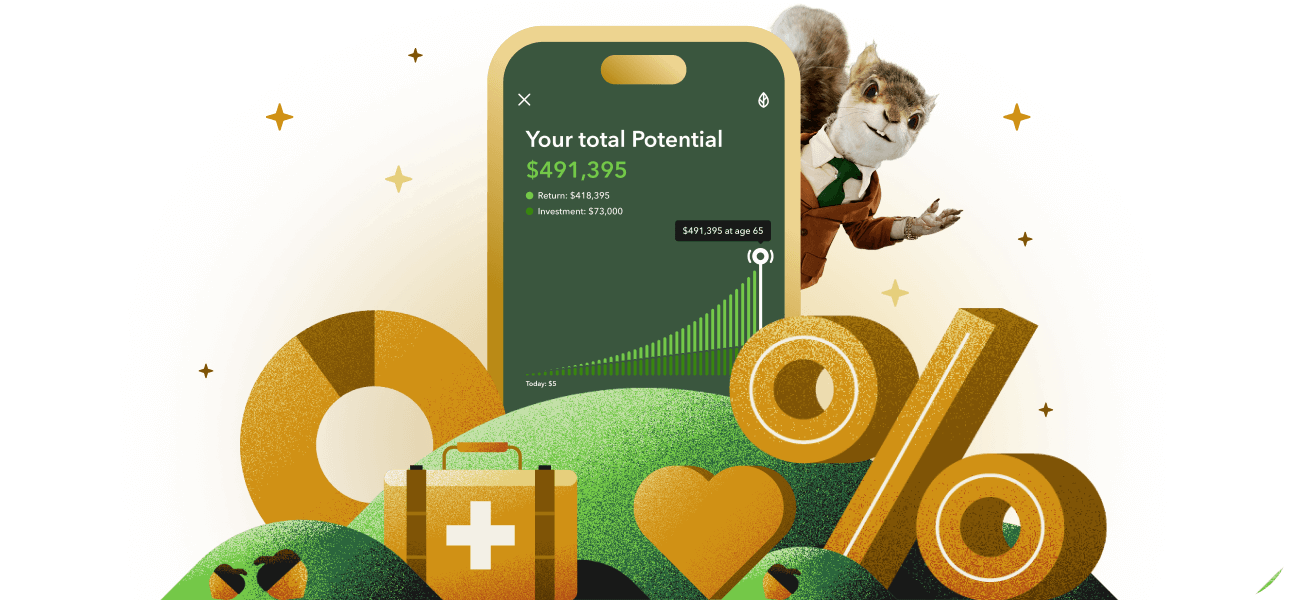

Set your kids up for life

Unlike education-only accounts, Early Invest funds can be used for anything that benefits your child — from a first car to college, a down payment, or extracurriculars.

Small steps, big future

Illustration of the power of compounding based on initial deposit, contribution schedule, time horizon, and rate of return specified. Changes in those variables can affect the outcome. Reset the calculator using different figures to show different scenarios. Does not include Acorns’ monthly subscription fees (min $3/mo), which would reduce account returns over time, or other deposits or withdrawals. Results do not predict or represent the performance of any Acorns portfolio and do not take into consideration economic or market factors which can impact performance. Investment results will vary. No guarantee investment return will achieve 8% or any annual returns.

Frequently asked

What age is an Acorns Early debit card for?

Acorns Early (formerly GoHenry) is for kids ages 6-18. It’s a great way for them to learn the value of money. Acorns Early helps kids develop healthy earning, saving, budgeting, and spending habits that will last a lifetime. Ultimately, we know that every family has a different approach to money and learning — so it’s up to you when you feel your kid is ready to give Acorns Early a try.

Where can you use Acorns Early debit cards?

Acorns Early debit cards can be used anywhere that Visa® is accepted. This includes online, in stores, and at ATMs.

Are kids' debit cards a good alternative to traditional bank cards and credit cards?

Acorns Early debit cards are for kids ages 6-18, which means kids under 18 can start learning about money before they are eligible for a traditional bank card and/or credit cards of their own. Plus, Acorns Early has features that traditional bank cards and credit cards might not have, such as instant transfers, chore tracking, and automatic allowances. And with real-time spend notifications, card locking, and spend category blocking, Acorns Early makes it easy for parents to stay in control.

Is Acorns Early included in an Acorns subscription?

Acorns Early is included in every Gold subscription. The Gold subscription also includes Acorns Early Invest, a flexible investment account for kids with a 1% match, Acorns Invest, an investment account with an expert-built, diversified portfolio, and Acorns Later, a retirement account with a 3% IRA match on new contributions, and much, much more!