ESG Investing

Acorns ESG Portfolios

Invest in companies rated for their impact on environment, social, and governance issues.

Get started

Invest in yourself with smart portfolios that reflect what's important to you

Why Acorns ESG Portfolios?

Remember, you should consult a tax advisor or visit www.irs.gov prior to making any account changes.

Frequently asked

What are ESG Portfolios?

Acorns’ “ESG portfolios” are composed of Exchange Traded Funds (ETFs) that invest in companies rated for how they approach environmental, social, and governance issues. This is their Morgan Stanley Corporate International (MSCI) ESG rating.

MSCI ESG ratings are a comprehensive measure of a company’s long-term commitment to socially responsible investments (SRI) and environmental, social and governance (ESG) investment standards. In particular, the MSCI ESG ratings focus on a company’s exposure to financially relevant ESG risks.

To explore Acorns ESG portfolios, visit your Invest screen, tap Portfolio, and scroll to “Theme.”

How do ESG Portfolios Perform?

The aim of the diversified ESG Portfolios is to perform in a manner comparable to our standard Core portfolios. Acorns cannot guarantee any rate of return for any portfolio. Similar to the Core portfolios, the ESG Portfolios were created with the intent to help you stay diversified in accordance with your personal risk tolerance and other information you provided in your investor profile. Our goal is to optimize your return, while taking your risk tolerance into account per the principles of Modern Portfolio Theory.

Disclosure: Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal.

Where is my money invested if I have an Acorns ESG portfolio?

There are four different Acorns ESG Portfolios, each composed of exchange-traded funds — ETFs for short. An ETF is made of broad holdings of stocks and/or bonds.

Remember, ESG portfolios contain ETFs made of companies rated for how they address environmental, social and governance issues.

Depending on your portfolio, you’re invested in a mix of companies, markets, and bonds. The overview of the ETFs can be found below:

- iShares ESG Aware MSCI USA ETF | ESGU

- iShares ESG Aware MSCI EM ETF | ESGE

- iShares ESG Aware MSCI USA Small-Cap ETF | ESML

- iShares ESG Aware 1-5 Year USD Corporate Bond ETF | SUSB

- iShares ESG Aware MSCI EAFE ETF | ESGD

- iShares 1-3 Year Treasury Bond ETF | SHY

- iShares MSCI USA ESG Select ETF | SUSA

- iShares U.S. Treasury Bond ETF | GOVT

- iShares MBS ETF | MBB

- iShares ESG Aware USD Corporate Bond ETF | SUSC

How did Acorns determine what Exchange Traded Funds (ETFs) are in the ESG Portfolios?

Our ESG ETF portfolios are designed with diversification in mind and include entities with an MSCI ESG rating. MSCI ESG ratings are a measure of a company’s long-term commitment to socially responsible investments (SRI) and environmental, social, and governance (ESG) investment standards. In particular, the MSCI ESG ratings focus on a company’s exposure to financially relevant ESG risks.

See “What ETFs are included in Acorns ESG Portfolios?” above to see a list of prospectuses of the ETFs which are included in our Sustainable Portfolios.

Please note, your investments may not include some of these ETFs. To see which ETFs your portfolio includes, please visit acorns.com/invest or the portfolio screen in-app.

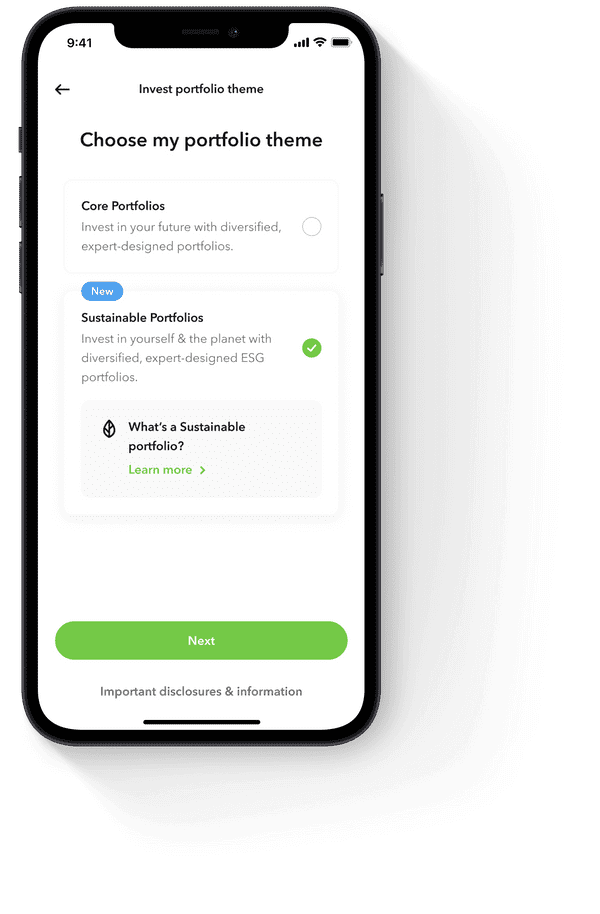

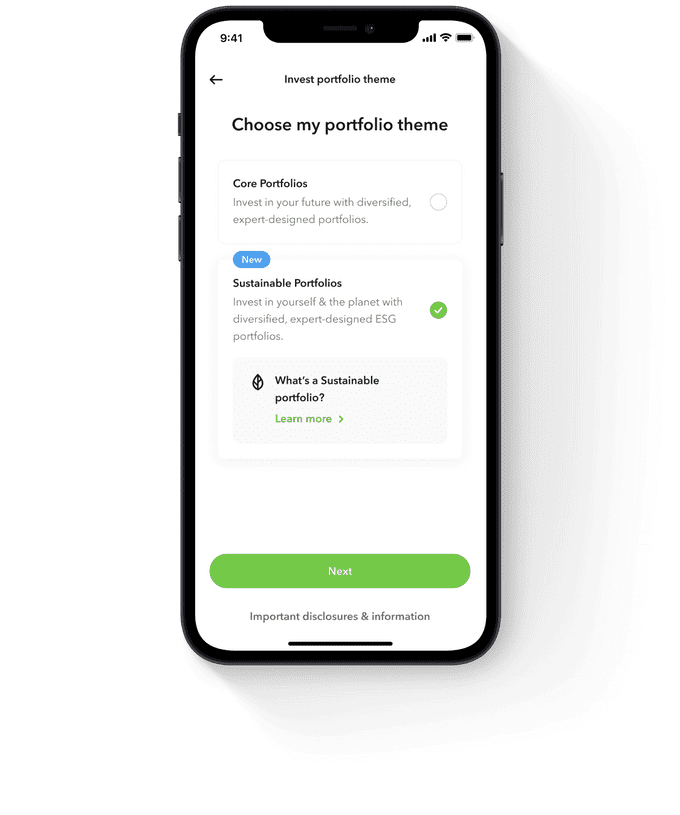

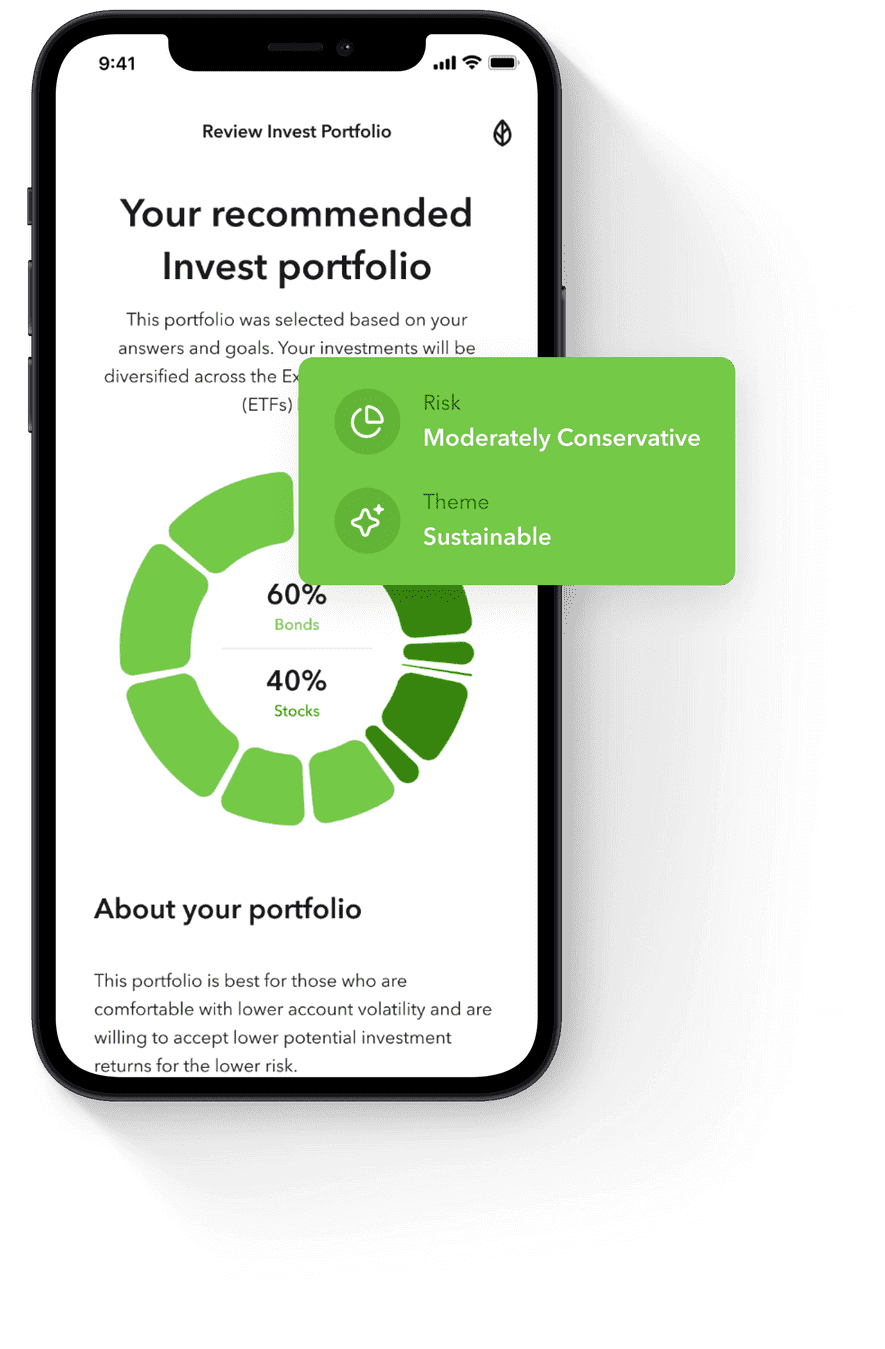

How do I get an ESG Portfolio?

If you are an existing customer, you can switch to an ESG Portfolio for your Invest, Later, or Early account. Please note, if you are currently in the Conservative Core portfolio, there is no Conservative ESG option.

For Mobile:

- Tap the Invest, Later, or Early.

- Tap “Portfolio”

- Scroll to the bottom to see Theme options.

- Tap “Theme”

- Review the details and disclosures

- Tap on your desired portfolio theme, then Next.

- Tap on “Change to this portfolio”

- Carefully review the information on the screen

- Tap “I’m sure” to confirm.

For Web:

- From the home screen, click your Invest, Later, or Early.

- Click “Portfolio”

- Scroll to the bottom to see Theme options.

- Click on “Theme”

- Click on your desired portfolio theme, then Next.

- Review the important disclosures and details

- Click on “Change to this portfolio”

- Carefully review the information on the screen

- Click “I’m sure” to confirm.

Acorns does not recommend changing portfolios often, due to our overall passive investment strategy and the potential tax consequences of selling securities in your account. You do have the ability to override the recommendation provided in the app.

As a reminder, changing portfolios may cause a taxable event, check with your tax professional for potential impact specific to your situation.