Retirement Account

Acorns Later

Automatically invest for retirement, and get potential tax benefits.

Get started

Start saving and investing for retirement

Sign up in minutes

Sign up in minutes

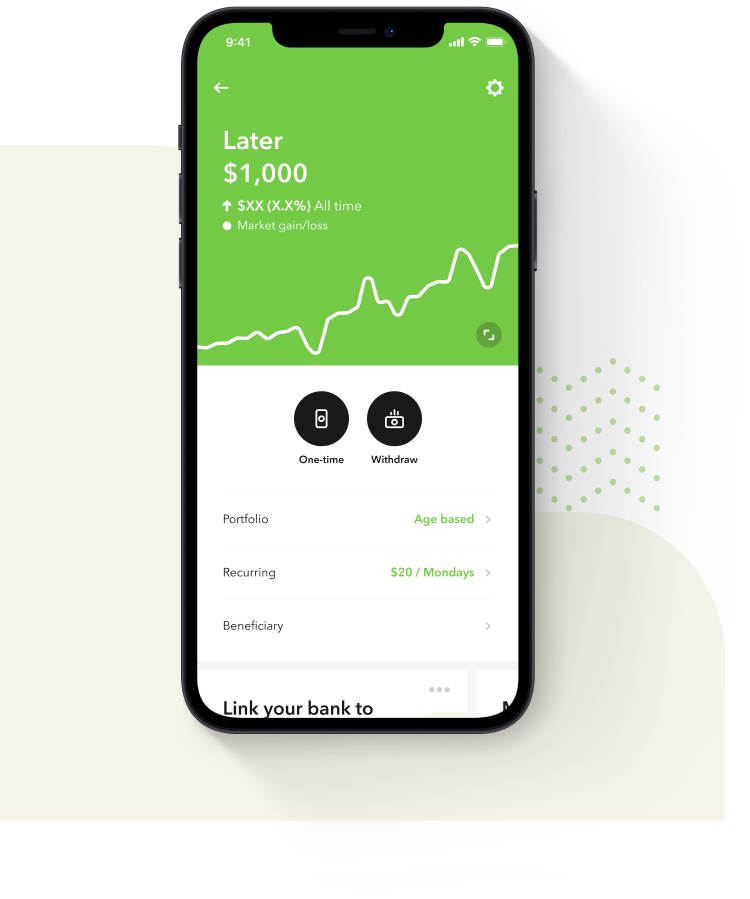

Set up an IRA portfolio recommended for your long-term goals

Set up an IRA portfolio recommended for your long-term goals

Set easy, automatic Recurring Contributions

Set easy, automatic Recurring Contributions

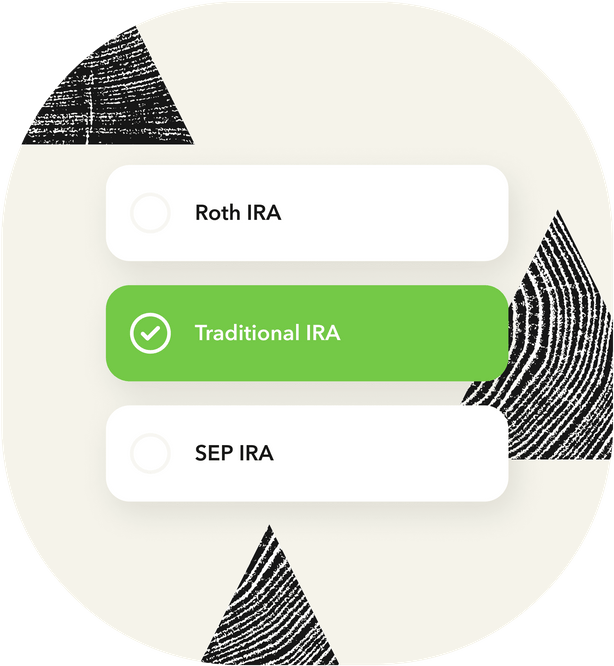

With your answers to a few simple questions, we'll recommend the retirement account that's right for you - Roth, Traditional or SEP.

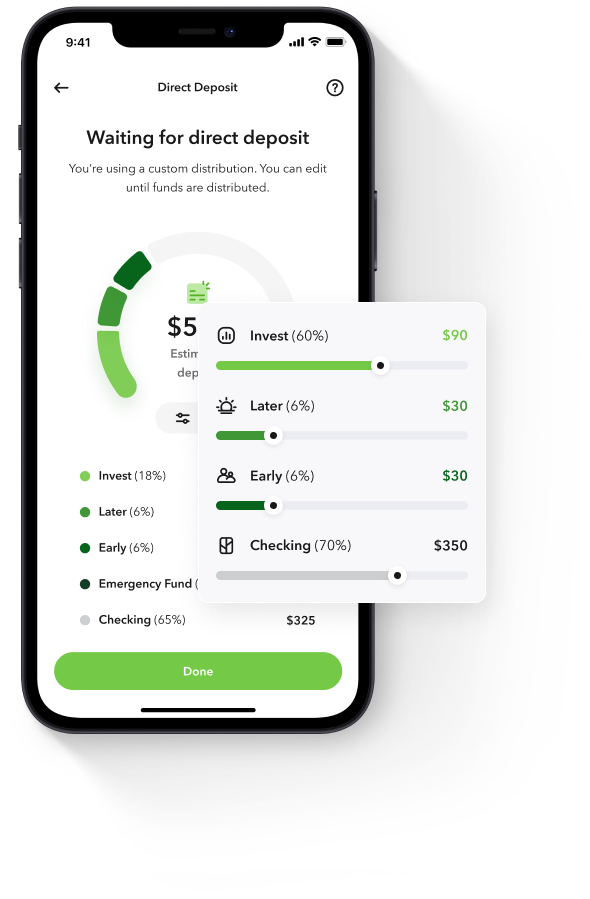

Invest a piece of every paycheck automatically

Invest a piece of every paycheck automatically

Pick how much to invest, starting at 1%, and change it any time

Pick how much to invest, starting at 1%, and change it any time

Allocate specific percentages to your Invest, Later, and Early accounts

Allocate specific percentages to your Invest, Later, and Early accounts

Frequently asked

What is Acorns Later?

Acorns Later provides access to three types of Individual Retirement Accounts (IRAs) that offer customers an easy, automated way to save for retirement.

How much money do I need to open an Acorns Later account?

Just as with our investment accounts, you can begin investing in your Acorns Later account with just $5!

How is my Acorns Later portfolio selected?

Your Acorns Later portfolio is selected based on your age and the time until you reach age 69.

Over time, Acorns adjusts your portfolio to help you stay on track toward your investment goals. For example, as you grow closer to retirement age, we may consider more conservative investments since your money may have less time in the market.

In other words, we’ll automatically rebalance your portfolio as you age — all in the background of life!

Why should I invest in an IRA?

An Acorns Later IRA can help you easily invest in yourself, while receiving potential tax advantages. For example, you may be able to defer some taxes until retirement or even pay less in taxes.

To learn more about investing in an IRA plan, check out the articles below.

The Difference Between Roth and Traditional IRA

Already have an IRA? No problem. You can have more than one IRA. If you prefer to have them in one place, you can roll over your existing IRA to an Acorns Later IRA. Simply contact our support team for step-by-step guidance.

For informational and educational use only. This is solely intended to provide notification of an available product or service. This is not a recommendation to buy, sell, hold, or roll over any asset, adopt an investment strategy, or use a particular account type. This information does not consider the specific investment objectives, tax and financial conditions or particular needs of any specific person. Investors should discuss their specific situation with their financial professional.

Can I invest into Acorns Later if I’m contributing to a workplace retirement plan, like a 401(k)?

Yes! You can contribute to a workplace retirement plan like a 401(k) and an IRA. You can also roll over an existing 401(k) to an Acorns Later IRA with help from our support team.

For informational and educational use only. This is solely intended to provide notification of an available product or service. This is not a recommendation to buy, sell, hold, or roll over any asset, adopt an investment strategy, or use a particular account type. This information does not consider the specific investment objectives, tax and financial conditions or particular needs of any specific person. Investors should discuss their specific situation with their financial professional.