What is Acorns (and why am I here)?

First things first — welcome! If you’re here, chances are your friend invited you to sign up for Acorns. And you’re probably wondering what it is, and why you should try it.

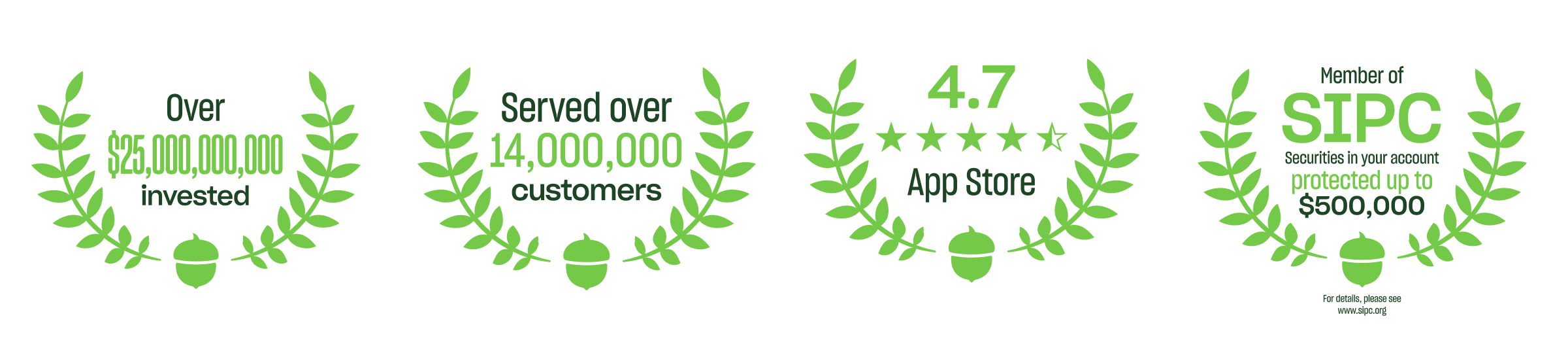

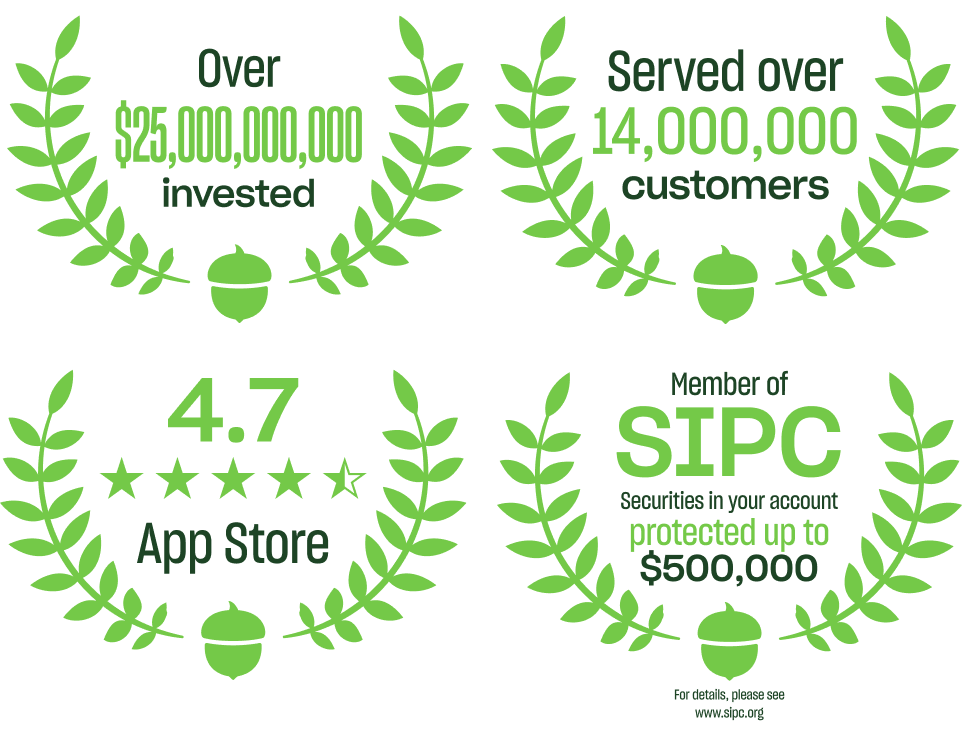

Acorns is an app that helps millions of people save and invest for their future and their family’s future. Already, our customers have used our easy and automated investing tools to invest over $25 billion, with much of that in spare change alone!

What is Acorns?

Why should I invest at all?

How do I invest with Acorns?

There’s a few different ways to invest with Acorns. You can choose a way that works for you and your financial situation.

What types of accounts can I invest in?

What else does Acorns offer?

GoHenry by Acorns

-

Personalized debit card made just for your kids

-

A learning app that helps kids build smart money habits

-

Weekly allowance transfers and digital chore tracker

-

Spending controls and real-time spend notifications

Acorns Checking

-

A checking account that saves and invests for you

-

Personalized Acorns debit card with Real-Time Round-Ups®

-

Auto-invest a piece of your paycheck across your Acorns accounts

-

No hidden, overdraft, or minimum balance fees, and 55,000+ fee-free ATMs.

How do I join and earn my $5 bonus?

5 minutes is all it takes to start investing with Acorns. Don’t forget to use your friend’s unique referral link to download the Acorns app. Once you create an account and make your first investment of $5 or more, both you and your friend will receive a bonus investment — on us!

Over 14 million all-time customers and over $25 billion invested since inception as of 12/4/2024. App Store rating as of 12/2/2024.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Article contributors are not affiliated with Acorns Advisers, LLC. and do not provide investment advice to Acorns’ clients. Acorns is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.