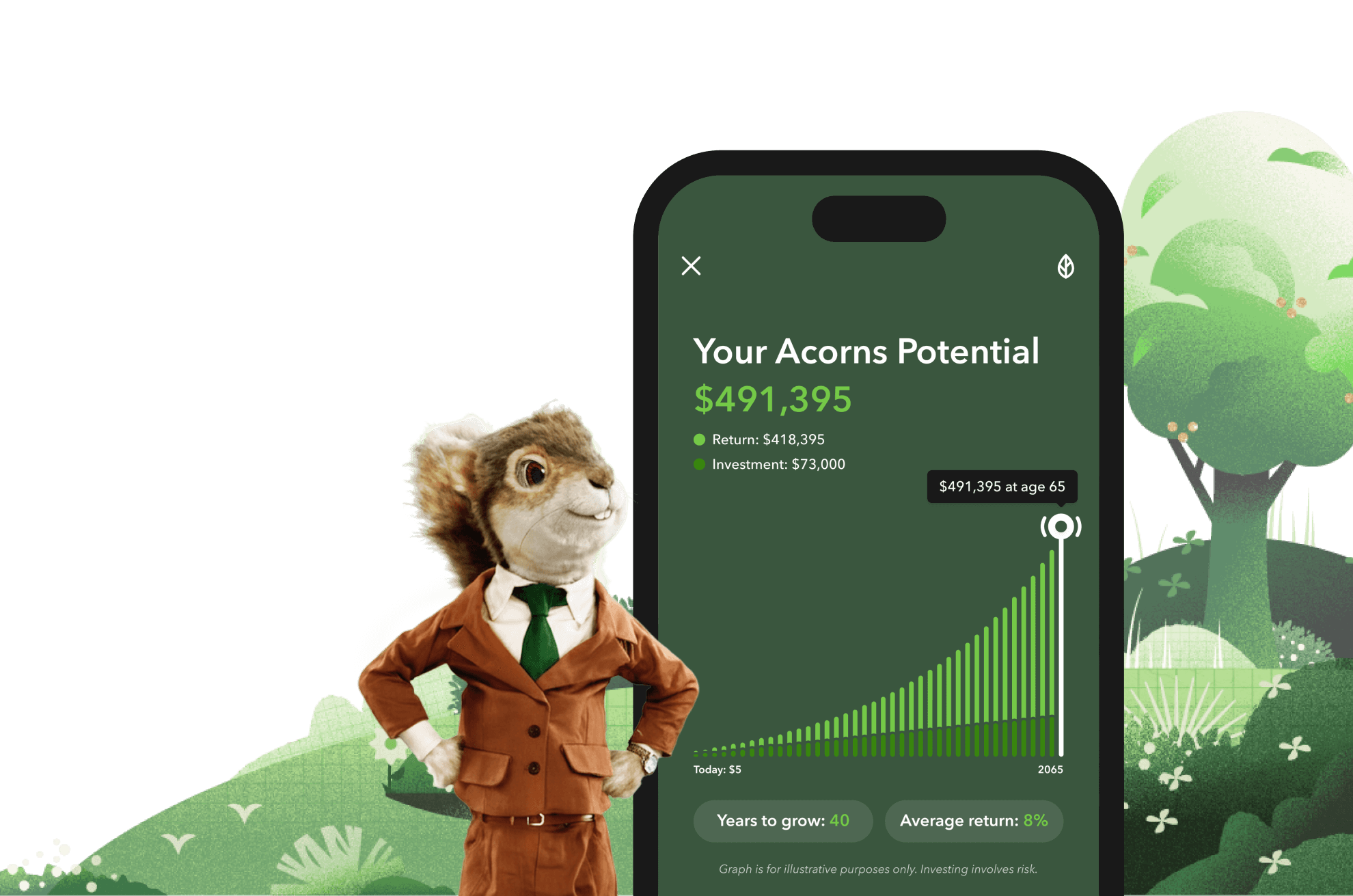

What is Acorns Money Manager?

Acorns Money Manager helps you get the most out of your money, automatically— investing, saving, and spending all in one place, so you can focus on living your life. Money Manager is available to Acorns Gold customers. Gold customers will need to set up four accounts to unlock Money Manager: Checking, Emergency Savings, Acorns Later, and Acorns Invest.

Once you’re on the Acorns Gold plan, visit our FAQ here for detailed steps on setting up these accounts and unlocking Acorns Money Manager.

How it Works:

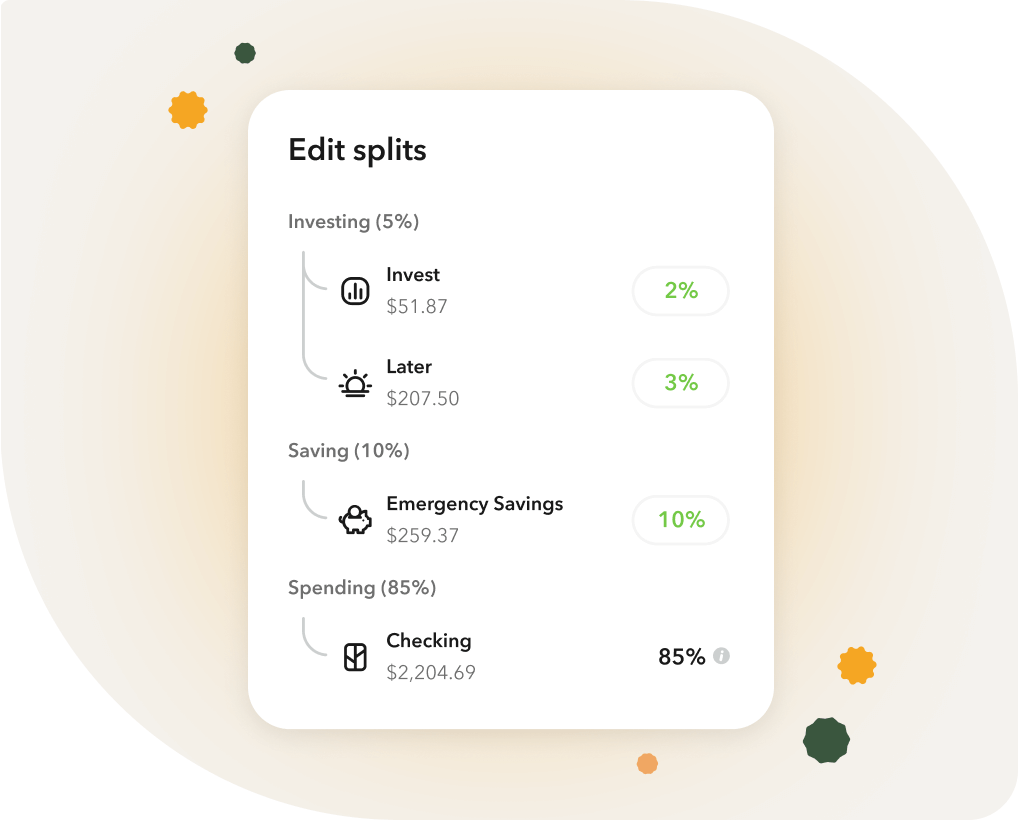

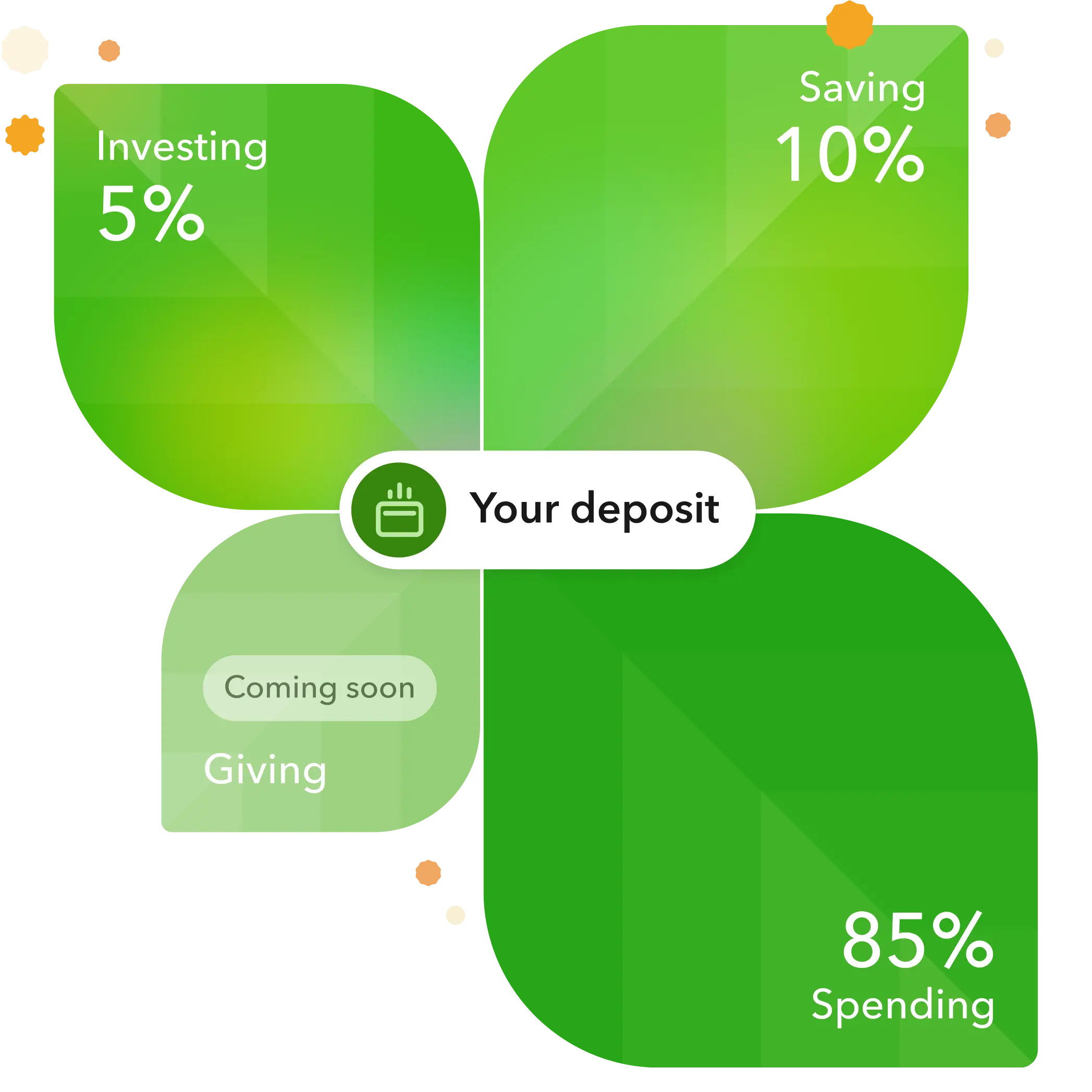

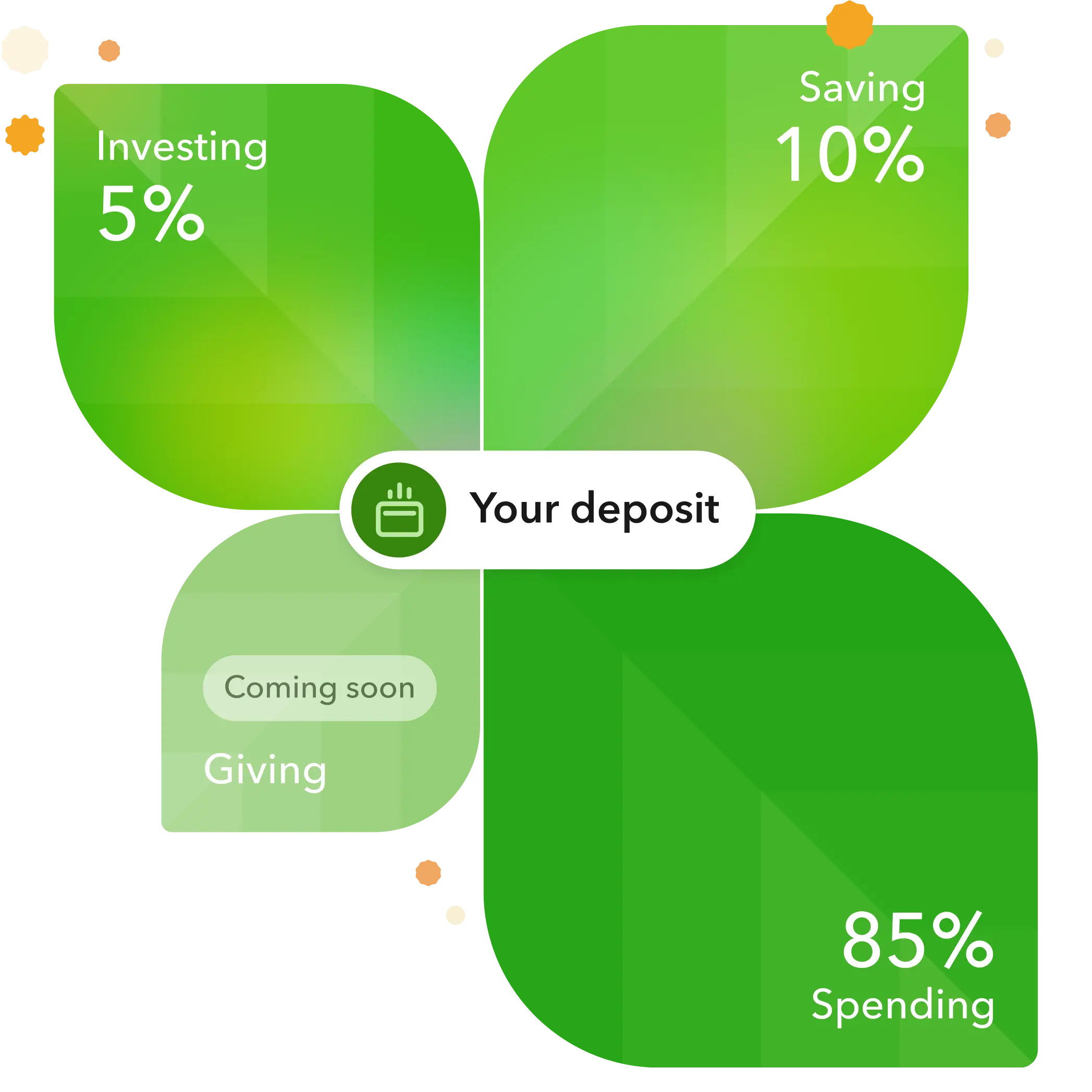

When your deposit comes into Acorns Checking, Money Manager splits it automatically across up to five Acorns accounts: Spending, Saving, Investing (Invest and Later), and, optionally, Kids (Acorns Early Invest).

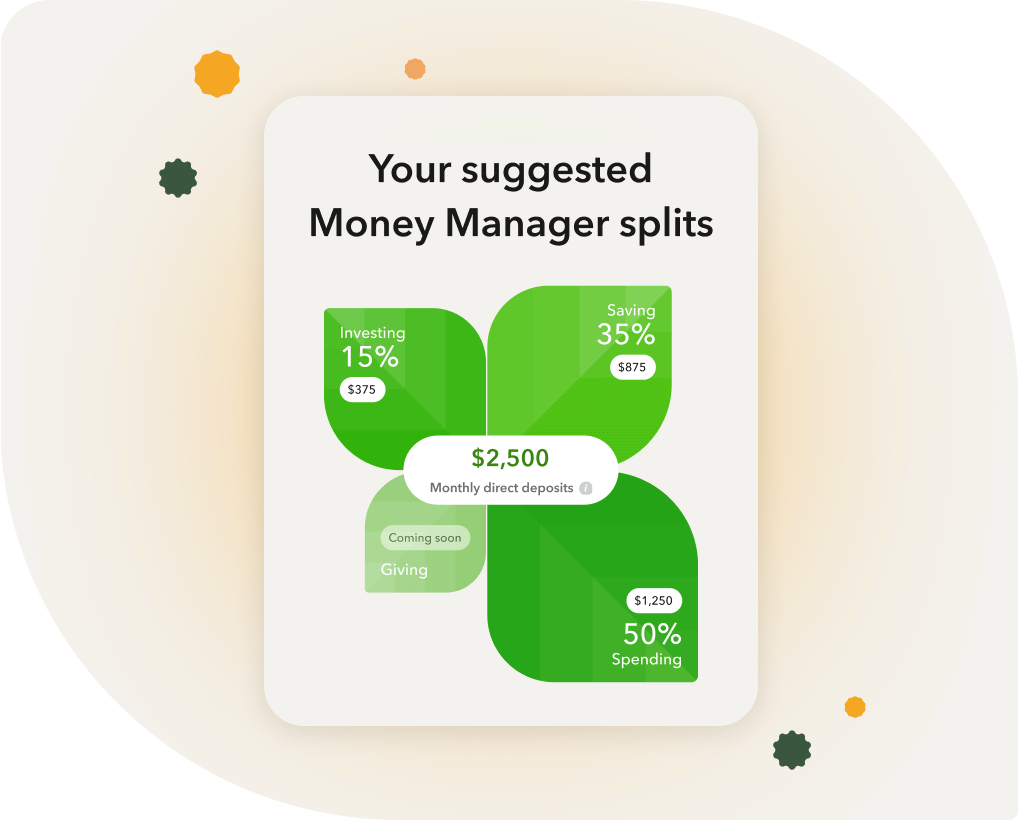

Our default splits are below:

Spending: 85%

Saving: 10%

Investing: 5%

You can edit these anytime.

With Acorns Money Manager, you don’t have to think about where to put your money, because Money Manager does it for you!

Money Manager even sets automatic Milestones, personalized by you, to help you reach your money goals. Money Manager will suggest default Milestones, which you can change anytime in your Money Manager settings.

Default splits among the accounts in Money Manager take into consideration your estimated income based on verified paycheck amounts deposited to your Acorns Checking Account. Milestone targets consider the income information provided by the customer during onboarding. Money Manager may not account for all market conditions or individual circumstances, may not be suitable for all individuals, and may not consider all factors relevant to your specific financial circumstances. You should carefully consider your unique financial situation, including factors such as your investment objective, time horizon, risk tolerance, tax implications, estate planning needs, and Acorns’ fees, prior to making any allocation decisions. Acorns’ Money Manager is not a financial planning service.

How do I set up Money Manager?

We’re excited to help you grow your oak with Acorns Money Manager! Eligible customers must meet this criteria:

To check or change your subscription plan, navigate to “My subscription” from your settings.

If you’re subscribed to the Gold Plan, here’s how to activate Money Manager:

Once you’re in the Money Manager setup screens, you'll be asked to enter your annual income (before taxes). This helps us set up default milestones, which you can change if you want to.

Next, we’ll show you your suggested Money Manager splits, which is how we’ll distribute your deposits across your Acorns accounts. You can edit your Money Manager splits at any time to align with your financial needs and goals.

Once you’ve confirmed your splits, Money Manager will start automatically managing your money!

After you activate Money Manager, you can go to the main Money Manager screen to see your scheduled deposits for the month. You’ll also see your scheduled splits — that’s how much money Money Manager will split into the Spending, Saving, Investing (Invest and Later), or Kids Investing (Acorns Early Invest) categories.

From acorns mighty oaks do grow. We hope this helps you grow your oak!

Default splits among the accounts in Money Manager take into consideration your estimated income based on verified paycheck amounts deposited to your Acorns Checking Account. Milestone targets consider the income information provided by the customer during onboarding. Money Manager may not account for all market conditions or individual circumstances, may not be suitable for all individuals, and may not consider all factors relevant to your specific financial circumstances. You should carefully consider your unique financial situation, including factors such as your investment objective, time horizon, risk tolerance, tax implications, estate planning needs, and Acorns’ fees, prior to making any allocation decisions. Acorns’ Money Manager is not a financial planning service.

What are Money Manager splits?

Money Manager Splits are the percentages of your direct or recurring checking deposits that get automatically distributed across your Acorns Investing, Saving, and Checking accounts.

We’ve designed a default split for the key pieces of your financial life — spending (85%), saving (10%), and investing (5%).

You can edit these splits anytime to align with your financial goals.

To learn more about Money Manager, tap here. Look out for ways Money Manager will become even smarter and more personalized in the future.

From acorns mighty oaks do grow. We hope Money Manager helps you grow your oak!

Default splits among the accounts in Money Manager take into consideration your estimated income based on verified paycheck amounts deposited to your Acorns Checking Account. Milestone targets consider the income information provided by the customer during onboarding. Money Manager may not account for all market conditions or individual circumstances, may not be suitable for all individuals, and may not consider all factors relevant to your specific financial circumstances. You should carefully consider your unique financial situation, including factors such as your investment objective, time horizon, risk tolerance, tax implications, estate planning needs, and Acorns’ fees, prior to making any allocation decisions. Acorns’ Money Manager is not a financial planning service.

What are Milestones?

Milestones are suggested money goals that your Acorns Money Manager automatically sets up for you. You can change them anytime in your Money Manager settings.

For example, you may want to set a Milestone that builds up one month's worth of income in your Acorns Checking account. Money Manager can help you achieve that Milestone by automatically distributing set amounts of your deposits into your checking account.

Milestones aren’t required and can be modified as your financial needs or goals change. Milestones are designed to make it easier (and more fun) to grow toward your long-term financial wellness.

From acorns mighty oaks do grow. We hope this helps you grow your oak!

Default splits among the accounts in Money Manager take into consideration your estimated income based on verified paycheck amounts deposited to your Acorns Checking Account. Milestone targets consider the income information provided by the customer during onboarding. Money Manager may not account for all market conditions or individual circumstances, may not be suitable for all individuals, and may not consider all factors relevant to your specific financial circumstances. You should carefully consider your unique financial situation, including factors such as your investment objective, time horizon, risk tolerance, tax implications, estate planning needs, and Acorns’ fees, prior to making any allocation decisions. Acorns’ Money Manager is not a financial planning service.

How do I set up Direct Deposit for Money Manager?

We’re excited for you to explore Money Manager! If you’re an Acorns Gold customer and don’t have direct deposit or a recurring deposit set up yet, simply tap into your Acorns Checking account and either tap “Recurring” at the top, or scroll down and tap the direct deposit card.

Acorns Gold customers can access Money Manager if they have an open Checking, Emergency Savings, Acorns Later, and Acorns Invest account, and have set up an Acorns Checking direct deposit of at least $10 or a recurring deposit of at least $50.

Once you’ve set up a recurring or direct deposit, go back to your home screen and look for the Money Manager action card to get started.

From acorns mighty oaks do grow. We can’t wait to help you grow your oak!

Default splits among the accounts in Money Manager take into consideration your estimated income based on verified paycheck amounts deposited to your Acorns Checking Account. Milestone targets consider the income information provided by the customer during onboarding. Money Manager may not account for all market conditions or individual circumstances, may not be suitable for all individuals, and may not consider all factors relevant to your specific financial circumstances. You should carefully consider your unique financial situation, including factors such as your investment objective, time horizon, risk tolerance, tax implications, estate planning needs, and Acorns’ fees, prior to making any allocation decisions. Acorns’ Money Manager is not a financial planning service.