Q1 Markets Review

Markets recap

What a quarter…

2023 has seen some big economic news so far, including:

-

The employment market remaining resilient despite mixed economic data, leading to some concerns about wage inflation

-

Inflation slowing, but not as quickly as hoped

-

Five large, global banks failing in a banking crisis

If we'd known about these at the beginning of the year, we probably wouldn't have expected stocks to actually end the first quarter higher and Bitcoin to rally materially.

But they did, and that’s what makes investing fascinating and difficult to predict over the shorter term.

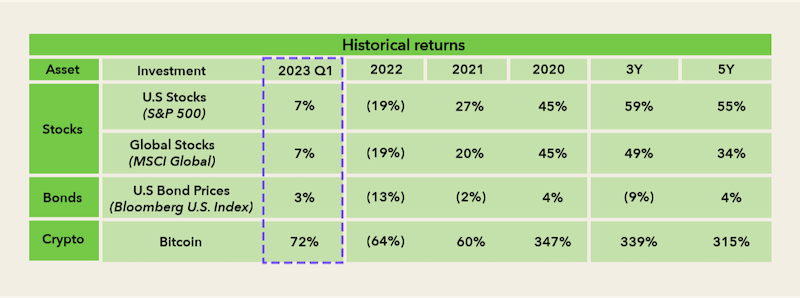

Here’s a quick recap of performance by asset class:

-

Stocks: The S&P 500 started the year off strong, increasing in the first quarter of the year by 7%.

-

Bonds: U.S. bond prices posted a much stronger start to the year than in 2022, rising more 3% in the quarter compared to last year’s first quarter decline of 6%.

-

Crypto: Bitcoin recovered meaningfully in the first three months of the year, rising 72% after its more than 60% decline in 2022.

Let's dive a little deeper on the factors influencing each asset class in Q1:

Stocks

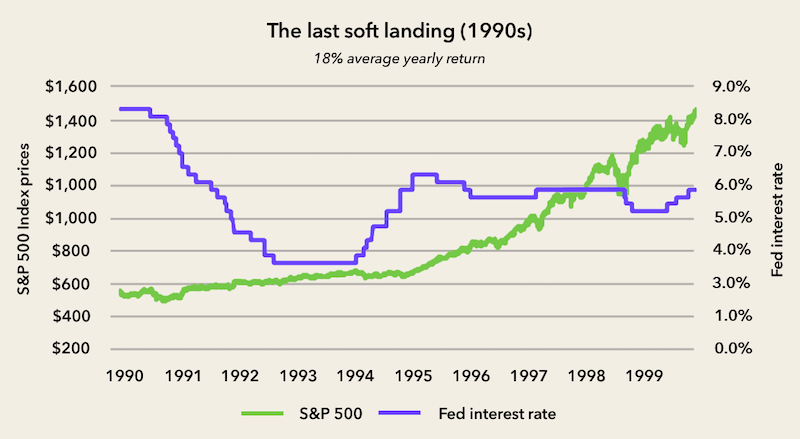

We previously wrote about the concept of a soft landing, in which the Fed is able to hike interest rates enough to bring down inflation without weakening the economy too much. It's a difficult feat to accomplish, but doing so has been meaningfully positive for the stock market, historically speaking. The best example of this was in 1994, when the stock market increased over 30% in the following year.

The perceived likelihood of achieving a soft landing has increased over the past few months, as inflation has continued to slow and the economy has remained broadly resilient (with the exceptions of the tech and banking industries — more on that later.)

Bonds

In last quarter’s letter, we mentioned there would be much less pressure on bond prices in 2023 than in 2022 because interest rates were expected to rise by less than 1% this year, compared to last year's 4.5% increase. So far in 2023, this has indeed been the case.

As a reminder, bond prices and interest rates generally move in opposite directions. This happens because bonds typically pay a fixed interest amount (also known as a "coupon") to bond investors. When new bonds are issued at higher interest rates, older bonds with lower rates become less attractive to investors, causing prices for the older bonds to drop. Conversely, when interest rates decrease, older bonds with higher rates become more desirable, leading to an increase in their prices.

So far, interest rates have risen by half a percent this year, to 5%. In spite of higher interest rates, bond prices actually saw positive returns in the first quarter of the year. This is an unusual dynamic, historically, but it's not unexpected. The rise in bond prices even while the Federal Reserve has raised interest rates is likely due to expectations for future movements in interest rates, which have recently shifted dramatically.

Heading into March, investors thought this year would end with federal interest rates at 5.5%. However, as we exited March, the expectation had fallen to 4.25%. This significant change in interest rate expectations is due to the recent banking failures and concerns related to the economic fallout of these events.

Bitcoin (Crypto)

Bitcoin has been known for its large up and down swings, but this year it has seemed to be less influenced by what’s going on in stock or bond markets than in previous years. Stocks, bonds, and crypto all did well in January, but stocks and bonds came under increasing pressure in February and March — while Bitcoin’s price continued to climb higher. In financial jargon, this is known as a drop in correlation between the movement of the different asset types (also called a "decoupling").

It remains to be seen whether this decoupling between crypto, stocks, and bonds will continue going forward, but for diversified investors, having different investment types moving in different directions is a positive sign. Having a "low correlation" between the investment assets in your portfolio means these assets are moving in different directions, spreading your risk between multiple investments. This can give you a better chance of stability — the ideal purpose of a diversified approach.

The big picture

The Federal Reserve (or "Fed") has a dual mandate: first, to keep inflation near 2%, and second, to keep unemployment as low as possible. Their primary tool to help them achieve this is by setting the benchmark interest rate. This benchmark rate influences all other interest rates, like mortgage payments or car loans.

It's a tight balance for the Fed to walk. Too much attention on one side of the mandate and the other could run amok. The focus on stimulating the economy during the volatility of the early Covid period gave inflation room to rise, which led to the more recent focus on bringing inflation down (by increasing interest rates). Normally, the Fed tries to strike a healthy balance between both agenda items, but in the past few years they’ve really swung the pendulum hard in both directions.

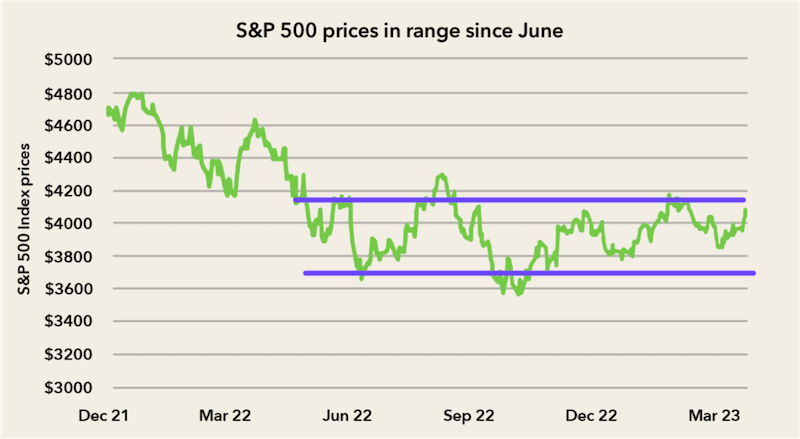

Since last June, the stock market has been relatively stable in a wide trading range (here, we're using the S&P 500 as a gauge of the stock market). Investors have been waiting to see what the Fed does next with interest rates, how this impacts inflation, and any fallout for the economy at large. The lack of any large directional movement in the stock market reflects a wait-and-see mentality among investors.

At the same time, the Fed has also been waiting to see how much their interest rate decisions influence the two things they care about: inflation and the economy. Over the past several months, most signs have pointed in a positive direction, with inflation starting to come down and the economy remaining resilient throughout.

Some of the Fed’s waiting game ended in March, with the failure of several global banks. Now, the Fed’s focus has been forced to shift from inflation back towards the economy. This has led to the change in investor expectations for forward interest rate decisions.

Canary in the coal mine

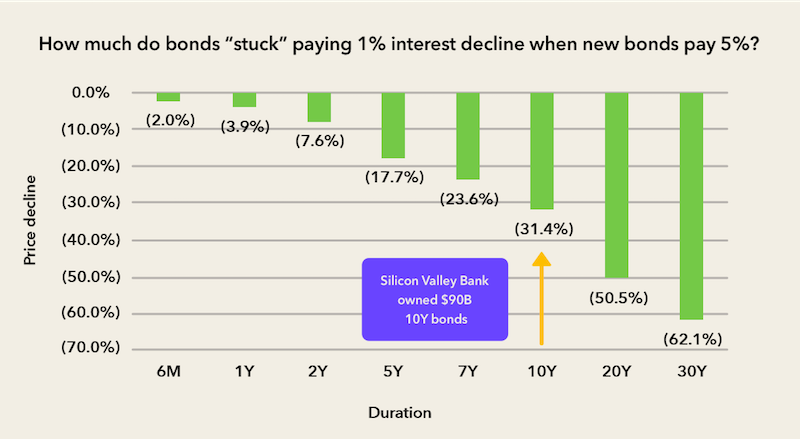

We know bond prices tend to decline when interest rates rise, but how much a bond declines when interest rates rise can depend on a number of things, such as its maturity date or when the issuer has to make a repayment for the bond. The longer the bond's duration, the bigger the hit to its price when interest rates change, because investors who hold these bonds are stuck earning lower interest amounts for longer.

This concept of an inverse relationship between interest rates and bond prices is what brought so much attention to the banking industry in March, and it's one of the reasons why Silicon Valley Bank suddenly collapsed.

Here’s the play-by-play:

In 2021, when interest rates were near 0%, the bank invested $90 billion of customer deposits into bonds maturing in 10 years. Those bonds would pay a little bit of interest each year until the end of 10 years, when the $90 billion would be repaid.

In 2022, interest rates rose from 0% to 4.5%, causing the value of those bonds to decline by billions of dollars. The government would still repay all of the $90 billion in principal once the bonds had hit their age of maturity — in about 8 years — but selling the bonds sooner than that would mean selling them for much less than $90 billion. In theory, the bank had $90 billion in bonds. But given their new market price, the value of the bonds if sold right then was much lower.

A drop in the value of Silicon Valley Bank's bond holdings likely wouldn't have been an issue — except the bank found itself in a position of needing to raise some money. That's because most of its customers were business owners, specifically concentrated around startups and tech companies, which have been withdrawing more money than they have been depositing lately. When the bank needed to have enough cash on hand to meet these withdrawal requests, they didn't want to sell their bond holdings at a loss, so decided to raise money by selling equity (shares in the bank itself) instead. This decision scared investors and worried depositors

Worried about the bank's health, more and more customers began withdrawing funds, starting what’s called a “run on the bank”, with $42 billion in outflows occurring in a single day. By the next morning, to stem concern over more withdrawals, the Federal Deposit Insurance Corporation (FDIC) stepped in and took control of the bank.

Ultimately, the Treasury Department and Federal Reserve responded quickly to the situation and promised no depositors of the bank would lose their money — even those with more than $250,000 in the bank (the usual limit for FDIC insurance). In the aftermath of the Silicon Valley Bank news, other banks' investments were heavily scrutinized. First Republic Bank and Credit Suisse were thought to be the next two dominoes to fall, but bigger U.S. banks stepped up to help out First Republic, and Credit Suisse was acquired by UBS with the help of the Swiss government.

All of these quick actions were successful in alleviating concerns over the state of the banking system, but ironically, it leaves us waiting to see. How will the downfall of a top 20 U.S. bank affect the broader economy? And with interest rate hikes no longer expected, were the Fed's actions so far enough to bring down inflation?

Speaking of inflation…

The stubborn lag

Last quarter, we mentioned that inflation's descent, from its peak in June (9.1%) through December (6.5%), was likely to continue in 2023 based on two factors: price stabilization and the potential for lagging data to catch up to reality. So far, we have seen inflation continue downwards in each month — it's now at 5% — but only for one of those two potential reasons.

For prices to stabilize, they don’t need to fall each month for inflation to go back to 0%, they only need to stop increasing from one month to the next. While inflation is at 5%, the total change in prices over the last nine months is much lower, at 1.9%. This means that if prices stayed the same for three more months, inflation would be below 2% — the Fed’s desired amount — in June. This is the main reason inflation has dropped this year so far.

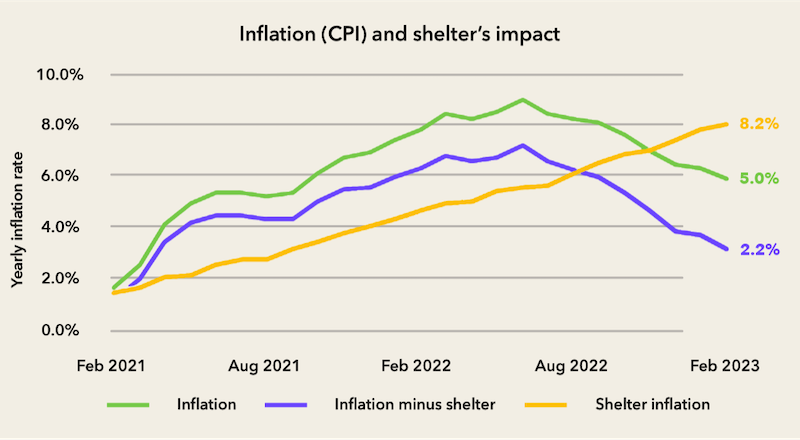

When it comes to the lagging nature of how inflation is calculated using the Consumer Price Index (CPI), we haven't seen any big benefits to inflation yet. A whopping third of the entire inflation number comes from one category: shelter (like your rent or mortgage payment). And this specific piece of the pie operates on a six-month lag.

We know from more up-to-date sources, like the Zillow Rent Index, that shelter prices stabilized a few months ago. But this hasn’t shown up in the inflation data yet. We can see the significance of this lag in this graph. If you exclude shelter, the yearly inflation rate in March was 2.2%, less than half the reported amount of 5%. It’s reasonable to assume the path to lower inflation, of 2% or so, may still be intact.

The opportunity

The stress on tech and banking is likely to have ripple effects across the broader economy. Tech companies are becoming more focused on efficiency and managing costs. Banks may be more selective now on new loans they provide. Businesses are already less inclined to take on new debt, as the interest cost is now much higher. All of these forces aren’t bad things either — some slowdown in an economy which had overheated last year, to the point of almost 10% inflation, may be a good thing.

Inflation has been trending downwards now for many months and, so far, appears likely to stay on track. With the delayed impacts of last year's interest rate hikes now visible in the slowdown in tech and the pressure on banks, it's prudent for the Fed to find its footing again on the dual mandate tightrope. The path to the highly-coveted "soft landing" scenario is within reach.

The last time the Fed achieved a soft landing was in the 1990s, a decade in which the market grew 18% a year — more than double its long-term average.

In closing

Investor concern can be a good thing. There's a saying in investing that refers to these concerns as "the wall of worry." But the wall is there to be climbed. Worried investors tend to hold onto their cash, leaving more money on the sidelines. When the outlook starts to improve or the market demonstrates resilience, there are lots of potential buyers ready to jump in and lead the market higher — climbing the wall of worry.

In contrast, when everyone is optimistic, there are fewer buyers left to push the market higher, limiting the potential for further gains.

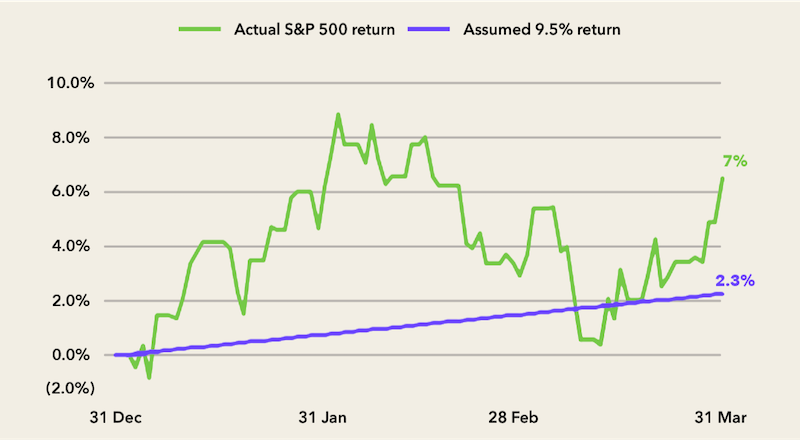

It's crucial to keep in mind that nothing ever moves in a straight line, both in life and the world of investing. The long-term average return for the S&P 500 is 9.5%. However, only two of the last 70 years saw a 9% return on the nose — there were over 20 years with a return above 20% and also 20 years with a negative return. This short-term unpredictability is evident in the last three months, as seen in this chart. This unpredictability underscores the challenge of timing the market and the importance of a long-term, diversified approach to investing.

Diversification aims to strike a balance between stability and returns. The benefits of diversification appear to be evident in 2023, with stocks, bonds, and crypto no longer moving in the same directions they did last year. This shift is a positive development. Diversification is becoming more impactful for investors.

"The only investors who shouldn't diversify are those who are right 100% of the time." - Sir John Templeton

Important Information

The opinions, statements and forecasts presented are for general information only and not intended as investment advice or recommendations. They do not account for specific investment objectives, tax or financial conditions. There is no assurance that the strategies discussed are suitable for all investors or that they will be successful.

Any forward-looking statements including economic forecasts may not develop as predicted and are subject to change based on future market and other conditions. Please consult your financial professional prior to investing.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. The S&P 500 Index is an unmanaged composite of 500 large capitalization companies. This index is widely used by professional investors as a performance benchmark for large-cap stocks. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. You cannot invest directly into an index. Generally, stocks, bonds and cryptocurrency are subject to investment risk. All performance referenced is historical and there is no guarantee of future results.

Investment involves risk, including the loss of principal. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. Investment advisory services provided by Acorns Advisers, LLC SEC Registered Investment Adviser. Brokerage Services provided to Acorns Advisers, LLC by Acorns Securities, LLC. Member FINRA/SIPC. For more information visit Acorns.com.