Round-Ups® today">

Round-Ups® today">

Invest Spare Change

Round-Ups®

by Acorns

Invest your spare change from everyday purchases.

Get started

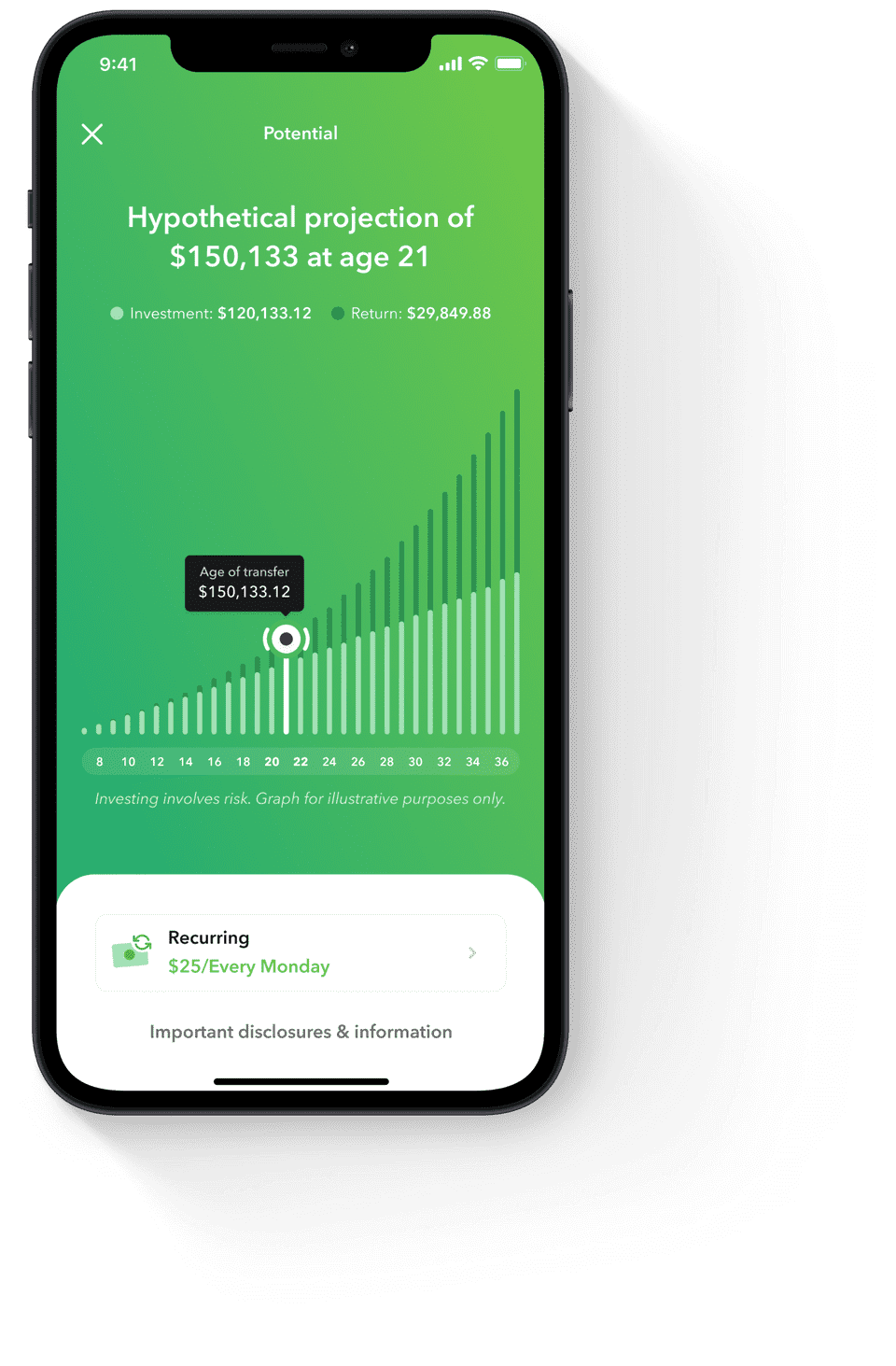

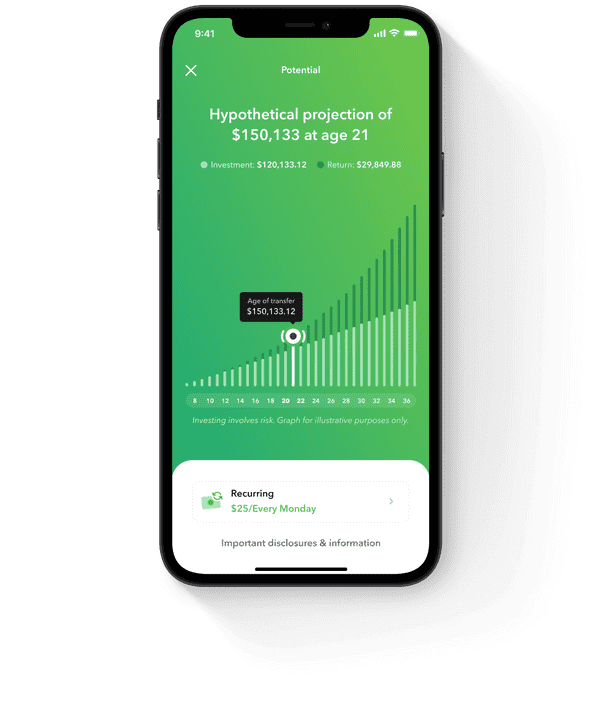

Imagine going about your day, but in the background, each purchase you make is becoming an investment in your future.

Groceries, subscriptions, events — every little charge creates spare change. And your spare change can be put to work for your future.

Acorns makes it easy - Acorns makes it easy - Acorns makes it easy - Acorns makes it easy - Acorns makes it easy - Acorns makes it easy -

Frequently asked

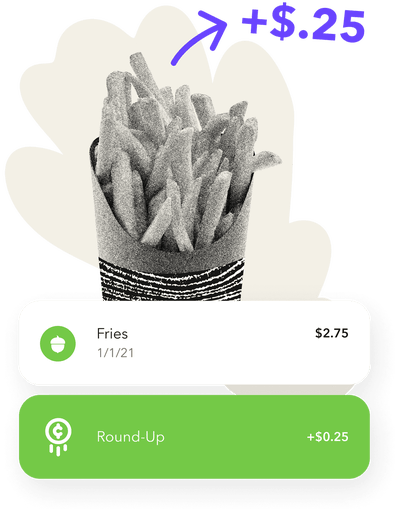

What are Round-Ups® investments?

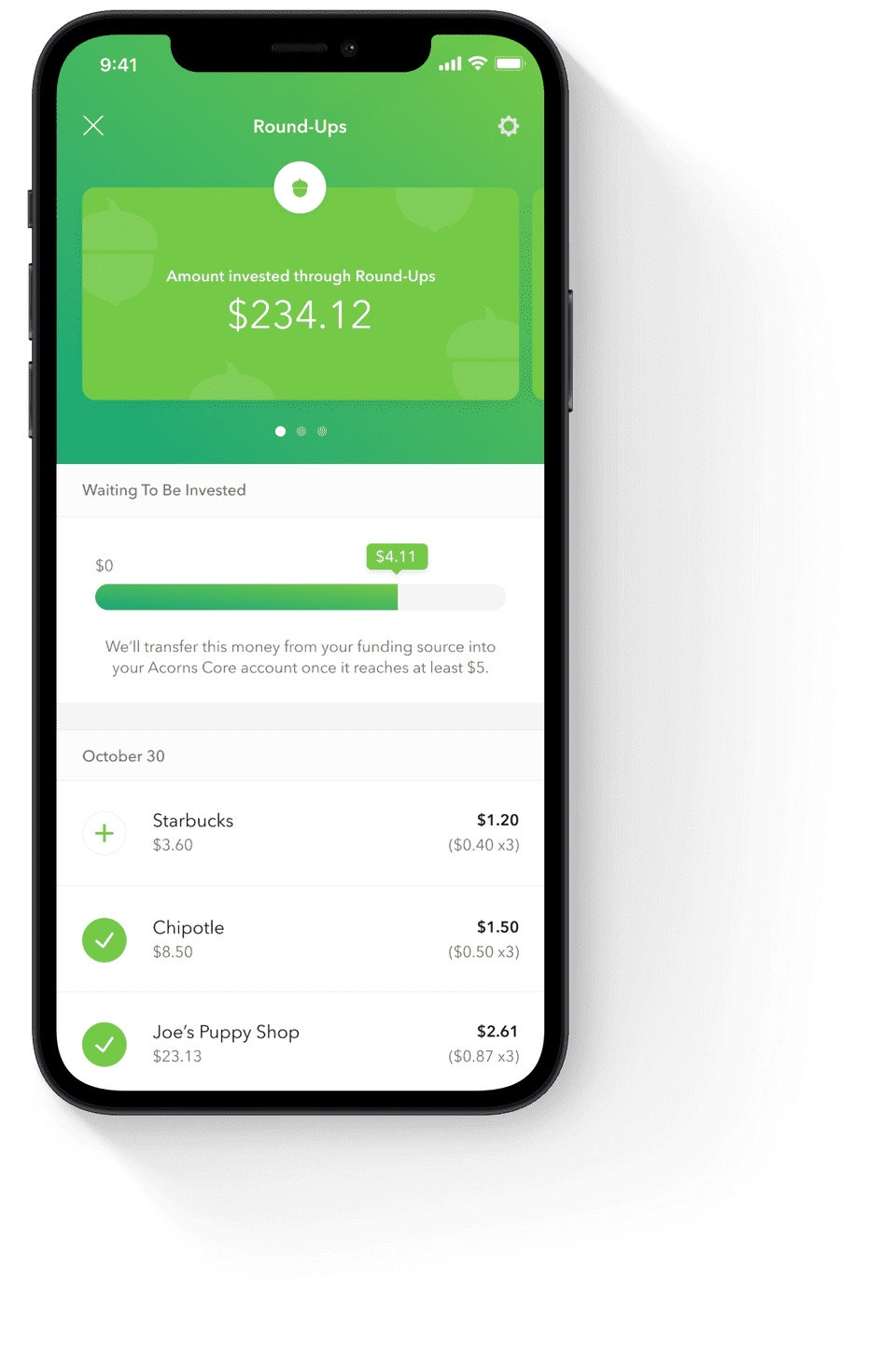

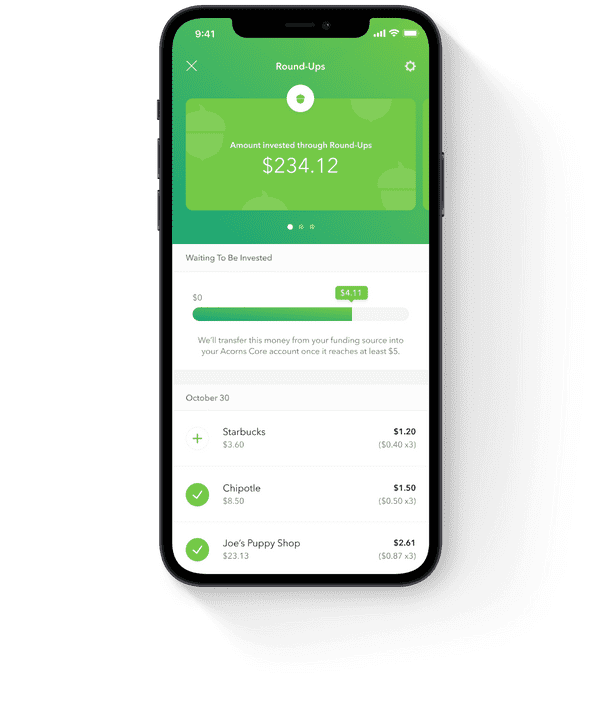

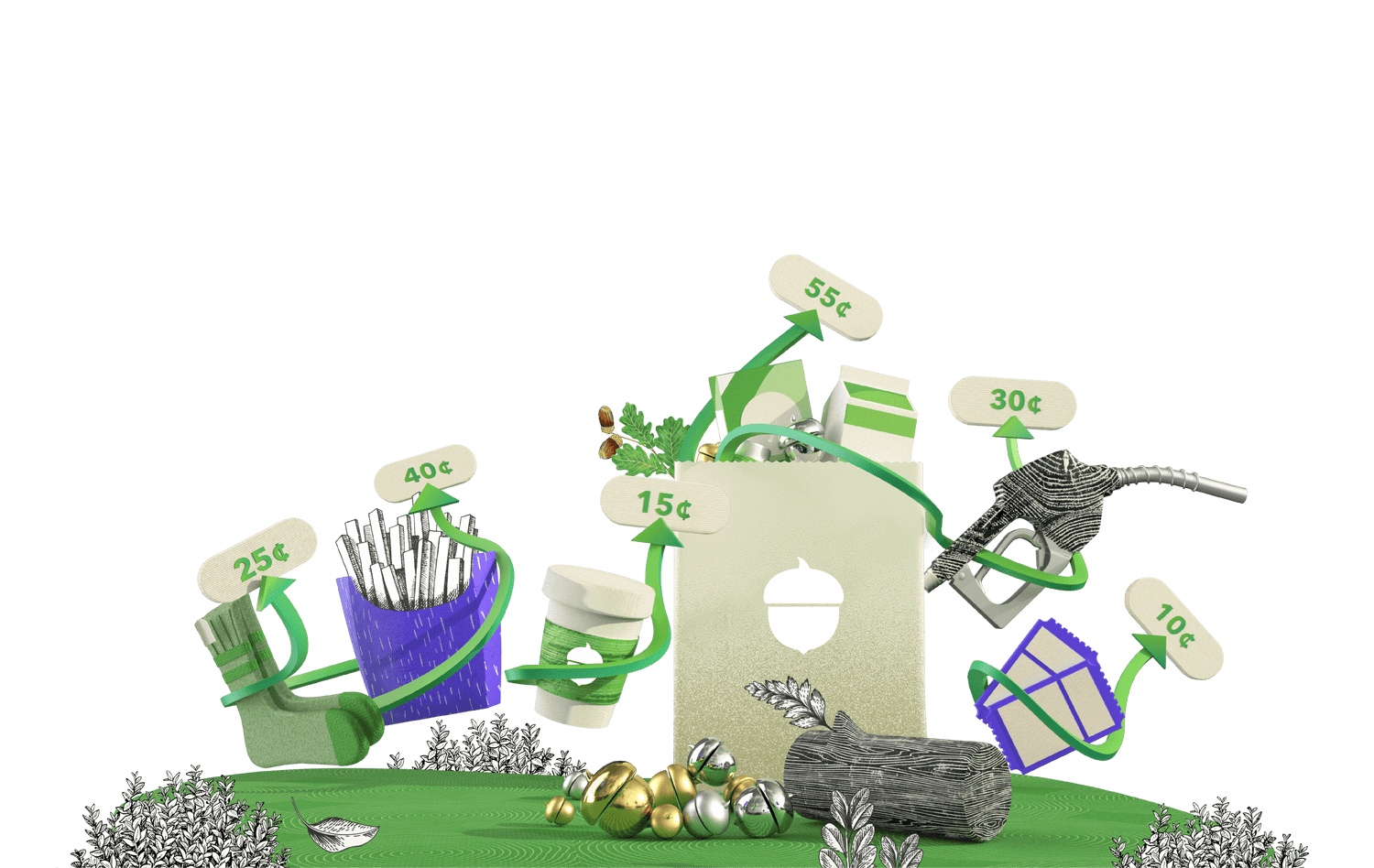

Acorns’ Round-Ups® feature helps you invest spare change from everyday purchases.

Groceries cost $30.45?

We’ll automatically invest $0.55 in your future!

Think of it as investing small amounts regularly, in the background of life. The average Acorns customer invests over $150 in their first 4 months with Round-Ups® investments, from just spare change.

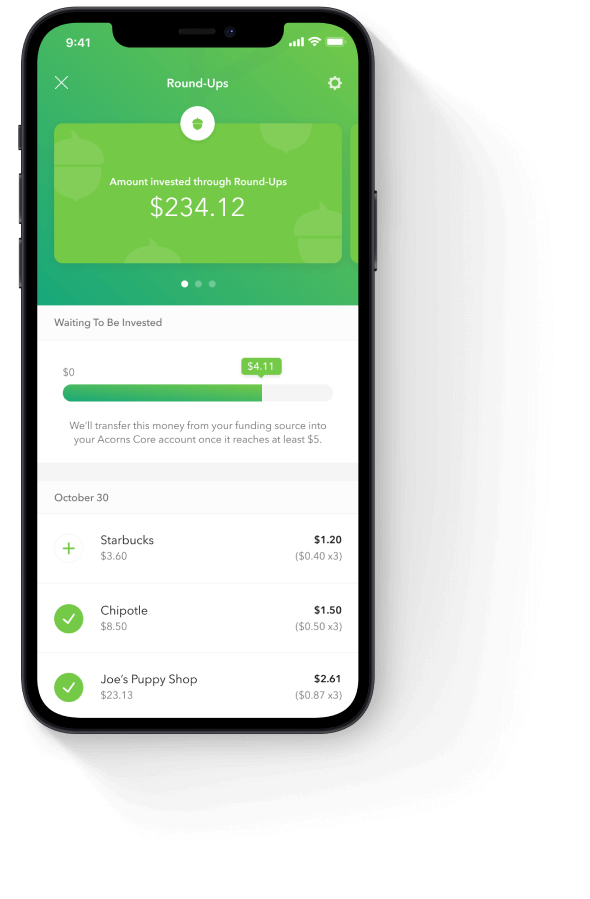

Here’s how to use our Round-Ups® feature:

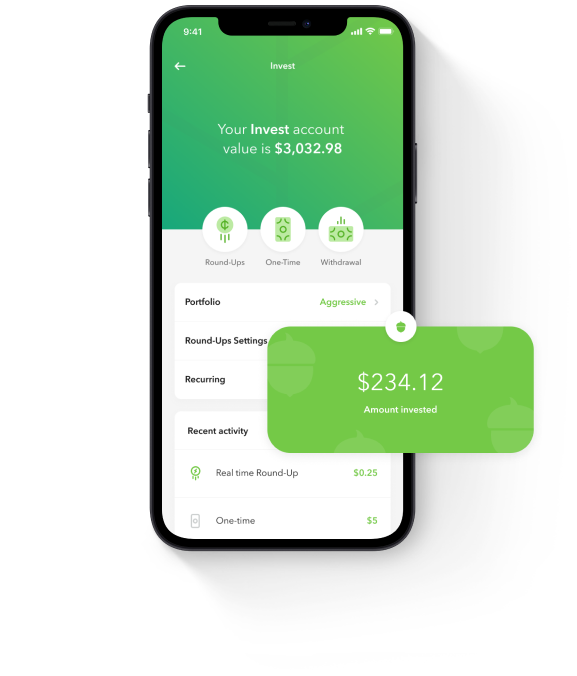

First, tap your avatar from your home screen.

Then tap Settings.

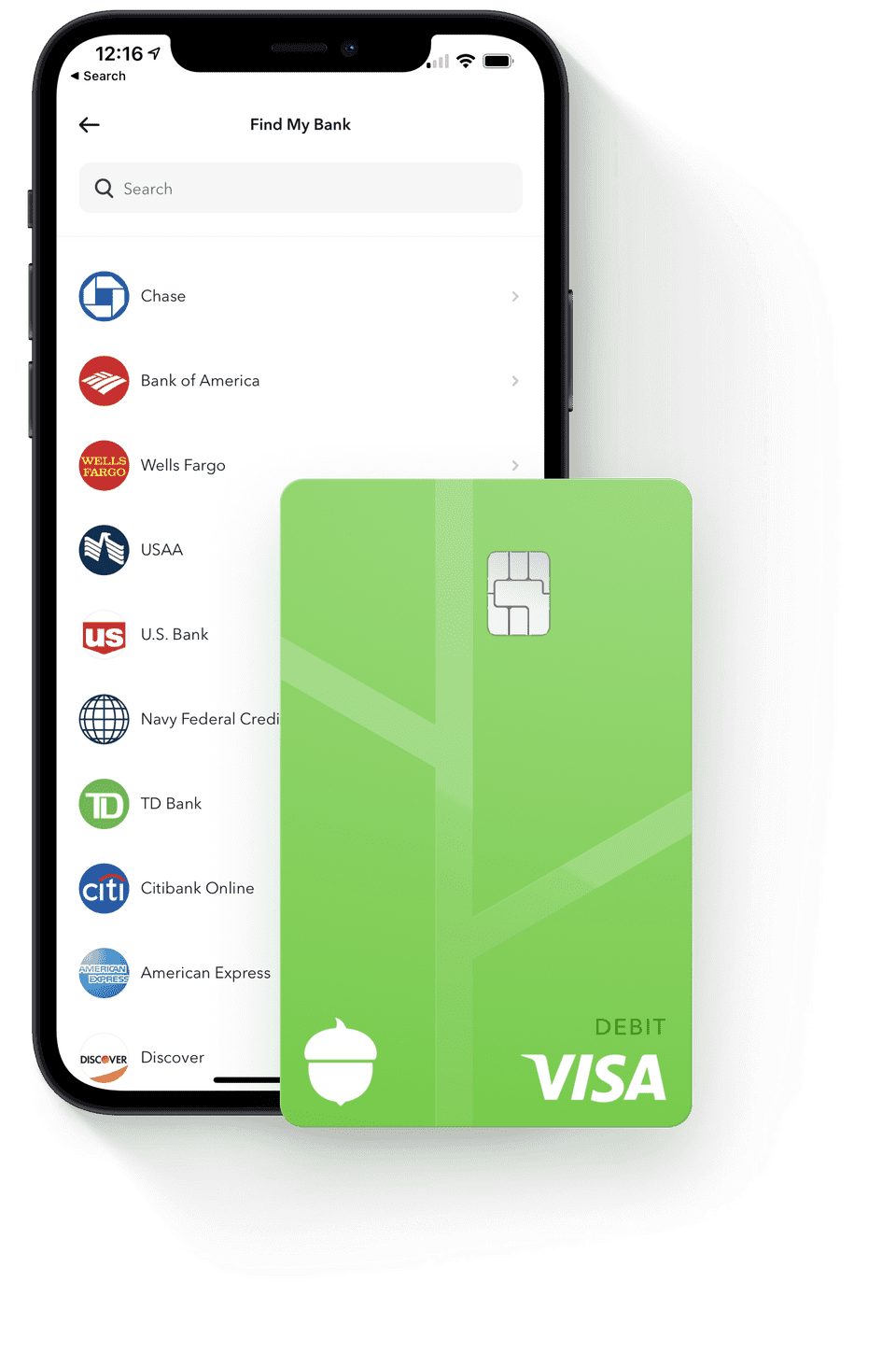

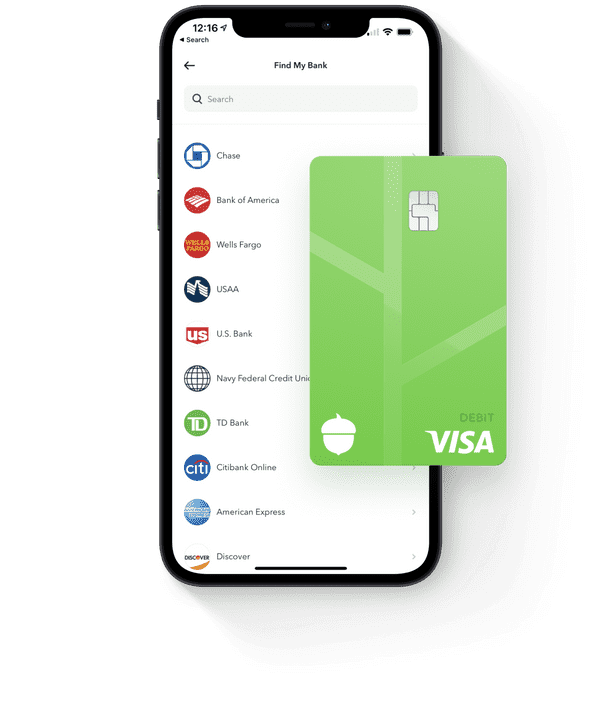

Tap “Linked Accounts” to be sure your primary checking account is linked to your Acorns account. This is how we seamlessly transfer your Round-Ups® Investments.

Next, link the credit and debit cards you use to shop, so we can round up your purchases as you go about your day.

To make sure Round-Ups® Investments are on, tap the “Round-Ups®” button on your Invest screen.

Tap the gear icon in the top right to check your settings.

Once Round-Ups® Investments are on, and your spending accounts are linked, we’ll start rounding up your spare change from everyday purchases.

Remember:

-

We transfer your Round-Ups® Investments from your linked checking account once they add up to at least $5.

-

Round-Ups® Investments transfer from your linked checking account. Round-Ups® investments are not transferred from linked debit and credit cards.

-

If you’re an Acorns Checking account customer, Round-Ups® Investments get transferred with every swipe of your Acorns Visa debit card, instead of waiting until they reach $5!

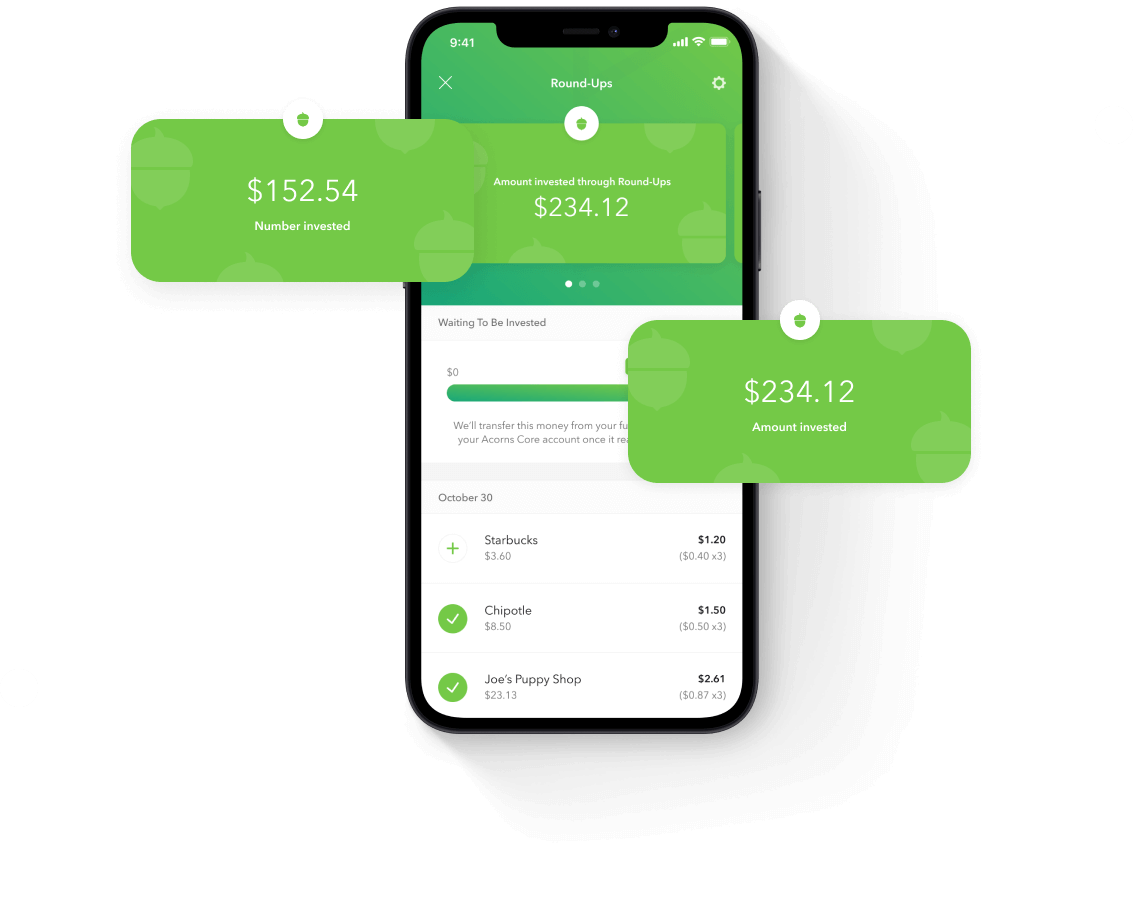

If you want to boost your Round-Ups® Investments in the background of life, try the Round-Ups® feature Multiplier and multiply your Round-Ups® Investments by 2x, 3x or even 10x.

From acorns, mighty oaks do grow. We’re excited to help you grow your oak!

The average Acorns investor, with a verified and active account, has rounded up $166 between 1/1/21 and 4/30/21. Individual results will vary and Round-Up® investment averages only take into account the Round-Up® investments themselves and do not reflect the impact investment volatility will have on overall performance.

From acorns, mighty oaks do grow. We’re excited to help you grow your oak!

What are Real-Time Round-Ups® investments?

If your Real-Time Round-Ups® investments are set to automatic and you make a purchase with your Acorns Visa™ debit card, we’ll transfer your spare change from your Acorns Checking Account to your Invest account as soon as the purchase clears. We call it Real-Time Round-Ups® investments, because you don’t have to wait for your change to add up to $5. Instead, it gets more time in the market.

How many accounts can I have linked for Round-Ups®?

There is no limit to how many debit cards, and/or credit cards you can link to the Round-Ups® feature. The more you link, the more chances you have to invest spare change!

Just remember, Round-Ups® investments transfer from your linked primary checking account, regardless of where the Round-Ups® investments originated.

How often are Round-Ups® investments invested?

Round-Ups® investments from your linked spending cards are transferred to your Acorns Invest account once they total at least $5. This money is always transferred from your primary checking account. Round-Ups® investments do not transfer from your linked cards.

What are Whole Dollar Round-Ups® investments?

When you make a transaction that’s an even dollar amount, you can choose how much you invest into your Acorns Invest account. It can be anywhere from $0 to $1.

Round-Ups® today">

Round-Ups® today">