Find your freedom with a debit card made for you

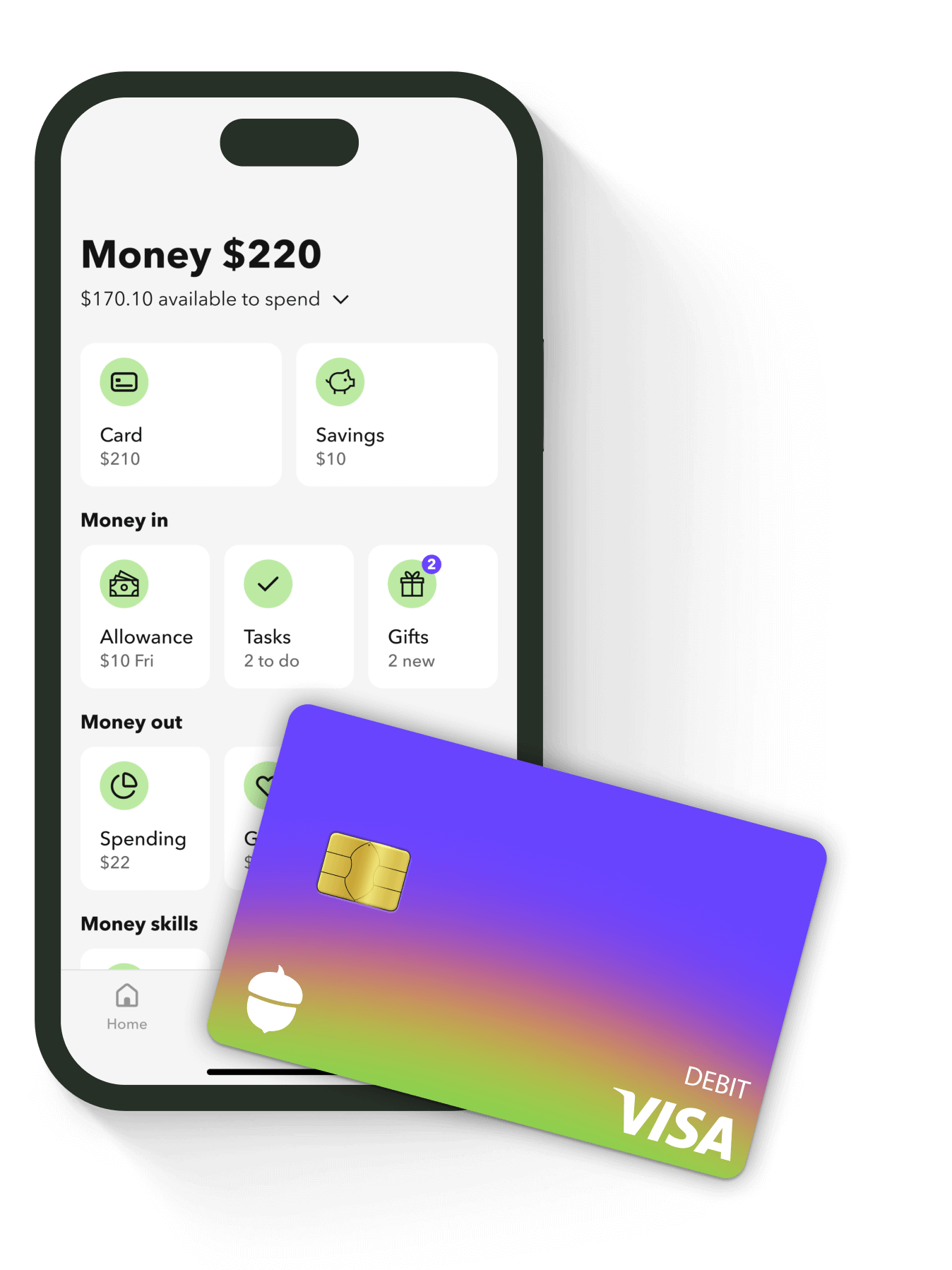

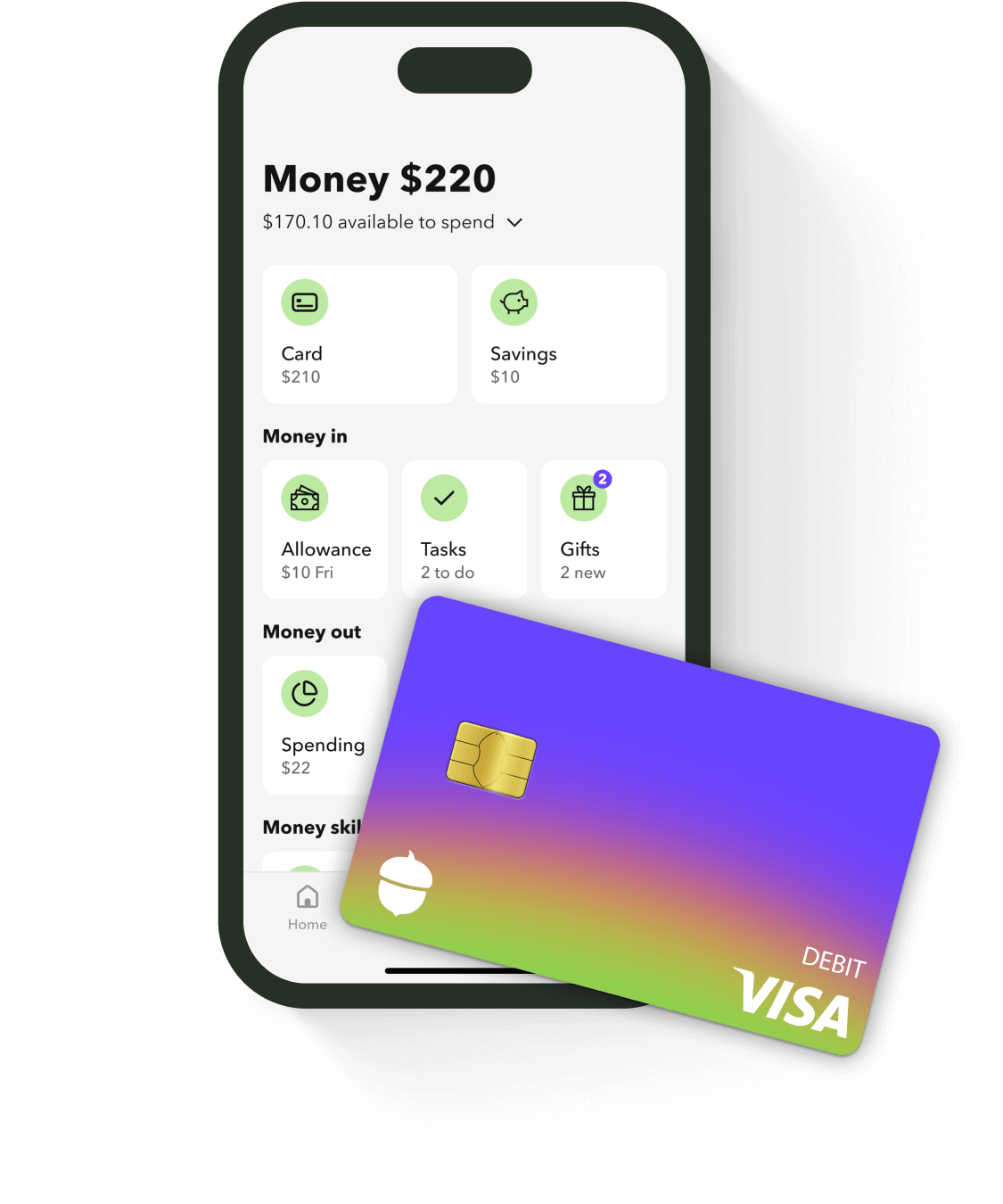

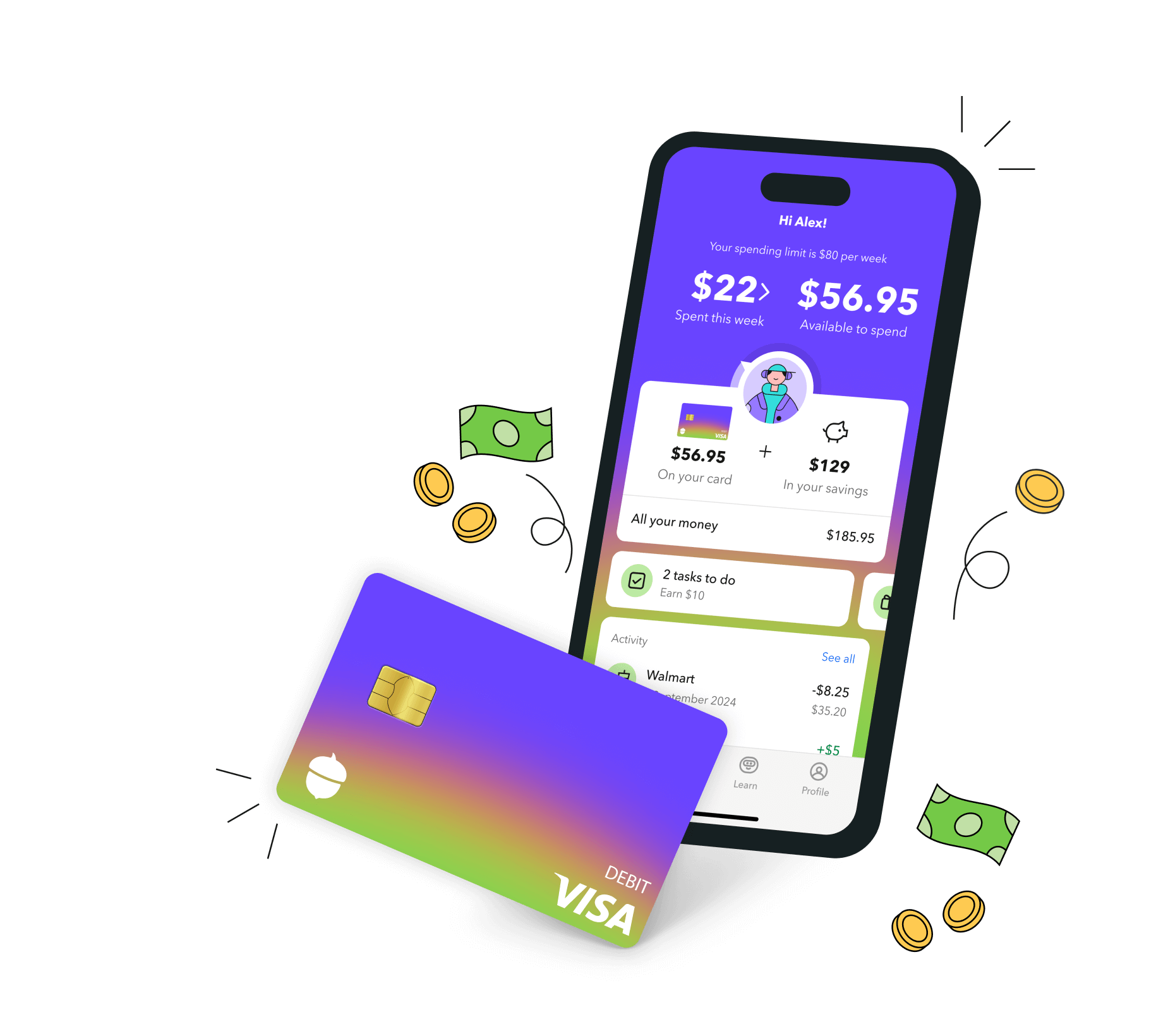

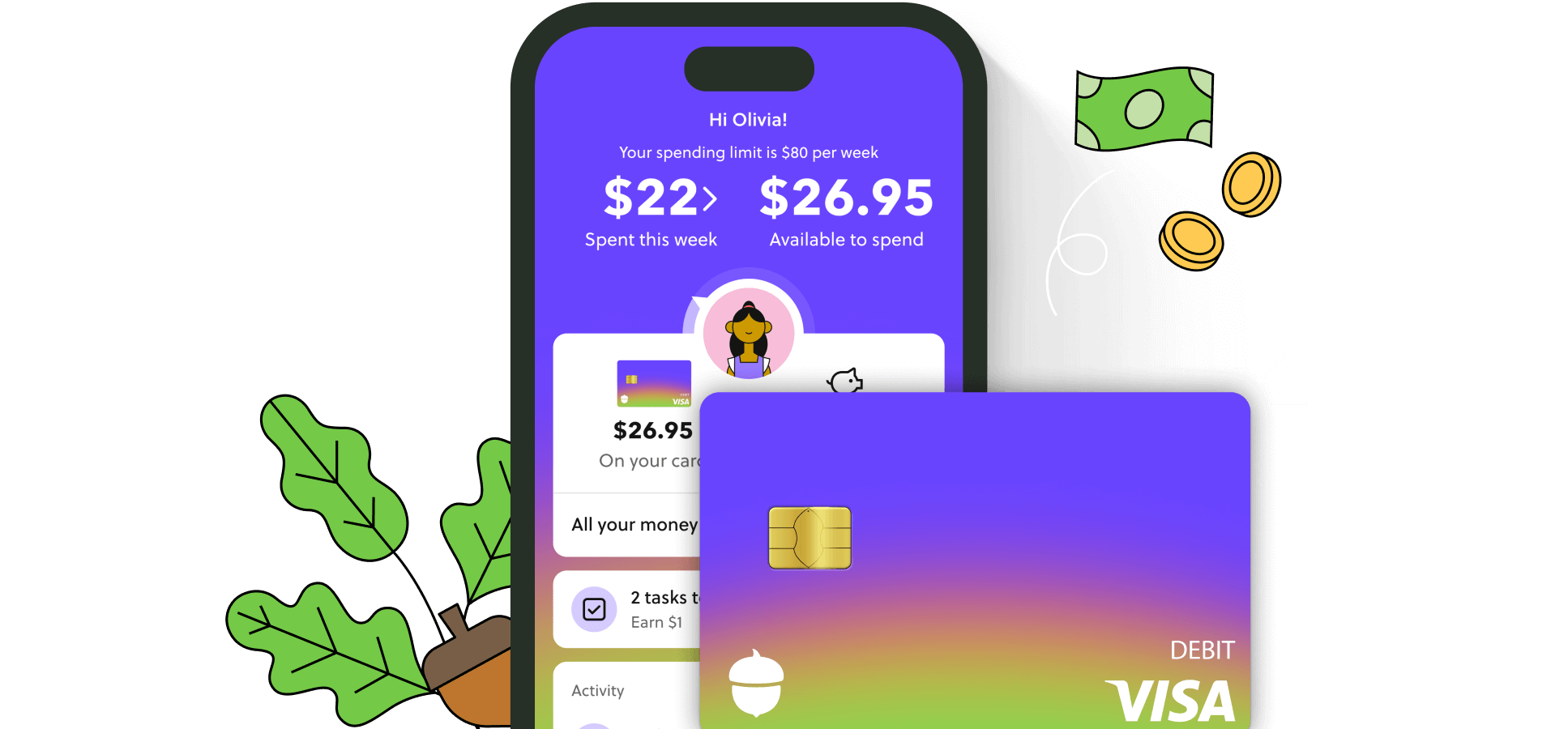

Money gets a glow-up with the Acorns Early smart money app and debit card made just for teens. Spend, save, earn, send money to friends, and more!

Get Acorns Early

Choose from 35+ customizable debit card designs

Why choose Acorns Early?

Zero Liability Protection by Visa®

Zero Liability Protection by Visa®

FDIC-insured up to $250,000 through a partner bank

FDIC-insured up to $250,000 through a partner bank

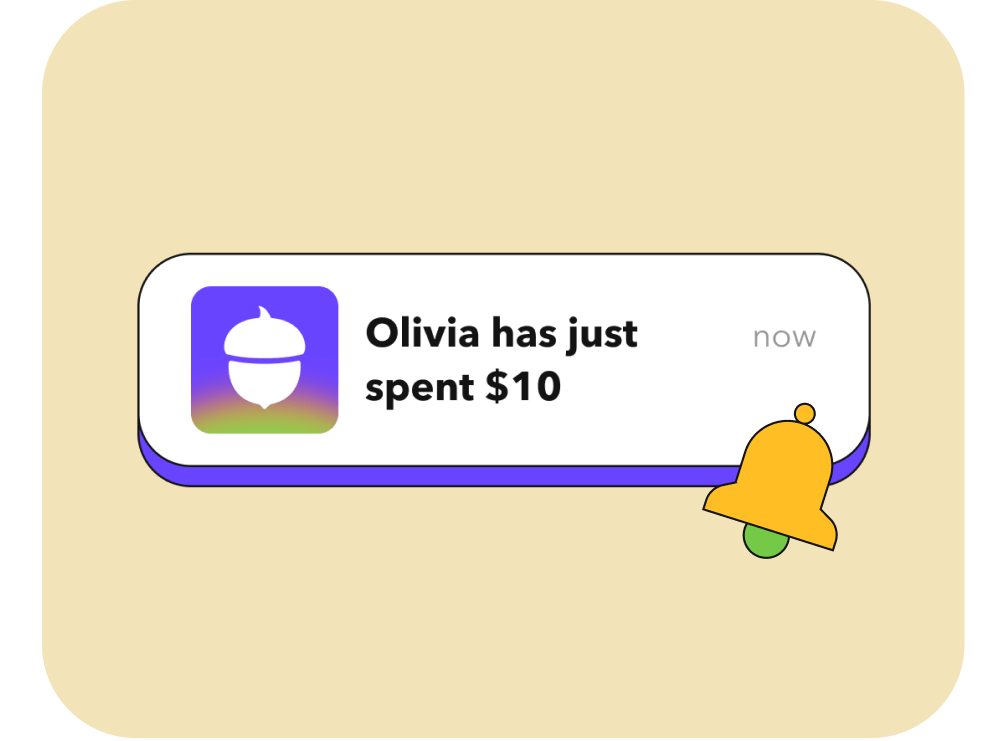

Real-time spending notifications

Real-time spending notifications

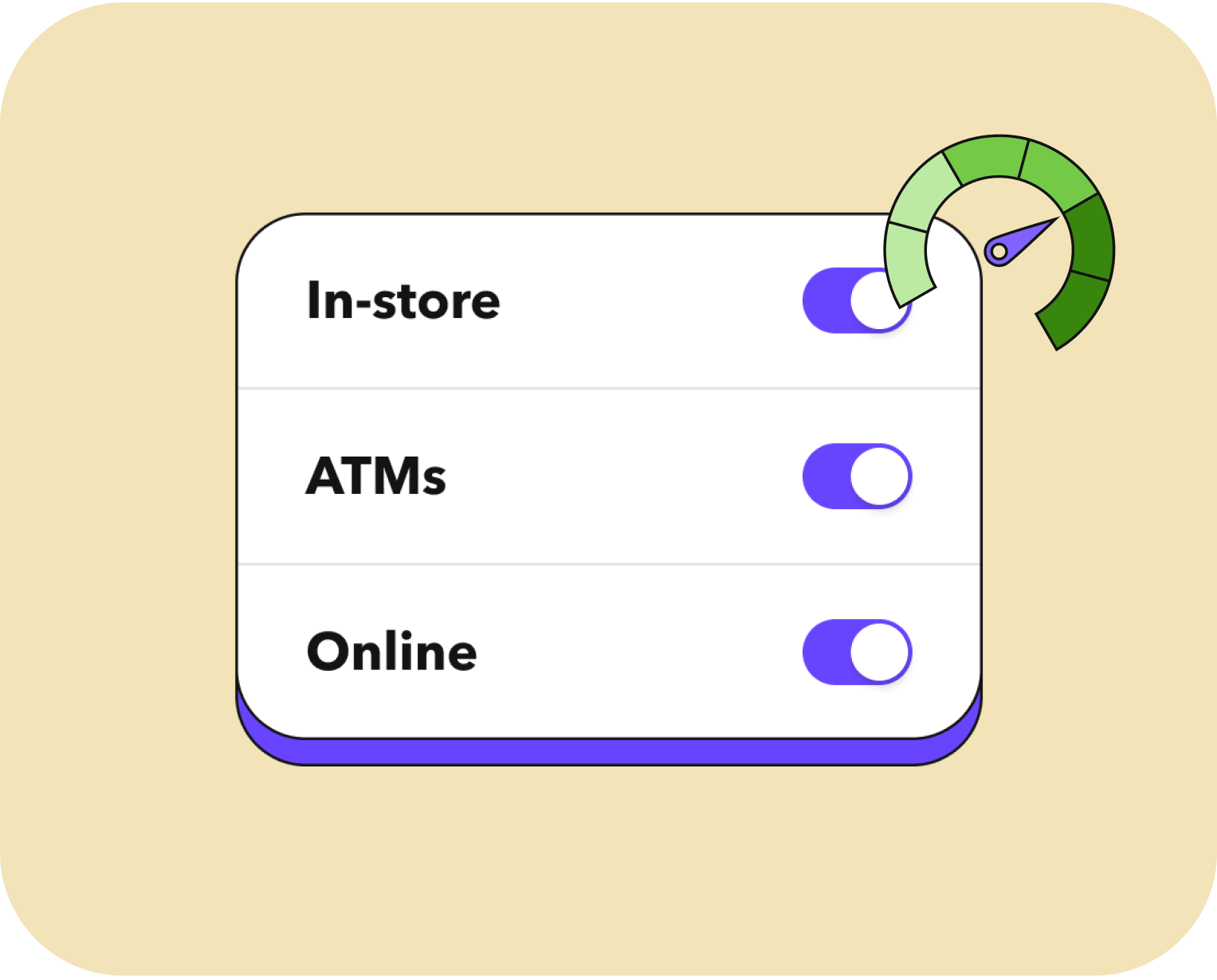

Acorns Early blocks unsafe spending categories

Acorns Early blocks unsafe spending categories

Chip and PIN-protected transactions

Chip and PIN-protected transactions

Secure PIN recovery in the app

Secure PIN recovery in the app

Bank-level encryption

Bank-level encryption

Easily block and unblock cards

Easily block and unblock cards

Why Acorns Early?

A teen debit card is also safer than carrying cash. You can block or unblock cards whenever you need to, and parents can send you a quick transfer for need-it-now moments.

Frequently asked

At what age can a teen get a debit card?

Acorns Early debit cards are available for kids ages 6 to 18. Teens just need a parent or guardian to sign them up to get their Acorns Early debit card.

Where can you use Acorns Early debit cards?

Acorns Early debit cards can be used anywhere that Visa® is accepted. This includes online, in stores, and at ATMs.

Are teens' debit cards a good alternative to traditional bank cards and credit cards?

Acorns Early is for kids ages 6-18, which means kids under 18 can start learning about money before they are eligible for a traditional bank card and/or credit cards of their own. Our features have been designed specifically for this age group—and allow for safety and parent transparency at all times. From real-time spend notifications and instant transfers to the ability to set chores and pay pocket money—Acorns Early is tailored to families. Plus, our safety features like the option to block and unblock cards, and being able to block unsafe spend categories helps you stay in control, too.

Is Acorns Early included in an Acorns subscription?

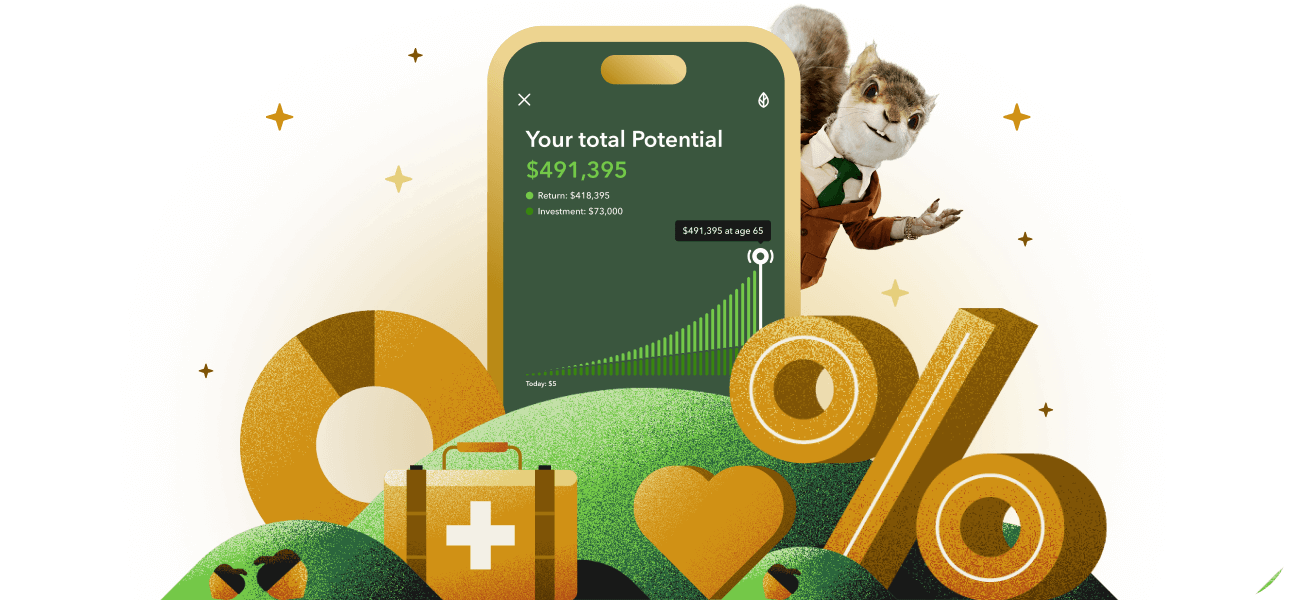

Acorns Early is included in every Gold subscription. The Gold subscription also includes Acorns Early Invest, a flexible investment account for kids with a 1% match, Acorns Invest, an investment account with an expert-built, diversified portfolio, and Acorns Later, a retirement account with a 3% IRA match on new contributions, and much, much more!