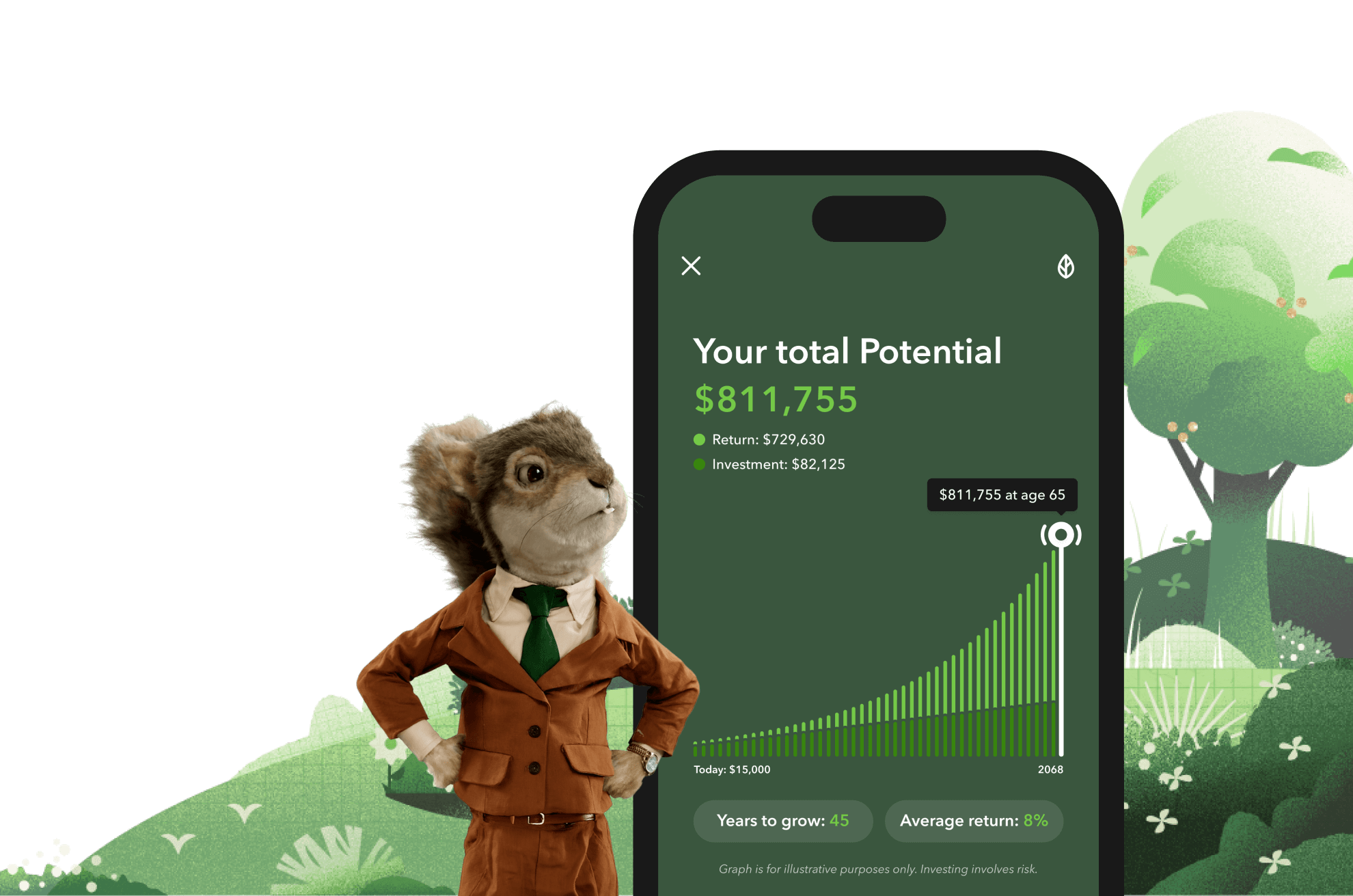

Bonus investments

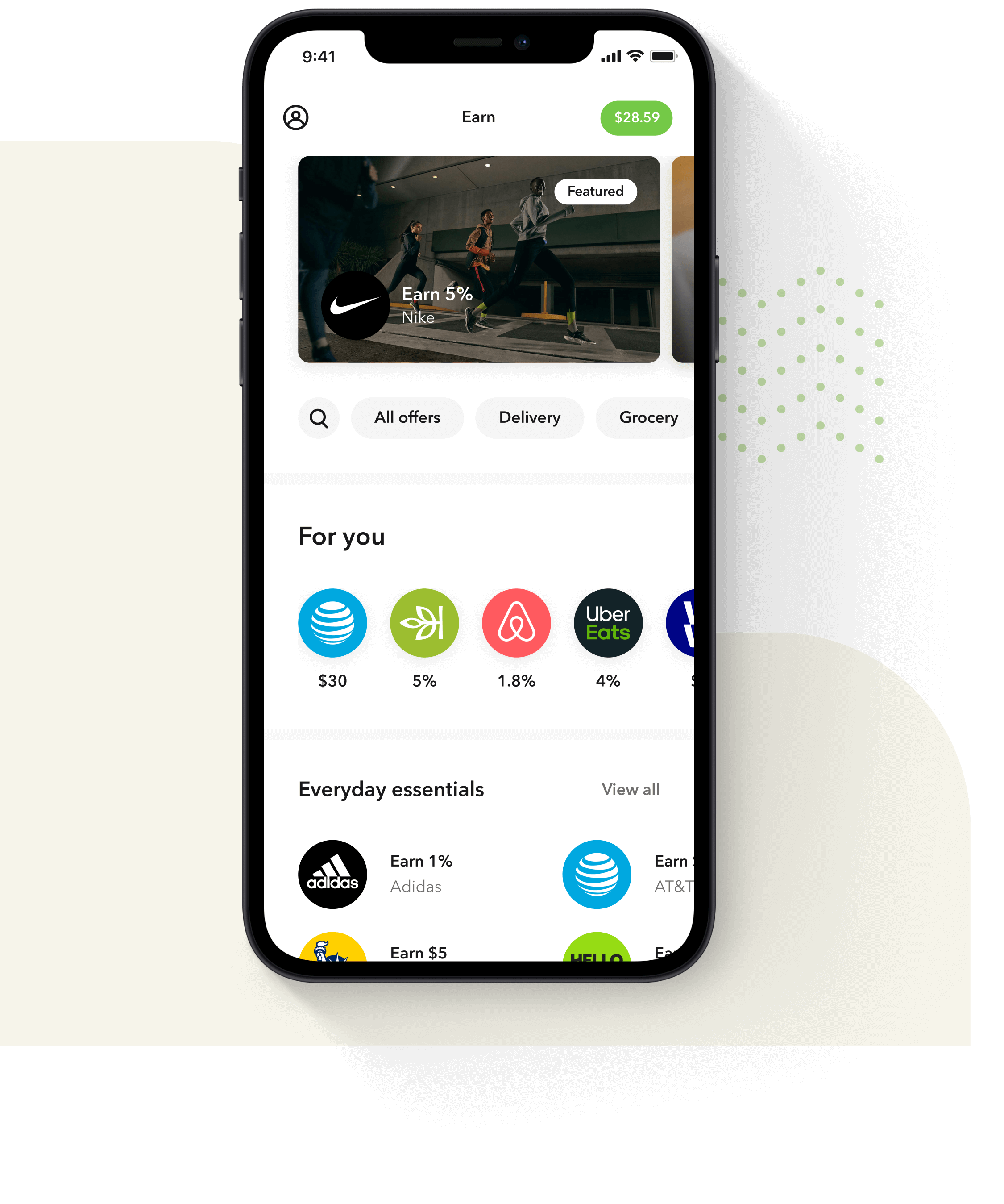

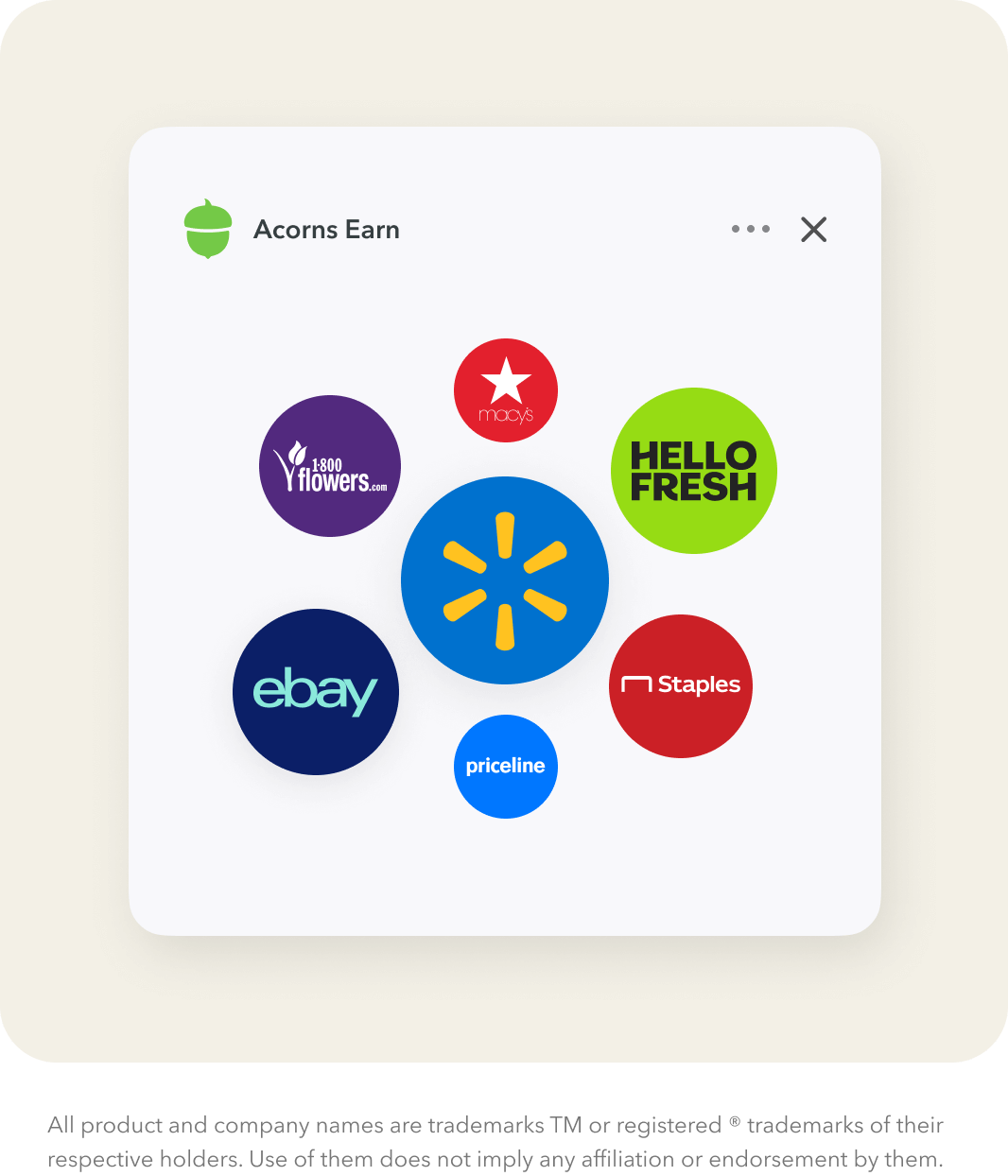

Acorns Earn

Automatically earn bonus investments when you buy what you need from brands you love.

Get started

11,000+ offers from the brands you love

Frequently asked

What is Acorns Earn?

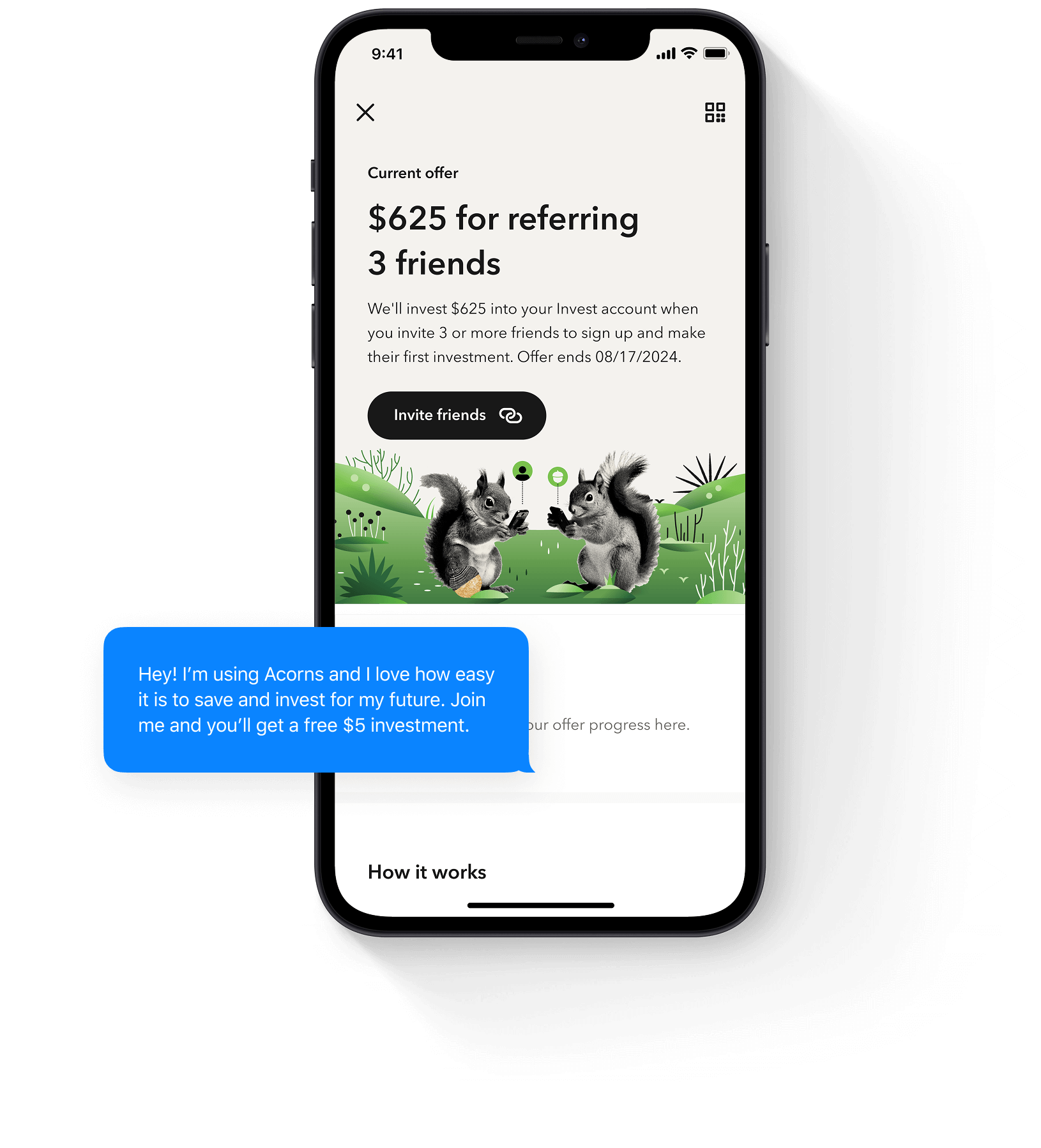

Acorns Earn helps you earn more money when you shop because when you earn more, you can save and invest more. We’re excited to be the financial wellness system that helps you earn more money.

How do I earn rewards?

We try to find as many ways for you to earn rewards as possible! Most rewards are earned by shopping through the offers in the Earn section of the app. There are also some “Simply Spend” rewards that you automatically earn when you shop with a card linked to Acorns. You can also install the Earn Chrome and iOS Safari Browser Extensions to earn rewards when you shop online.

When will my Earn Rewards be invested?

You should receive a reward confirmation email and see the reward pending in Earn within 3-7 days of making the purchase. The reward will be invested within 60-120 days, giving you plenty of time to return any items, rewards may be adjusted due to returns or cancellations. Please check the terms and conditions for each offer for more details.

How do I earn rewards from the Acorns Earn Chrome Extension?

Download the Acorns Earn Chrome Extension from the Chrome store, then log in with your Acorns email address and password. Once installed, whenever you land on a participating merchant you’ll see the offer details pop up, activate the offer and you’ll earn the reward once the purchase is complete!

How do I earn rewards from the Acorns Earn Safari Extension?

With the Acorns app installed on your iPhone, follow the instructions for the Acorns Earn Safari Extension. Safari Extensions are only available on iOS 15 or greater. Once setup, whenever you land on a participating merchant you’ll see the offer details pop up, activate the offer and you’ll earn the reward once the purchase is complete!