The chart shows an estimate of how much an investment could grow over time based on the initial deposit, contribution schedule, time horizon, and interest rate specified. Changes in those variables can affect the outcome. Reset the calculator using different figures to show different scenarios. Results do not predict the investment performance of any Acorns portfolio and do not take into consideration economic or market factors which can impact performance.

Compound Interest Calculator

Compound Interest Calculator

Compounding is often described as “interest earned on interest,” and can help grow investors’ money quicker.

But you’ve got to understand compounding to really be able to take advantage of it. Let’s take a closer look.

Start saving and investing today with Acorns

What is compounding?

Your money compounds when you earn interest or returns on money that’s already earned interest or returns.

Think of it like a snowball rolling down a hill. The snowball starts small, but as it keeps rolling, its momentum builds and it grows bigger and bigger.

Take a savings account, for example. When you have money in a savings account that earns interest, you receive interest on the amount you deposit and the interest you earned from the previous period.

The term "compound interest" is usually used for accounts that pay a set, guaranteed interest rate (like a savings account). Money that’s invested can compound, too. Technically, your investments can earn “compound returns,” because investments don’t always grow and you don’t earn a set interest rate from them. But many people use the terms “compound interest” and “compound returns” interchangeably.

For both savings and investment accounts, compound interest can work in your favor. Take a long-term approach and stay the course, and you have a better chance of your money growing over time.

How does compound interest work?

Compounding can be confusing, so here’s an example.

Suppose you open an investment account with an initial deposit of $100, and you earn a hypothetical, conservative 6% annual return.

-

Year 1: After one year, you’d have a balance of $106: your original $100 plus $6 in gains.

-

Year 2: You leave your $106 invested, and a year later, you notice you have more than expected. Your balance is now just over $112.

So what happened? Since your investment was compounding, your returns in year 2 were calculated using your new year 1 total of $106. You then earned another 6% in year 2 — or $106 plus a little more than $6 in returns.

Extend this example a few years or even decades out, and your balance will likely be higher. In 10 years, with markets growing at the same average annual rate of 6%, you’d have about $179, or almost 80% more than your initial investment, without having invested any more money!

Just remember that 6% annual returns is a conservative estimate. The market has recorded average annual returns of 9.5% since the S&P 500 was started nearly 100 years ago. Using higher average annual returns would, of course, change our hypothetical example and boost your results.

But it’s important to set conservative, realistic expectations when thinking about the growth of your money. No one really knows what will happen in the future, and if history will repeat itself. So by being conservative, you’re less likely to be caught off guard.

In other words, if you plan for 6% and get 9.5%, that’s a pleasant surprise. But planning for 9.5% and getting 6% could be a costly setback.

It’s also important to know compound interest can also work against you. For example, when you don’t pay off your credit card in full each month, the issuer charges you daily interest on your unpaid balance and unpaid interest. In other words, more interest is added on top of what you already owe.

Benefits of compound interest

The potential benefits of compounding can’t be stressed enough. From its potential for long-term growth to the opportunity to build wealth, compounding is one reason that investing is worthwhile.

Long-term growth

When you invest early and often, you give your money more time and more opportunities to take advantage of the potential power of compounding.

Every time you add money to your account, you’re effectively letting the market and compounding do what it does best — and that’s to give it the chance to grow. Historically, the market has always grown over time.

When your investments compound, you’re not just earning today’s price minus yesterday’s. You’re also earning money on your previous gains.

A key to building wealth

For long-term investors, compounding can be one key to building wealth. That’s because compounding is interest or returns you earn on your initial investment plus your accumulated gains.

When you start investing, compounding may not seem all that fruitful. But over time those gains can add up.

It's important to remember that compounding can have the biggest impact if you give it time. Ten years isn’t all that much time when you’re thinking about your long-term goals. Imagine what compounding could do 20 or even 30 years down the road.

Great way to save for retirement

Similarly, saving for retirement isn't something you can achieve overnight. It can take multiple decades to save enough to one day hit your “magic” number.

That’s why most experts say to start investing for retirement as early as possible. When you start early, you’re giving your initial investment and accumulated returns more time to potentially compound. The boost from compounding may be just what you need to get over the finish line.

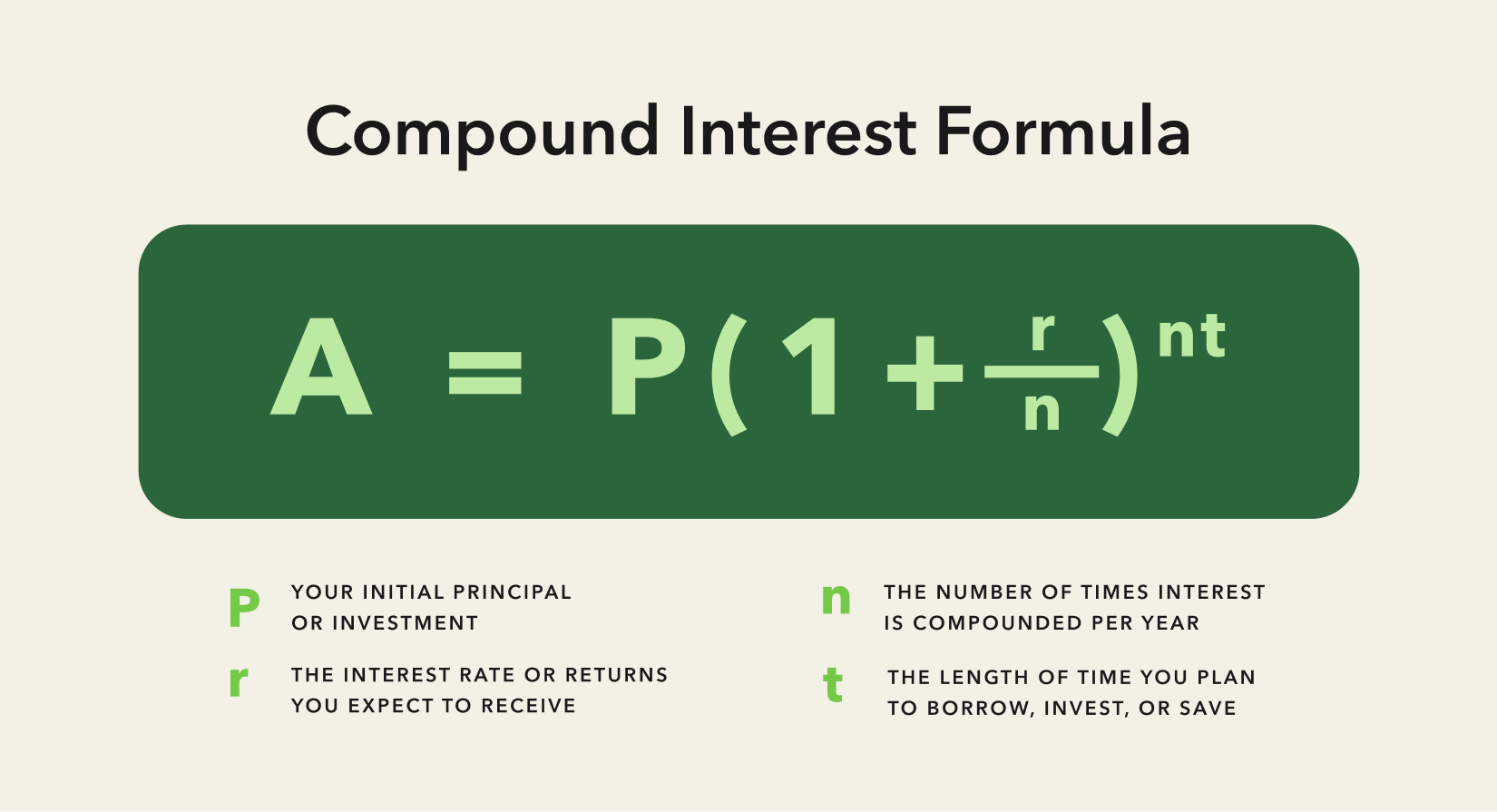

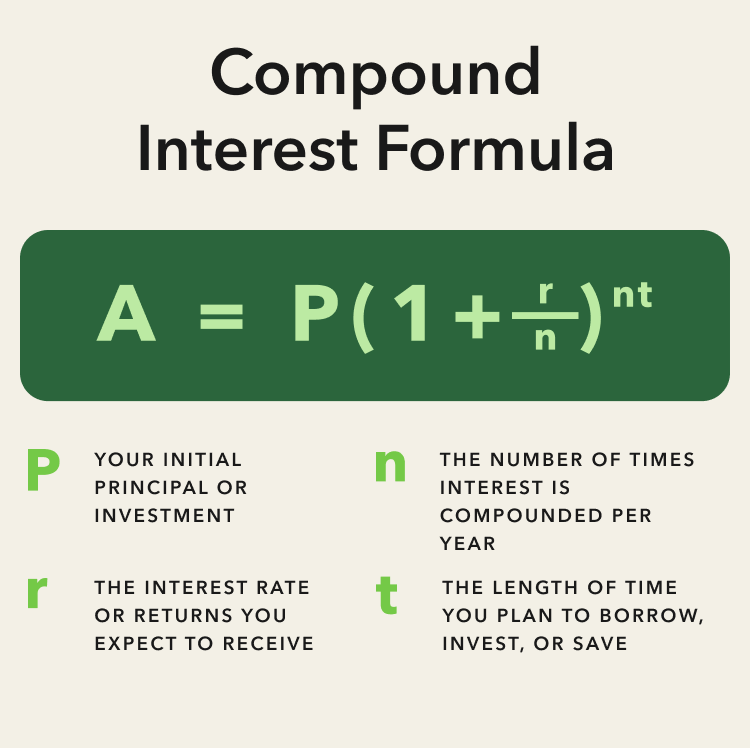

How to calculate compound interest

Before you break out your TI-83, here’s a look at the formula for calculating compound interest and returns.

Compound Interest Formula

A = P(1 + r/n)nt

-

P is your initial principal or investment. This is the amount you start investing or saving with.

-

r is the interest rate or returns you expect to receive. Remember, this is an average, so some years have higher gains and some have bigger losses.

-

n is the number of times interest is compounded per year. The most common compounding periods are daily, monthly, and annually.

-

t is the length of time you plan to borrow, invest, or save. Long-term investors should try to think about this variable in decades, rather than months or years.

Hopefully, this formula doesn’t give you nightmares of high school algebra, but if it does, there are easier ways to calculate compound interest, especially for investors.

Sign up today and set a recurring investment

How to use this compound interest calculator

This compound interest calculator can help you calculate your potential returns. Try out different numbers to see how much your investment could change over time. Many of the input fields should remind you of the compound interest formula above

Initial deposit: This is your investment on Day 1, or how much you’ll be starting with.

Contributions: If you plan on investing on an ongoing basis, you can enter an ongoing contribution amount. This way, you can see how using a consistent investment strategy (or dollar-cost averaging) could impact your investment’s potential growth.

Contribution frequency: Since every investor is different, you can pick how frequently or infrequently you plan to make those contributions. Maybe it’s one dollar a day from your Acorns Round-Ups®, or maybe you like the idea of investing $100 at the end of each month with a Recurring Investment.

Average annual return: This is the percentage you expect your investments to grow each year. When you’re investing, it’s unlikely you’ll get a steady return of 7%, or any other amount — the stock market can go up and down daily and even yearly.

But history shows that the U.S. stock market has always grown over time, so this annual return represents how you expect your investments to grow on average and over the long term, not every single year. A 7% return is an estimate based on the growth of the general market over the last hundred years, but more conservative investors may consider reducing this.

Years to grow: This is your investment horizon, or how long you plan to leave your money invested.

The Rule of 72

Another way to quickly calculate potential compound interest is with the Rule of 72. The Rule of 72 is a quick formula for estimating how long it would take to double your investment.

Divide 72 by your expected annual rate of return and the result is the years you’ll have to wait before your investment doubles.

For example, if you expect to earn an average annual return of 7%, you’d have to wait a little over 8 years before your $100 becomes $200.

Don’t let this napkin math guide your investment strategy, but as a launching pad, the Rule of 72 can be helpful.

Simple interest vs. compound interest

Simple interest is a little different from compound interest. You’ll typically see simple interest rates charged annually on mortgages, car loans, or personal loans.

To figure out how much interest you might owe if you're being charged a simple interest rate, multiply the principal balance by the annual interest rate and number of years on the loan.

As a general rule of thumb, simple interest favors borrowers and compound interest favors investors. That’s because simple interest is calculated based on your principal balance. If you take out a $1,000 car loan with a simple interest rate of 5% for 5 years, you would end up paying a total of $250 in interest on the debt.

Now let's say you used the same example with compound interest. Then you would owe a percentage of both the original loan balance plus any of the previously accumulated interest. That could really add to your bill.

But compounding, as we’ve seen, can work in your favor as an investor. When you invest in the market, you're hoping to earn a return on your principal investment. So, in this case, you wouldn’t want to accumulate returns just on that initial investment. You also want to earn returns on top of everything you’ve earned so far.

That's what you can get with compound interest. You have the potential of earning on your initial investment plus gains from previous periods.

How to take advantage of compounding

Compound interest can be a force that propels your investments further — here are three ways that might help you take advantage of it.

1. Invest early

More time in the market translates into more time for your money to potentially compound, if the markets rise. If you can, start investing as soon as possible — even small amounts can add up over time.

2. Invest often

By making consistent investments, you give your money a chance to take advantage of potential dips in the market. Over time, those small nibbles can turn into big bites.

3. Stay diversified

There’s a reason most experts advise against putting all your eggs in one basket. A diversified portfolio holding multiple types of investments (such as stocks or bonds) gives your investing portfolio a shot of weathering the storm in bad times and can help set you up for success in the long term.

Getting started is simple. Open an Acorns Invest account to access a diversified portfolio that matches your personal circumstances and financial goals. With Acorns, you can also set up Recurring Investments — an easy way to make periodic investments that could help you take advantage of compound interest over time.

Start saving and investing today with Acorns

This information is for illustrative purposes only. Compounding is the process in which an asset’s earnings are reinvested to generate additional earnings over time. Compound calculators do not take into consideration fees, taxes, dividend reinvestments, or other economic or market factors that may impact performance. Actual investment results may be materially different than portrayed. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principle. References to past performance do not guarantee future results. Investments cannot be made directly in an index. Unmanaged index returns do not reflect any fees, expenses, or sales charges. Investing involves risk including the loss of principal. Please consider your investment objectives, risks, charges, and expenses carefully before investing.