What Is the 50/30/20 Rule?

A monthly budget is a plan for how you'll spend your money. It's meant to put guardrails around your income so you can live comfortably today while saving for the future. The right budget can be empowering. One CFP Board survey found that people who have a budget feel more in control, confident, and secure in their finances than those who don't.

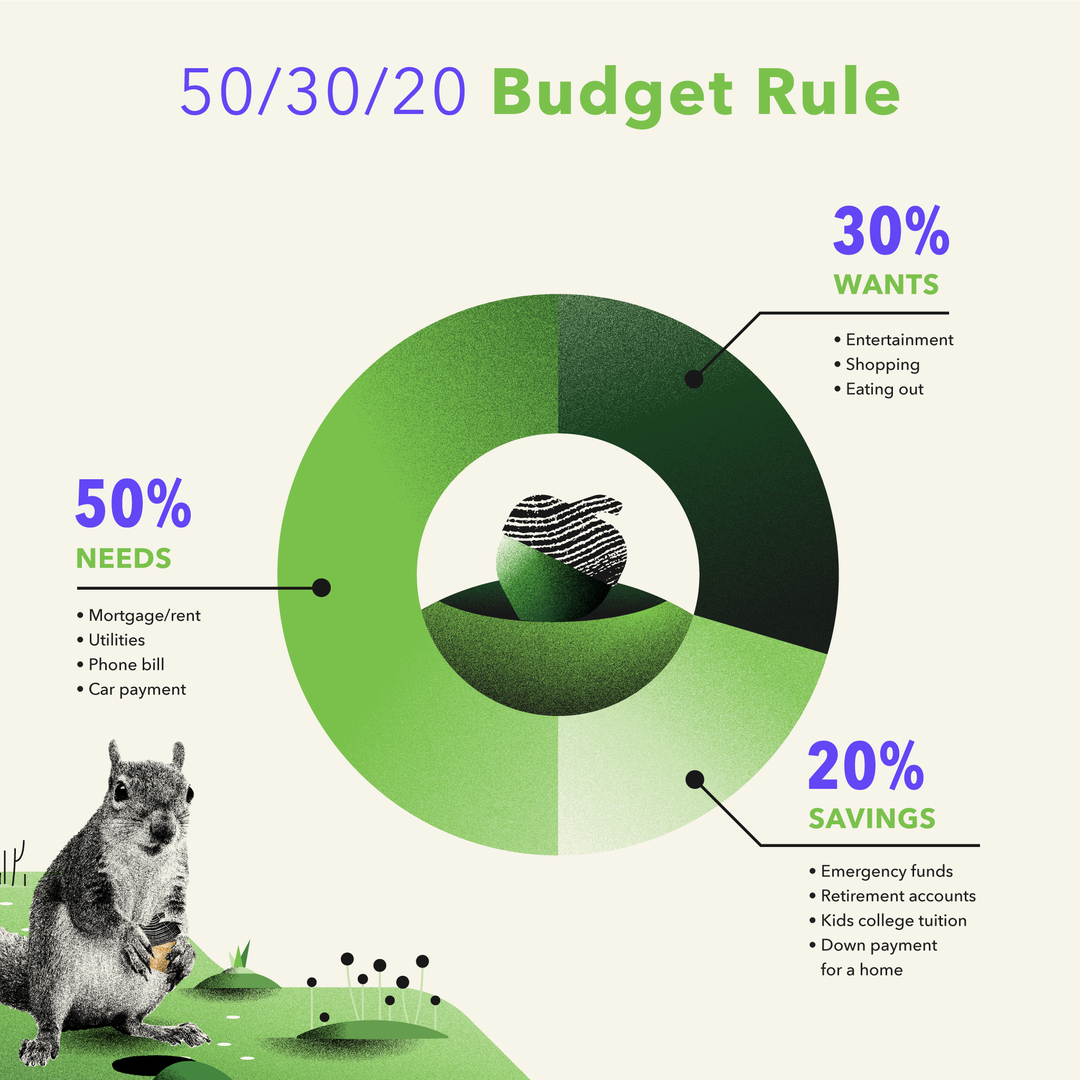

The 50/30/20 rule is a popular budgeting method that breaks your spending into three main categories. Here's how it works.

What is the 50/30/20 rule?

Using the 50/30/20 rule of thumb, you'll divide your monthly after-tax income like this:

-

50% for essential spending

-

30% for flexible spending

-

20% for financial goals

It carves out space for regular bills, day-to-day spending, and short- and long-term financial goals. There's even room to treat yourself a little. When seen through this lens, your monthly budget can become a tool for financial freedom.

Budget 50% for needs

The 50/30/20 rule devotes half of your take-home pay to basic needs. All of your essential monthly bills go in this pile. Below is a starter list of what that might include:

-

Your mortgage or rent payment

-

Utilities

-

Phone bill

-

Car payment

-

Gas and other transportation expenses

-

Minimum debt payments (such as credit cards and student loans)

-

Out-of-pocket medical expenses

Budget 30% for wants

The 50/30/20 rule earmarks roughly a third of your take-home pay for discretionary spending (also known as "wants"). The following expenses all land here:

-

Entertainment

-

Dining out

-

Shopping

-

Treat-yourself splurges

While it may be tempting to skim here and devote more money to another category, going too lean on flexible spending can feel restrictive. Balance is the name of the game. One benefit of the 50/30/20 rule is that it makes it easy to see exactly where your money is going each month.

Budget 20% for saving and investing

Achieving your financial goals probably won't happen overnight. The 50/30/20 rule allows you to save gradually so that every month, you're getting closer to the finish line. With this monthly budget, you'll put aside 20% of your income for saving, investing, and other financial goals. That might include:

-

Building your emergency fund

-

Growing your retirement accounts

-

Contributing to a brokerage account

-

Saving for your children's education (like a 529 plan or custodial account)

-

Setting aside money for a down payment on a home

-

Padding your travel fund

-

Saving money to start a business

The 50/30/20 rule is all about making things simple. Putting saving and investing on autopilot can help with that. Once you decide on savings targets that feel right for your budget, you can set up automatic transfers to your bank account each month. You can also automate your retirement contributions and other investment dollars. With Acorns Invest, you can start with as little as $5.

Why is the 50/30/20 rule important?

It's easy to overspend when you don't have a monthly budget. The 50/30/20 rule is designed to help people live within (or below) their means. The most time-intensive part is usually getting started because it requires you to track your spending and categorize your expenses. After that, you'll have a plan to cover your bills and work toward your financial goals. This budgeting style also frees up some fun money, which allows you to spend on yourself without the guilt.

Without a budget, it might feel like your paychecks are slipping through your fingers each month — leaving little left over for saving and investing. The 50/30/20 rule can put structure around your spending.

How to use the 50/30/20 rule

Here's what the 50/30/20 rule looks like in practice.

Step 1. Calculate after-tax earnings

Begin with your take-home pay, which is how much you make after taxes and deductions are taken out of your paycheck. You can also include earnings from side hustles or passive income streams. If your income is irregular, make a conservative estimate. (It's always better to have more money than you expected than not enough.) To calculate your income, check your direct deposits or take a quick look at your pay stubs.

Step 2: Review your spending

You can pull up your recent debit and credit card statements to figure out your monthly expenses. Your fixed costs will probably be the easiest to tally up. That includes your housing payment, phone bill, and minimum debt payments. Irregular expenses might be a little trickier. Things like groceries, utility bills, and entertainment spending may fluctuate from month to month. Be realistic about your spending and make your best guess.

You'll also want to factor in nonmonthly expenses. These are bills that pop up at odd times throughout the year, like insurance premiums or school tuition payments. For each one, take your total spend and divide it by 12. That number represents your monthly cost.

Step 3: Categorize your expenses

After reviewing your monthly expenses, the next step is putting them into the categories mentioned earlier — needs, wants, and financial goals. Some expenses will fit neatly into a certain category. Your housing payment, for example, is an essential expense. Your minimum monthly debt payments are also considered essential, but extra money you put toward debt would fall under the financial goals category.

Step 4: Adjust as needed

Now it's time to crunch the numbers. You might notice that your flexible spending currently exceeds 30% of your income, or that you aren't saving and investing quite as much as you'd like. The good thing about the 50/30/20 rule is that you can adjust it as needed. That may mean decreasing your spending in one category and redirecting that money elsewhere.

It could also reveal you're living above your means — or that you have more than enough each month and just need to be more intentional with your spending. The specifics will be unique to you.

The 50/30/20 rule in action

Let's say your average take-home pay is $4,500 per month. The 50/30/20 rule would shake out like this:

-

$2,250 for essential expenses

-

$1,350 for flexible spending

-

$900 for saving and investing

If spending in one category is running high, you can look for ways to reduce your expenses. That could mean:

-

Consolidating debt

-

Negotiating lower interest rates on your credit card debt

-

Meal planning

-

Taking on a roommate or moving to a more affordable home

-

Carpooling or taking public transportation

50/30/20 rule vs zero-based budgeting

Zero-based budgeting is a different type of spending plan. You start with your monthly after-tax income, then subtract every monthly expense until you get to zero. If you end up with a negative number, your expenses are greater than your earnings. Ideally, you'll have a surplus that you can put toward your financial goals. This method can be more involved than the 50/30/20 rule, but some people like getting granular with their finances.

Neither is better than the other — they're just different. The right budgeting method for you will depend on your spending personality and personal preferences. What matters most is choosing a plan, sticking with it and adjusting as needed.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Article contributors are not affiliated with Acorns Advisers, LLC. and do not provide investment advice to Acorns’ clients. Acorns is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.